SI Research: Delfi – Delighting Asia’s Chocolate Lovers

Last month, Shares Investment featured JB Foods as a company operating in an industry that will never become obsolete. Since then, the producer of cocoa ingredient products saw its shares, which were trading at around $0.61, climb as much as 14.8 percent in less than three weeks to a high of $0.70 on 23 February 2018.

While investors who made a profit from this might think that all other companies in obsolete-immune industries are investment worthy, it is necessary to take into consideration the valuation of the company as well.

As a sequel to our earlier article, this issue we take a look at one of the main consumers of cocoa ingredient products.

The Company

Manufacturers of chocolate confectionery are one of the main consumers of cocoa ingredient products. Operating in a relatively obsolete-immune industry, Delfi (formerly known as Petra Foods) markets and distributes its own brand of chocolate confectionery in its core markets of Indonesia, Philippines, Singapore and Malaysia. With a rich history of over 60 years, the group has since expanded its portfolio of chocolate confectionery brands, including 10 master brands such as SilverQueen, Ceres, Delfi and more than 20 key sub brands.

Delfi’s extensive sales and distribution network across South East Asia is supported by two chocolate manufacturing facilities in Indonesia and the Philippines. In addition, the group also markets chocolate confectionery products in other countries in Asia such as Thailand, Japan, Hong Kong, Australia and China through the use of sales agents and distributors.

Financial Performance

Delfi’s share price over the past few years have been disappointing. Investors who went long on Delfi’s shares in 2014 would be in the red by over 50 percent today and the dividends collected over the years would be far from to make up for this decline.

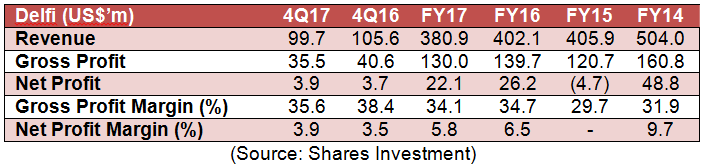

The decline in share price is easily explained by the group’s financial performance. Revenue has been on the downtrend and declined by 5.3 percent for FY17 as a result of the group’s product rationalisation exercise and a government imposed transportation disruption which affected business operations in Indonesia in 4Q17. The group faces a concentration risk as revenue contribution from Indonesia remains the highest at 71 percent.

Although margins recovered slightly in the fourth quarter, full year net profit was down 15.6 percent despite having recorded a pre-tax gain of US$4.6 million from the divestment of the group’s 50 percent stake in PT Ceres Meiji Indotama.

Indonesia Domestic Consumption

Chocolate consumption in Indonesia is likely to grow, as the country remains one of the fastest growing emerging market economies despite economic growth slowing down to around five percent.

In a bid to boost the economy further, Indonesian President Widodo has not only set an ambitious target to attract 20 million visitors in 2019 but also called for US$20 billion in investment in the tourism sector. Earlier in 2016, the country opened up to more foreign visitors by granting visa free access to nationals of 169 countries. Going forward, it is expected that the travel and tourism industry alone will generate 2.4 million new jobs.

More jobs will result in higher disposable incomes per household and ultimately increased consumption of goods such as chocolates.

On top of that, Indonesia’s central bank has cut interest rates eight times since 2016 to 4.25 percent. A lower interest rate would mean that consumers have cheaper access to funds, which leads to greater spending power.

Valuations

While the outlook does not appear too bleak for Delfi, investors may not be too comfortable with the decrease in dividends for FY17.

Delfi proposed a final dividend of 0.76 cents per share, bringing the total dividend for the year to 2.42 cents per share. In comparison, the group’s total dividends per share for FY16 amounted to 3.18 Singapore cents. Based on FY17 dividends per share, Delfi’s shares are now trading at a dividend yield of 1.6 percent.

Despite the fall in share price, Delfi’s current valuations are still relatively high. Price-to-earnings ratio stands at 31.4 times, above the industry average of companies in the food industry of 12.6 times. Price-to-book ratio of 3.3 times is also highly unattractive, indicating that the company’s shares could very well be overpriced.

That said, the industry that Delfi operates in remains strong and investors could find a decent entry point should the group’s valuations decrease in future.

Yahoo Finance

Yahoo Finance