SI Research: Hock Lian Seng Holdings – Strong Financial Position, Clear Earnings Visibility

In Issue 558 of Shares Investment, we identified some companies in the different parts of the construction chain which could benefit from the increased public sector construction demand. This issue, we take a closer look at Hock Lian Seng Holdings (HLS), a home-grown civil engineering and construction company which has recently racked up an order book close to $1 billion.

Over the past year, HLS’s shares gained around 60 percent to $0.48 as at 19 May 2017. This is not including the recent dividends of $0.125 per share, which comprises a $0.10 special dividend on top of the regular dividends. In comparison, the benchmark Straits Times Index gained approximately 15 percent over the past year.

The Business

Founded in 1969, HLS has close to 50 years of experience in civil engineering and infrastructure, having undertaken and completed a wide range of projects for both public and private sectors in Singapore. In fact, many Singaporeans have enjoyed the benefits of such infrastructure without actually being aware of the contractor involved in the construction. Recognised by the Building Construction Authority as a Grade A1 contractor, HLS works include, but are not limited to, bridges, expressways, tunnels and the local mass rapid transit system.

With a market capitalisation of $244.8 million, the group has certainly built up a strong reputation in Singapore. A recent testament to HLS’s reputation is the group’s 60 percent joint venture having secured a $1.1 billion project from Changi Airport Group in August 2016.

While it is unknown whether HLS will join the ranks of potential privatisation candidates, with the rise of privatisation deals, it is certainly useful to take note of the company’s substantial shareholders as well as its float. The single largest shareholder of HLS holds 47.8 percent of the total issued shares, while the group’s float stands at just 23.5 percent.

Financial Performance

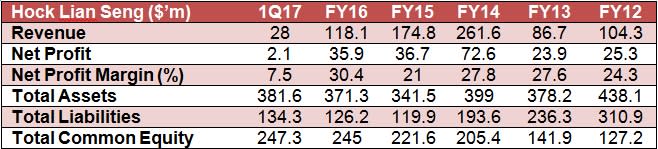

A glance at HLS’s track record and some may misunderstand the many ups and downs over the years as a sign of unstable earnings. However, that is due to the nature of the group’s business where revenue recognition is affected by the progress of on-going projects.

As such, HLS’s full year margins would show a clearer picture of the group’s performance. One of the reasons why HLS has made it onto our watchlist is its ability to keep costs low, maintaining a net profit margin of over 20 percent for the past few years.

Source: Shares Investment

The group’s order book for on-going projects was approximately $915 million as at 31 March 2017. The largest component, which is the Changi Airport project, is expected to be completed by early 2020. Applying a conservative net profit margin of 20 percent, this implies that the group could be on track to progressively add a total of $183 million to its bottom line over the next three to four years.

Apart from the strong earnings visibility, the group holds a large pile of cash amounting to $200.8 million as at 31 March 2017, while loans and borrowing only amounted to $15.5 million. This places the group in a net cash position of $185.3 million or $0.36 per share, before accounting for the recent dividends.

Deducting the total dividends of $63.7 million, HLS will still maintain a net cash position of $121.6 million, approximately 50 percent of the group’s current market capitalisation.

Potential For Dividend Growth

There are many factors to consider when assessing the potential dividend growth of a company. Two main factors are the company’s ability to generate free cash flow and the strength of its balance sheet.

Generally, the ideal scenario would be for a company to pay its dividends using cash generated from its businesses. For HLS, the recent dividend payout even exceeded FY16’s free cash flow due to the company already holding onto excess cash. The group, which is also known to maintain stable margins while keeping overall costs low, is unlikely to face any significant issues in generating free cash flow over the next few years.

Shareholders of debt laden companies assume a certain level of risk that dividend payouts could be reduced should there be any unforeseen circumstances or an overall economic downturn. Vice versa, a company loaded with cash provides a certain level of protection during tough times, with the ability to maintain dividend payouts.

Valuations

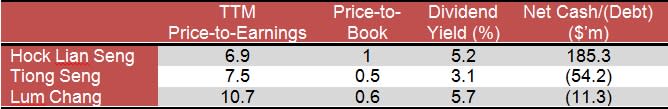

Following the strong share price rally over the past year, is there any more upside potential for HLS? We take a look at the valuations of some competitors in the civil engineering and infrastructure industry.

As at 19 May 2017

Amongst the three companies, HLS is currently valued at the lowest price-to-earnings (P/E) ratio of 6.9 times, while trading fairly in terms of price-to-book value. In fact, the company’s shares, after excluding the cash portion, are valued at an attractive P/E ratio of 3.4 times.

In terms of dividend yield, while HLS at 5.2 percent falls slightly short of Lum Chang Holdings’ 5.7 percent, it is notable that HLS is a net cash company, which indicates a stronger ability to maintain, or even increase regular dividend payouts.

Given HLS’s downside protection and upside potential, investors should certainly consider adding this stock to their portfolio.

Yahoo Finance

Yahoo Finance