SI Research: An Interview With Jubilee Industries Holdings

Animal spirits amongst local investors were recently lifted when the Ministry of Trade and Industry announced that advanced estimates for Singapore’s 3Q GDP showed a 4.6 percent growth this year. The higher-than-anticipated growth rate was driven by the robust expansion of manufacturing industries in the electronics, biomedical engineering and precision engineering clusters.

The phenomenon is a manifestation of the global race to become “smarter” nations, as the technology of the past decade unravels new spectrums of growth opportunities. Focusing on the electronics cluster, companies now aspire to harness the powers of big data and artificial intelligence. On the other hand, consumers demand more “smart” products like the smart TVs, smartphones and driverless cars more than ever.

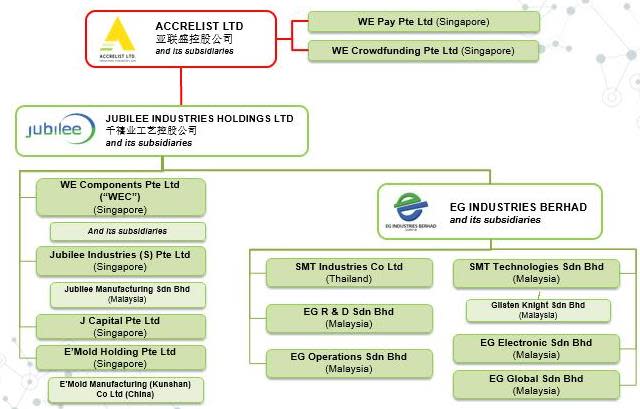

Riding on this trend is Jubilee Industries Holdings (Jubilee), an electronic components distributor that provides value-added services such as precision plastic injection molding (PPIM) and mold design and fabrication (MDF). Parent and investment holding company, Accrelist (also listed on Singapore Exchange), signalled its upbeat sentiment when it exercised its rights of conversion of the convertible loans into shares and boosted its stake in Jubilee from 29.1 percent to 64.7 percent in June 2017. The move drew great attention from market watchers.

We interviewed Mr. Terence Tea, the current Chief Executive of Jubilee, to gain insights into the group’s restructuring efforts and how the group intends to capture the booming electronics market.

Understanding New Organisation Structure

Originally, Jubilee was known as JLJ Holdings (JLJ) which was a pure-play mechanical molding business. In 2010, the company was saddled into a corruption case relating to Apple’s then global supply manager. As Apple was JLJ’s only customer, business was badly affected which forced its then Executive Chairman to resign in June 2011.

In June 2014, Mr. Terence Tea took control of the embattled Jubilee (after a name change) via deemed interest, upon Accrelist’s 25.5-percent acquisition of the company from its then shareholders. Under Mr. Tea’s helm, Jubilee undertook a rights-cum-warrant issue and subsequently acquired 100-percent of Accrelist’s stake in WE Component Holdings and its minority stake in electronic manufacturing services provider and Bursa-listed EG Industries.

Leading to 2017, the group underwent a lengthy restructuring period, expanding on its profitable electronic components distribution (ECD) business while trimming its loss-making legacy mechanical business. Having already undertaken two years of impairments and restructuring costs, Jubilee’s latest FY17 results showed that financial performance hinted to a turnaround towards profitability in the near term. From FY16 to FY17, top line grew an impressive 28.6 percent from $84.6 million to $108.8 million, while net loss was trimmed by 66.3 percent from $22.2 million to $7.5 million.

Riding The Electronics Trend

Despite posting a loss-making year in FY17, Jubilee’s electronics business actually delivered positive results. Consolidated results were mainly dragged on by its legacy mechanical business. In FY17, revenue from the electronics segment grew 39.8 percent to $100.4 million from $71.8 million in FY16. Jubilee’s electronics segment made a gross profit of $5.3 million on its revenue.

Breaking down the numbers, its ECD business accounted for $95.9 million or 95.5 percent of the segment revenue and its ECD business recorded a 33.5 percent growth in revenue. Gross margin on ECD business was about 4.8 percent, slightly lower than the industry average of 5 to 7 percent.

