SI Research: Jiutian Chemical Group – On Track For A Record Year

Chemical substances are an integral part of everyday life with over 100,000 different substances in use. They can be found in various household products, ranging from consumable products such as processed food and drinks to non-consumables such as cleaning products. In fact, even furniture and electronic appliances make use of chemicals during the manufacturing process.

Jiutian Chemical Group (Jiutian), mainly engaged in the manufacturing and production of dimethylformamide (DMF) and methylamine, is one of the world’s largest manufacturers with a total annual capacity of 150,000 tons. The group is also engaged in the processing and sale of consumable carbon dioxide and oxygen.

Despite the chemical manufacturer’s products being used in the production of a wide range of consumer products, Jiutian’s shares, unfortunately, fell out of favour with investors over the past four years, leading to a steep decline in its share price of over 90 percent.

However, since end-June 2017, Jiutian’s shares staged a strong rally from $0.014 to over $0.04, representing a gain of over 185 percent in less than four months. Could there be a turnaround for the chemical manufacturer?

The Business

Located in Henan, the most populous province in China, which together with surrounding provinces has a combined population of 450 million, Jiutian is strategically positioned to take advantage of the rapid industrialisation and urbanisation in these regions.

Demand for the group’s main product, DMF, has been driven by an increase in production of consumer products due to its diversified range of applications. DMF is commonly used as a feedstock in the production of polyurethane, a key component in the manufacturing of consumer goods such as leather products and shoe soles, as well as feedstock in the production for pharmaceutical and agro chemical products. It is also a universal industrial solvent that can be used as an absorbing agent mainly in electronics, acrylic fibre and pharmaceutical products.

Growth Of Chinese Exports

It is widely known that goods made by Chinese manufacturers are typically lower priced than their foreign counterparts. This is mainly due to the lower manufacturing cost due to the economies of scale as well as the lower labour and raw materials costs in China. The same reason has led to the rapid expansion of China’s exports over the years. In addition, several multinational corporations relocated their manufacturing facilities to China in order to reap the benefits of lower cost, thus contributing further to the growing exports.

China’s trade data showed that in September 2017, exports increased by 8.1 percent. Though falling slightly short of analysts’ expectations, the high single-digit growth is quite an improvement from August 2017 when exports were only up 5.5 percent. Chinese exports were also affected by a strengthening Chinese yuan in early September as well as a 6.7 percent decrease in exports to North Korea as trade between the two neighbouring countries face intense scrutiny.

The continued growth of Chinese exports certainly bodes well for Jiutian as the increasing demand drives the manufacturing sector’s expansion, thus providing the group with more opportunities.

Performance Recovery

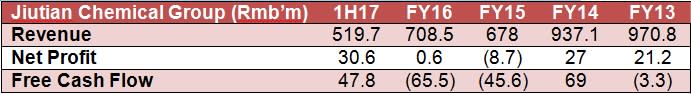

Jiutian reported stellar results for 1H17 with a huge net profit of Rmb30.6 million, dwarfing the previous full year net profit of just Rmb0.6 million. Although Jiutian tends to report better results in the first half of the year, its performance for the first half of 2017 far exceeded that of prior years, putting it in a position to end the year on an excellent note.

(Source: Shares Investment)

The group’s downside is that its free cash flow has not been consistent over the past years. In addition, the group still has 172.8 million in accumulated losses, which means that shareholders are unlikely to receive any dividends in the near future.

While it does seem as though a performance recovery is underway, it would depend largely on the group’s second half results. Even then, investors should be prepared to be in for the long run.

Risks Of Unfair Advantage

As a penny stock, Jiutian appears to be speculative in nature and highly risky. Naturally, high levels of risk are often associated with high potential returns.

However, it is noticeable that the probability of certain market participants having an unfair advantage is relatively high. This can be seen from the surge in Jiutian’s share price prior to the profit guidance announcement on 20 July 2017.

Due to its low share price and market capitalisation of $72.7 million, another risk that investors should take note of is the risk of price manipulation.

Valuation

Given the recent surge in share price, how high have valuations gone?

(As Of 23 October 2017)

On the surface, Jiutian’s valuations are not exactly appealing as compared to other chemical manufacturers. The group lacks dividend payout despite commanding one of the highest price-to-earnings ratios.

That said, should Jiutian be able to maintain its momentum, the valuations would not be that high after all.

Yahoo Finance

Yahoo Finance