SI Research: Sapphire Corporation – Train Engine At Full Throttle

Staging a successful turnaround coupled with a potential for further growth are usually the two key ingredients of a recipe found in the making of multi-bagger stocks. Chances are such companies are not even well-covered by analysts or being discussed in the media and hence resulting in a low demand for these stocks that tend to be priced attractively. Specifically, Sapphire Corporation (Sapphire) seems to fit the bill of an uncovered gem in that aspect.

Shares Investment is pleased to invite the management of Sapphire to share with investors how the group is set to benefit from China’s investments through the “One Belt One Road” initiative in our Shares Investment Convention on 10 March 2018. As a prelude to the event, we seek to provide investors with a little background of Sapphire’s business and why we think this company is worth taking a look at.

Shifting The Course Of Navigation

Back in 2013, Sapphire was on the brink of being placed on Singapore Exchange’s watch-list following three years of consecutive losses as a result of the group’s struggling steel business. However, the group was quick to stop its bleeding through the divestment of its legacy steel business in 2014 followed by the disposal of its 81 percent stake in Mancala, the group’s mining business in Australia, in early 2017.

As part of Sapphire’s turnaround strategy to propel growth, Sapphire acquired a 99.6 percent stake in China-based Ranken Infrastructure (Ranken) in October 2015, which specialises in design, civil engineering and construction for land transport infrastructure particularly in the urban rail transit sector. Ranken is China’s second largest privately-owned integrated rail transport infrastructure groups, and holds full Triple-A qualifications and licenses for design, civil engineering, construction and project consultation in the urban rail transit sector.

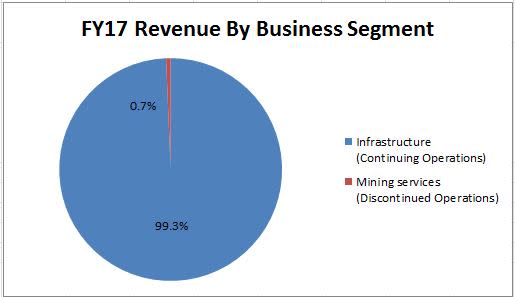

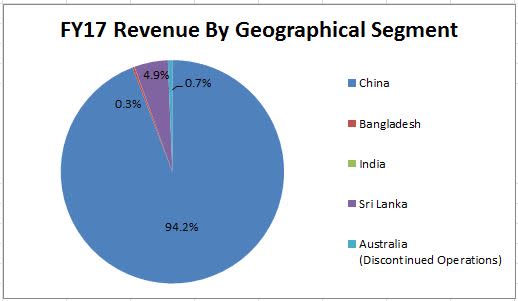

Following the acquisition, Sapphire’s entire FY17 revenue from continuing operations was then contributed by its infrastructure segment, out of which 94.8 percent was derived from China based on geographical location. With effect from 15 December 2017, Wang Heng has been helming Sapphire’s operations, corporate strategy and business development with her appointment as chief executive officer of the group. As a co-founder of Ranken as well as having 10 years of experience working in China Railway Construction – one of the largest state-owned enterprises in rail transit industry in China, Wang strives to bring Sapphire to greater heights with her wealth of expertise and experiences. As can be seen, it is clearly evident of management’s intent to focus on reaping benefits from China’s investment in infrastructure as its main engine of growth.

Source: Company Annual Report

Charting An Era Of Recovery

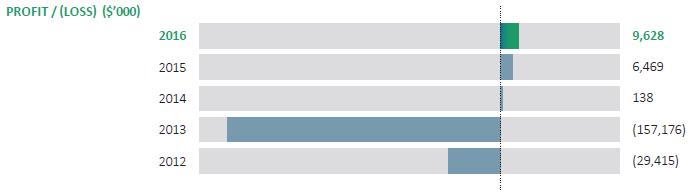

The timely acquisition of Ranken has begun to bear fruits. As a result of Sapphire’s corporation transformation and contributions from new acquisitions, the group reversed years of losses and was led back into the profitable territory.

Over the last three years since Sapphire had turned around in FY14, revenue grew at a compounded annual growth rate (CAGR) of 95.7 percent to $223.9 million in FY16. Likewise, net profit jumped exponentially at a CAGR of 735.3 percent to $9.6 million.

Source: Company Annual Reports

FY17 extended this momentum with revenue rising 21 percent year-on-year to Rmb1.3 billion ($271.3 million) largely due to a higher number of ongoing projects. As expected, the group continued to remain profitable for the year reporting a net profit of Rmb44.4 million ($9.2 million) in tandem with the higher revenue.