Nonetheless, the strong growth in Jubilee ECD’s topline was a result of the acquisitions of two new product lines from Neophotonics Corporation (Neophotonics) and Innodisk Corporation (Innodisk). Neophotonics is a leader in the field of fibre optics and is listed on the New York Stock Exchange with a market cap of US$238.7 million. On the other hand, Innodisk is an industrial grade producer of flash and DRAM memory, with a market cap of TW$7.7 billion on Taiwan Stock Exchange.

Notwithstanding Neophotonics and Innodisk, Jubilee has distributorship agreements with other renowned brands like Samsung Electro-Mechanics and Hynix. It is also likely that we have yet to see the full potential of Neophotonics on Jubilee, since the agreement was only signed in 2H17. In addition, as Singapore pushes for the 5G network next year, we will likely see a ramp up in demand for fibre optics components which Neophotonics’ products are fittingly catered for.

As it appears, Jubilee’s growth strategy for its ECD business is courting desirable agreements with well-known principal suppliers that develop innovative products. In the current trend where demand for higher processing capabilities in electronic devices, strong growth for more powerful fibre optics, memory components and other electronic component peripherals should bode well for Jubilee.

To give investors some perspective, Mr. Tea highlighted that the new generation of iPhones pack over hundreds of Multilayer Ceramic Capacitors (MLCCs) compared to about 50 MLCCs for the older generation of iPhones. This already indicates substantial growth in demand for just the MLCC component in the entire smartphone industry.

Apart from the ECD business, Jubilee is also engaged in the distribution of energy smart meter modules which contributed maiden revenue of $4.5 million for the remainder of the electronic segment in FY17. Management intimated that it sold as much as 500,000 module units to a customer who used them to produce smart energy meters deployed by Perusahaan Listrik Negara in Indonesia and utility companies in India. The energy meter modules generate higher gross profit margin of about 7 percent in FY17 for Jubilee, and as the energy meter projects in Indonesia and India are still preliminary stages, we are expecting strong growth to continue from this sub-segment.

Major Suppliers

Turning Around The Mechanical Business

In October 2017, Jubilee proposed to undertake a rights-cum-warrant issue to raise $15 million of gross proceeds for additional capital. Of the $15 million, Jubilee plans to utilise $9 million for expanding capacity of its mechanical business organically or via new acquisitions while the remaining $6 million will be injected into the working capital of the electronics business.

In FY17, Jubilee’s mechanical business (that comprises PPIM and MDF services) made a gross loss of $1.6 million on revenue of $8.4 million. Comparatively, the revenue was $12.8 million while gross loss was $1 million in FY16. The poorer performance in the segment was a result of further restructuring costs and impairment losses incurred for its operations in China which have been downsized dramatically.

In FY18, Jubilee has an ambitious goal to rejuvenate the segment by increasing its capacity by five-folds, from the existing 30 moulding machines to 150 machines. Having already incurred restructuring and impairment losses, we believe that the negative legacy issues in its mechanical business are more or less disposed and hence such charges will not materially recur.

As such, we see it as a positive sign that Jubilee is now spearheading its capacity expansion again. Going forward, we can expect its mechanical business to yield bigger economies of scale and see margin expansion. By revving up its scale, we hope to see the segment’s gross margin increase towards the industry average of 15 percent in the near term.

Major Customers

Building On Verticals

The overarching strategy that Mr. Tea is employing for Jubilee is to build a one-stop platform for its customers. By factoring its 11.8-percent stake in EG Industries whose key customers include Hewlett Packard, Flextronics and Dyson; investors should now see the bigger picture. From mechanical moulding to components assembly and finally components distribution, Jubilee can build on the operational synergies between each business segment to drive growth and deliver value.

With all that said, we recognise that there is numerous execution risks involved as Jubilee begins to scale up. Having already seen a spike in activities in the electronics cluster, we do not rule out a slowdown which can put the brakes on Jubilee’s growth plans.

Despite the uncertainties, Mr. Tea exuded his confidence for Jubilee as he hinted that the group’s order load is packed in the near term. For sure though, investors will be scrutinising its upcoming 1H18 results bound to be released in mid-November. Another bout of positive performance will definitely inspire more investors’ interest.

Yahoo Finance

Yahoo Finance