SI Research: Re-look At The Property Sector

Flash estimates released by the Urban Redevelopment Authority (URA) revealed that the price index for private residential property rose 0.5 percent in 3Q17, reversing four years of decline since 2013. New private home sales by developers for the first eight months of this year hit 8,391 units, exceeding the 7,972 units sold for the whole of last year.

Meanwhile, en bloc sales and government land bids continue to flush new records. The sale of Amber Park condominium to listed City Developments set a new record for freehold collective sale at $906.7 million. Meanwhile, GuocoLand won the tender for a 99-year leasehold commercial site at Beach Road with a $1.6 billion bid, translating to a record $1,706 per square foot based on gross floor area.

On that note, APAC Realty recently made its debut with immense buying interest from investors, resulting in its share price jumping 15.2 percent above its IPO price of $0.66 to close at $0.76 at the close of its first trading day. Quoting APAC Realty Chief Executive Officer Jack Chua, “We are now at the initial stage of a market run. For the next one year, everyone knows the market will be good, so it is only logical to list now.”

It is notable that FTSE ST Real Estate Holding and Development Index, a benchmark tracking the performances of Singapore’s real estate developers, has also delivered a remarkable 26.4 percent year-to-date return as at 5 October 2017.

Once is chance. Twice is a coincidence. Third time it will be a trend. If all the facts and figures are now pointing to a recovery in the property sector, then it is definitely an area which we do not wish to miss out on.

City Developments – Developer With The Most Residential Units Sold

According to URA’s statistics, developers sold a total of 6,039 new private homes excluding executive condominiums (ECs) in 1H17, increasing by 64.3 percent from 3,675 units sold in 1H16 and achieving 75.8 percent of FY16 sales at 7,972 units. Likewise, 2,026 new ECs were sold in 1H17 rising 8.5 percent from the 1,867 units sold in 1H16.

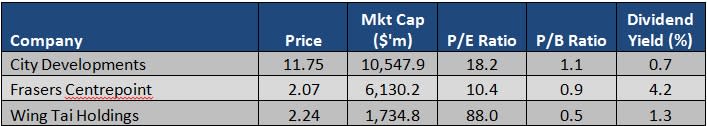

When it comes to the developer with the most number of residential units sold in Singapore during the first half of this year, the winner to claim the first place would be none other than home-grown property giant City Developments (CDL). For 1H17, CDL, together with its joint venture associates, sold 691 units including ECs with total sales value standing at approximately $1.2 billion. The group’s robust residential sales alone account for around 8.6 percent of the total transactions done during the period, a result of healthy sales from launched residential projects comprising Gramercy Park, The Venue Residences, Forest Woods condominium in Serangoon, Commonwealth Towers next to Queenstown station, as well as two EC projects including The Brownstone and The Criterion. In terms of number of units sold and sales value, CDL’s performances this year surged 113.3 percent and 198.2 percent respectively year-on-year compared to 1H16’s results.

Going forward, CDL plans to launch another high-end project in the prime District 9 area – the 124-unit New Futura condominium – slated to obtain TOP in 3Q17 when it is expected to garner much interest given its unique design, freehold status and strategic location. In addition, another condominium development located close to the upcoming Tampines West station targeted to launch in early 2018, offered seven 15-storey blocks of residential apartments with a total of about 861 units.

Wing Tai Holdings – Most Undervalued Developer

Trading at the market price of $2.24 as at 9 October 2017 and a net asset value of $4.07 as at 30 June 2017 which translate to a price-to-book ratio of 0.5 times, Wing Tai Holdings (Wing Tai) is the most undervalued developer in terms of book value.

Wing Tai has total borrowings of $929.6 million and cash and cash equivalents of $847.4 million, putting it in a net debt position of $82.3 million. Net debt has pared down significantly from $653.6 million a year ago and as a result, the group’s net gearing ratio has also improved considerably from 0.21 times in FY16 to 0.02 times in FY17.

Nevertheless, Wing Tai’s top-line and profitability were not too impressive and hence leading to the current depressed share price. FY17 revenue fell 51.7 percent to $263.2 million largely due to the lower contributions from development properties. Net profit, however, more than doubled to $20.1 million lifted by the share of profits of associated and joint venture companies as well as income tax credit. In spite of that, if we were to look at Wing Tai’s bottom line over the last five years, net profit actually shrank at a compounded growth rate of negative 55.9 percent from $531.1 million in FY13.

In August 2017, Wing Tai together with Keppel Land, successfully secured the tender for a 99-year leasehold residential site at Serangoon North Avenue one, which the partners plan to jointly develop over 600 units with a gross floor area of 462,561 square feet. This development placed the group along the tailwind to benefit from the upcoming property uplift.

Frasers Centrepoint – Highest Yielding Developer

Frasers Centrepoint (FCL) has been paying out dividends of $0.086 consistently every year since its listing in 2014. With a market price of $2.07 as of 9 October 2017, this implies a current yield of 4.2 percent making it the highest yielding developer listed in the Singapore Exchange.

FCL has maintained a payout ratio of less than 50 percent for the last three years. Coupled with stable positive cash flow from its operations, we believe that the group is more than capable to maintain its dividend payout.

One of FCL’s core strategies has always being to grow and strengthen its recurring income contributions. As at 30 September 2016, around 70 percent of the group’s total assets are recurring income assets valued at about $16.9 billion. Consequently, more than 60 percent of FCL’s FY16 profit before income and tax were in fact derived from its recurring income sources.

Most notably, with the listing of Frasers Logistics and Industrial Trust in June 2016, at the moment FCL has a total of four REIT platforms to cater to each of the different investment properties in the retail, commercial, industrial and hospitality sectors. Apart from being the key contributors to FCL’s recurring income base through management fees, the REIT platforms also serve to provide an avenue for the group to recycle its mature assets into capital when necessary.

Construction of Northpoint City (Retail) is on track for completion in the second half of this year. In addition, Frasers Tower, a 38-storey high premium Grade-A office building located at the gateway of the CBD in Tanjong Pagar with a net lettable area exceeding 687,000 square feet, is also scheduled for completion in 2018. As these projects got completed over the next the two years, FCL’s recurring income would also be expected to be given a pleasant boost.

Source: Singapore Exchange, updated 9 October 2017

Yahoo Finance

Yahoo Finance