The increasing infrastructure investments from China will continue to lend support to Ranken’s healthy order book which as at 31 December 2017, reached a record high of Rmb3.2 billion ($660 million) after securing Rmb2.2 billion ($438.6 million) worth of projects in 2017 which surpassed Rmb1.7 billion achieved in 2016.

Massive Market In China’s Urban Rail Transit Projects

China’s budget set aside for national infrastructure is enormous, approximated at Rmb15 trillion for 2016 – 2020 according to the 13th Five-Year Plan (FYP13), including Rmb3.5 trillion for railways alone.

Fortunately, Ranken’s traditional strength is in the construction of metro and urban rail transit systems in the first and second-tier cities of China, and it is a huge market with ample opportunities. As at the end of 2017, there are already 34 metro systems in Mainland China with a total combined length of 5,021.7 kilometers. Moreover, the number of metro systems is expected to rise to around 50 by 2020 to cover all the first-tier cities and most second and third-tier cities.

Even in cities that currently have existing urban rail transit systems, there is still much room for further developments in comparison to international metropolitan cities. Taking Tokyo for example, its subway mileage per square kilometer has reached 0.46 kilometers handling approximately 70 percent of the public transport traffic. In contrast, Shanghai’s and Beijing’s figures merely stood at 0.07 kilometers and 0.03 kilometers respectively, sharing some 30 percent and 20 percent of their respective public transport traffic.

In addition, new modes of rail transit in third and fourth-tier cities are also promising markets worth exploring. The new modes of rail transit – inclusive of magnetically levitated train, single track monorail and suspended monorail – offer alternatives with significantly cheaper cost of construction despite a lower capacity than traditional subway.

Ranken has undertaken projects across 18 cities in China and is now ranked as one of the country’s top private enterprises specialising in underground and urban rail engineering and construction. Underpinned by ongoing investment in China’s infrastructure, the company’s prospects remain bright.

Seeking Growth In Relevant Sectors

Leveraging on its competitive strength in urban rail transit system construction, Ranken is also actively seeking expansion in related sectors comprising construction and operation of underground utility tunnels.

According to China’s FYP13, the state would pick up pace with the construction or urban utility tunnels and management of underground pipelines and cables, so as to alleviate the pressure of traffic congestion and city clustering thereby improving on the overall quality of urbanisation. Come 2020, underground utility tunnels planning to be constructed sum up in excess of 8,000 kilometers.

Extending on its edge with strong track records of completed projects the group had participated in, projects in the relevant fields open up new opportunities for Ranken. It is confident of possessing the necessary technical know-how and equipment to partake in such projects. Securing more bids in the related sectors will not only bring in additional revenue for the group, but also build up on the group’s reputation and capabilities.

Vying For A Piece Of The PPP Pie

Public Private Partnerships (PPP) are business relationships in which government bodies procure the resources and expertise of the private sector for the purpose of completing or operating a project that will serve the public, usually more commonly found in public transportation networks, toll roads and highways, city infrastructure, utilities, water treatment facilities and building of schools and hospitals.

In recent years we have seen China’s increasing efforts to promote PPP projects. Not only has the country’s top state planner issued guidelines in November last year reserving more room for private enterprises to participate in PPP projects, details of the fourth batch of new PPP demonstration projects published by the Ministry of Finance in February this year revealed that participation by private enterprises stood at around 57.9 percent.

The growth in opportunities for private enterprises definitely spell good news for Ranken. PPP projects with their higher margin, can offer stable profits and consistent cash flows over a longer period of contract term if managed efficiently. Therefore, Ranken is also constantly on the look-out for suitable small-scale and quality projects which are not too overwhelming for the group.

Setting Its Sight Beyond China

Although majority of Sapphire’s revenue was derived from China geographically and the opportunities there appear more than sufficient, the group’s ambition did not stop just right there. At this moment, Ranken is involved in several overseas projects in Bengal, Sri Lanka and India, brought about by the “One Belt and One Road” initiative.

Sapphire being based in Singapore with an excellent strategic location, serves as an ideal base for the group to bring its technology to other Asian markets and securing its foothold in the South Asian region. In addition, its listing status also provides a viable source of cheaper financing for Ranken’s projects should the needs arise.

As compared to its previous self in FY13 before the turnaround, the transformed Sapphire is definitely in a much better shape today. However, its share price has hardly recovered by a similar extent with merely a 21.5 percent increment from its historical low of $0.177 trading at $0.215 as at 5 March 2018, despite multiple jumps in the group’s top and bottom-line.

As such, we feel that Sapphire’s value has yet to be fully realised given the lack of attention from the investing community, and believe that Sapphire’s share price remains attractive at current level in light of its stronger financial foundations coupled with a clearly defined growth strategy.

Yahoo Finance

Yahoo Finance