SI Research: SATS – Changi Airport’s Capacity Expansion To Drive Growth

In May 2016, SI Research identified an opportunity to be positive on SATS as valuations fell lower following the release of the group’s FY16 results. Defying the modest target prices, SATS’s shares surged from just $4.25 on 23 May 2016, gained over 20 percent to $5.11 as at market closing on 14 June 2017.

Despite the current assigned street price of $5.05 presenting a potential downside to the current market price, we believe that SATS’ potential could be underestimated.

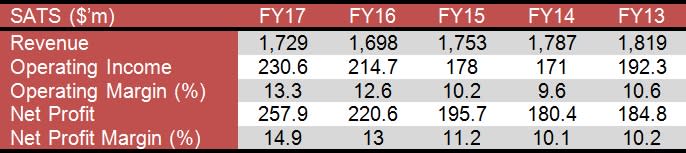

Financial Performance

For FY17, SATS reported a marginal increase in revenue of 1.8 percent while net profit gained 16.9 percent mainly due to higher share of results of associates and joint ventures, which included a negative goodwill of $15 million for Evergreen Sky Catering Corporation. Excluding the one-off gains, net profit would still have been 10.1 percent higher at $242.9 million.

(Source: Shares Investment)

While the group’s revenue growth is nothing to boast about when compared to that of earlier years, efforts to increase productivity through technological innovation have paid off with notable improvements in margins.

Notwithstanding the insignificant increase in revenue, operating margin improved by 0.7 percentage point, leading to a 7.4 percent increase in operating income.

SATS financial position has remained stable maintaining a debt-to-equity ratio of just 6.4 percent. The impressive part is the group’s massive cash balance of $505.8 million, which is more than sufficient to cover the total debts of $108.6 million, placing SATS in a net cash position of $397.2 million or $0.356 per share.

Changi Airport Expansion

Singapore’s Changi Airport registered a record 58.7 million passenger movements as well as 360,490 aircraft movements in 2016, a growth of 5.9 percent and 4.1 percent respectively. Despite already handling close to the designed total annual capacity of 66 million passengers, the gateway to Singapore added two passenger airlines and established eight new city links last year.

Changi Airport’s strong operating statistics come ahead of the opening of fourth terminal in the second half of this year, which is expected to boost the airport’s total passenger capacity to around 85 million per year by 2020.

Already in the pipeline, the fifth and largest terminal planned for the late-2020s will boost the total passenger capacity to 135 million per year. However, according to a leading industry consultancy, the additional capacity could be fully utilised by 2032 or earlier.

In FY17, SATS’ operations in Singapore, in which the group holds an approximate 80 percent of the market share, contributed to 79.9 percent of the total revenue. As such, the expansion of Changi Airport is expected to bring much benefit for SATS.

Asian Carriers Expand Fleet

Singapore is positioned at an excellent strategic location in the region, which has experienced strong growing demand for air travel in recent years. In response to the increasing demand, several Asian carriers have plans to expand their fleet size this year. For example, Malaysian budget carrier, AirAsia, announced last month its intention to add 29 planes this year, while India is set to become the third largest buyer of commercial passenger planes in the world.

In China, explosive demand has led to the construction of Boeing’s first overseas facility designed to deliver 100 planes a year. In addition, the world’s second largest economy advanced a major step towards becoming a global aviation powerhouse as its homegrown large passenger plane, C919, took flight last month. Currently, China takes the top spot with 30 cities served by flights from Changi Airport.

Valuation

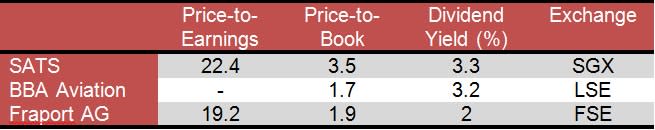

Now that SATS’ shares are changing hands close to an all-time high, could there be more upside potential or have valuations hit a wall? As SATS is the only aviation services company listed on the SGX, we put the group’s current valuation against some foreign listed competitors.

(As at 19 June 2017)

SATS’ price-to-earnings (P/E) ratio of 22 times far exceeds that of Fraport AG at 19.2 times, while BBA Aviation posted a net loss for FY16. However, looking back on the past year historical P/E, SATS’s shares traded between a P/E of 19.6 times and 26.9 times, also above 23 times for the most part of the year.

In terms of price-to-book (P/B) ratio, SATS is almost double that of Fraport AG, while exceeding two times that of BBA Aviation. As such, it would seem that the group’s share are slightly overpriced based on this component.

SATS pays out regular dividends, which have increased steadily over the years. For FY17, the group proposed a final dividend of $0.11 per share, bringing the total dividends for the financial year up by $0.02 per share to $0.17 per share. Comparing the dividend yield, SATS’ dividend yield of 3.3 percent takes the top spot.

Based on the trading multiples, it would seem that SATS is currently close to being fully valued. However, we believe that the region’s growing air travel demand, in particular Singapore, could be underestimated, presenting much opportunity for SATS in the future.

Yahoo Finance

Yahoo Finance