SI Research: Is Sheng Siong The Investors’ choice?

Supermarkets play a crucial role in our daily lives as the ease of accessibility, fresh and low-cost food offerings are the key factors that appeal to consumers.

In the latest 2017 December report by Singapore’s Department Of Statistics, retail sales of supermarkets grew by 8.2 percent year-on-year. While we should expect similar Sheng Siong Group’s (Sheng Siong) revenue to perform in-line with the general trend, its revenue grew only 4.2 percent in FY17. Clearly, the threat of new entrants from the e-commerce sector has come into play while competitive pricing has also intensified competition among the major players.

The Business

Sheng Siong Supermarket, an established local household name was founded in 1985 by the Lim brothers (Mr Lim Hock Eng, Mr Lim Hock Chee and Mr Lim Hock Leng), is now one of Singapore’s largest retailers with 46 supermarket/grocery stores located island wide. Likewise, it has also recently ventured into the China market by opening its first supermarket store in Kunming, in November 2017.

Sheng Siong has placed utmost importance in providing consumer with ‘wet and dry’ shopping choices, ranging from a wide assortment of fresh, processed, frozen, packaged food products to essential household products. It has more than 400 products under more than 10 house brands that are quality alternatives to international brands but sold at lower prices.

Risks & Challenges Ahead

In order to tackle competition from RedMart and other players from the e-commerce sector, Sheng Siong came up with an online shopping website “allforyou.sg” in 2014 that provides same-day delivery with a three-hour window to selected areas in Singapore. RedMart is owned by Lazada, a leading e-commerce player in Southeast Asia which Alibaba owns an 83-percent equity stake. Alibaba bought out most of the previous shareholders except for the management of Lazada and Temasek Holdings.

The lack of digital expertise puts Sheng Siong at a disadvantage in the e-commerce sector as RedMart offers rebates from credit card partnerships, extensive list of products, price match guarantee while Sheng Siong’s online shopping platform does not offer.

Moving forward, we feel that the traditional brick and mortar of supermarket may come under further competition from the e-commerce players and, in terms of food quality, a certain segment of consumers would still prefer to visit wet markets. The loss of market share to the various competitors may further drive Sheng Siong’s revenue downwards, dragging its bottom-line as it continues to focus on expansion of its new stores without developing new online offerings.

Future Developments

Sheng Siong has recently commented that the available tenders for upcoming Housing Development Board (HDB) shops allocated for supermarket use looks promising and it is expected that they will continue bidding for such stores. From Sheng Siong’s expansion strategy, it seems that they are targeting existing residential sites without any supermarket presence in its proximity.

Four new stores were planned at Anchorvale 338, Fernvale Link 417, Canberra 105 and ITE Ang Mo Kio with over total 30,000 square feet of space, bringing total store count to 48 by 1H18. In addition, an expansion to the warehouse is expected to be completed before end of 2018, which adds approximately 97,000 square feet of space to meet the demand of new stores.

Concerns regarding declining same-store sales in matured housing estates remain a bugbear as some of these stores will undergo through a major re-fitting, which would mean approximately a month of lost sales for each of the affected stores while increased re-fitting costs and lower revenue is expected, further dragging down bottom-line.

Financial Position

Financial performance continues to strengthen for Sheng Siong’s FY17 as net profit climbed 10.9 percent to $69.5 million largely attributable to a 6.2 percent rise in gross profit and improvement of gross profit margin to 26.2 percent. It also declared a full year dividend of 3.30 cents which translates to 71.1 percent dividend payout ratio.

Revenue increased by 4.2 percent to $829.9 million of which 4.5 percent was contributed by new stores, 2.1 percent by comparable same store sales, while being reduced by 2.4 percent due to temporary closure of Loyang Point and permanent closure of The Verge and Woodlands Block 6A stores.

Administrative expenses rose by four percent to $137.9 million as well as distribution expenses that increased by 7.7 percent to $5.5 million, as both grew in line with higher business volume and headcounts for new stores.

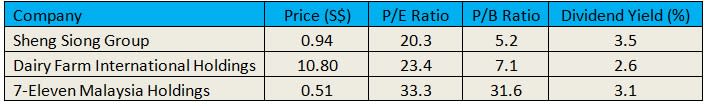

Additionally, Sheng Siong sits on a healthy cash position of $73.4 million and zero debt as at end-FY17. Sheng Siong’s current price-to-earnings (P/E) ratio is trading at 20.3 times, well below its regional peers of 28.4 times P/E ratio. At the same time, Sheng Siong’s price-to-book (P/B) ratio is trading at 5.2 times, lower than regional peers trading at 19.4 times. As at 6 March 2018, Sheng Siong’s share price is trading at $0.94.

While Sheng Siong continues to show growth, we expect competition to come in while population growth slows. We point to the excellent execution record of Sheng Siong as an investment merit despite concerns that rental and labour costs remain a key pressure on businesses.

Yahoo Finance

Yahoo Finance