SI Research: Riverstone Holdings – An Undervalued Gem?

The medical glove plays a key role in an expanding global healthcare sector. Underpinned by the increase in global population, rising standards of living and greater awareness of the importance of hygienic practices, the rubber glove industry has been growing at an average of eight percent to 10 percent for the past 25 years and it is expected to continue growing in FY19, according to the Malaysian Rubber Glove Manufacturers Association.

After closing 2018 at $1.083, the share price of Riverstone Holdings (Riverstone), a Malaysian manufacturer of specialised cleanroom and healthcare gloves, has fallen to below $1-mark to close at $0.965 as at 17 May 2019. Is the drop in the share price simply an overreaction following its recent disappointing earnings? Is the beaten-down share price an opportune entry point for investors

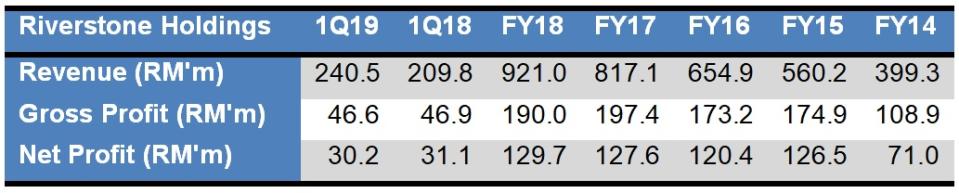

Financial Performance

(Source: Shares Investment)

Riverstone’s 1Q19 performance fell short of expectations. Revenue increased 14.6 percent to RM240.5 million attributed to growing sales volume for both its healthcare and cleanroom gloves.

However, gross profit declined marginally by 0.5 percent to RM46.6 million as gross margin contracted from 22.3 percent to 19.4 percent owing to an unfavourable shift in product mix toward healthcare gloves with a lower average selling price (ASP). Apart from a competitive market landscape, the downward price pressure on ASP for healthcare gloves also reflects the falling price of butadiene, an important raw material in the production of nitrile-based gloves.

Following the completion of Phase 5 expansion plan at the end of 2018, the total production capacity increased by 1.4 billion to nine billion pieces of gloves per annum. As the Group ramped up its sales efforts to secure orders and capture growth, selling and distribution expenses grew 10.4 percent to RM4.3 million while general and administrative expenses also inched up 3.9 percent to RM5.7m.

Ultimately, net profit fell 2.8 percent to RM30.2 million due to a drop in ASP for healthcare gloves and higher taxation as higher profits from subsidiaries do not benefit from tax incentives.

Strong Financial Position

Despite having tripled its production capacity over the past five years, Riverstone maintains a low debt level at just RM17.5 million. With a cash pool of RM82.7 million, the groups sits on a net cash position of RM65.2 million or RM0.088 per share. Its cash position highlights its prudent balance sheet and financial flexibility to provide a good war chest for expansion and also a reserve in times of need.

Adding to this, management paid a total dividend of RM0.0675 per share for FY18. At the closing price of $0.965, this translates to a decent dividend yield of 2.3 percent.

Future Outlook

Phase 6 expansion is on track as Riverstone plans to add another 1.4 billion pieces of gloves by the end of 2019, boosting its total annual production capacity to 10.4 billion pieces of gloves.

Meanwhile, other than lower raw material prices, the recent strengthening of the US$ against RM will work in Riverstone’s favour as the majority of sales are denominated in US$.

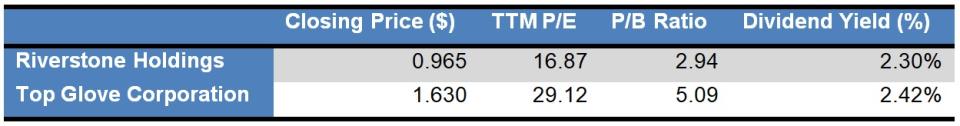

Fair Valuations

(As at 17 May 2019)

At $0.965 per share, Riverstone is currently valued at 16.9 times earnings and 2.9 times to book value while dividend yield stands at 2.3 percent.

Against the valuations of Top Glove Corporation (Top Glove), Riverstone would certainly be a more attractive choice. However, Top Glove’s steeper valuations are partly due to its aggressive expansion strategy which could result in greater rewards for investors over the long term. As at 28 February 2019, Top Glove’s aggressive expansion has put it in a net debt position of RM2 billion.

That said, we believe that Riverstone is an investment-worthy candidate that could add stability to one’s portfolio in view of the capacity expansion and the growing demand for gloves.

Yahoo Finance

Yahoo Finance