SI Research: Dairy Farm Or Sheng Siong, Which Is A Better Buy?

Dairy Farm International Holdings (Dairy Farm), a leading pan-Asian retailer, operates over 9,700 outlets across 11 Asian countries as at 31 December 2018. The group’s food segment, which consists of businesses in supermarkets/ hypermarkets and convenience stores comprising internationally well-known brands such as Cold Storage, Giant and 7-Eleven, collectively constituted around 70.2 percent of its top-line in FY18. The remaining revenue came from the group’s health and beauty, restaurants and home furnishings segments each contributing 14.7 percent, 11.8 percent and 3.3 percent respectively.

Dairy Farm’s share price recently sank more than 24.1 percent in the last two months from a peak of US$9.75 a share on 16 January 2019 to US$7.40 on 13 March 2019, bringing it to a multi-year low last seen only in the year 2016. Many would have deemed this as an opportunity to initiate a purchase. However in comparison against home-grown grocery retailer Sheng Siong Group (Sheng Siong), which of the two would stand out as the better investment?

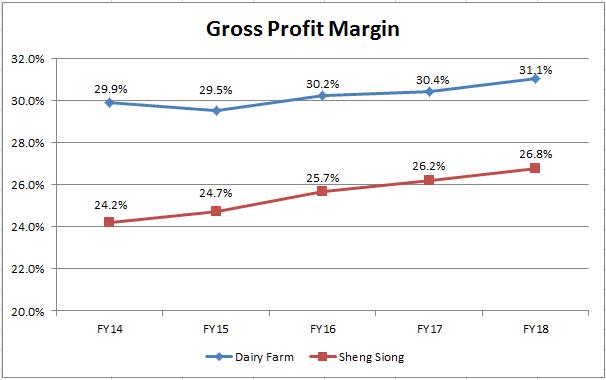

Gross Profitability

Gross profit is the profit that a company makes after deducting the cost of goods sold (COGS) from its sales. Gross profitability assesses a company’s efficiency at controlling its variable costs associated with making and selling its products, including material and labor costs which fluctuate in accordance to the level of output. While trying to achieve higher revenue, a good company should also strive to attain lower COGS at the same time to be more profitable. This is particularly more so for businesses in the sector of fast moving consumers goods. A company which earned a higher gross profit could be an indication that it had achieved greater economies of scale, and hence suggesting greater competitive advantage over its competitors.

While Dairy Farm’s gross profit margin is higher standing at 31.1 percent in FY18, the group’s gross margin has more or less stagnated in the last five years hovering around the 30 percent level. Meanwhile, Sheng Siong is playing catch-up fast. The latter’s gross profit margin had shown a marked and consistent improvement over the years from 24.2 percent in FY14 to 26.8 percent in FY18. This could be the result of Sheng Siong achieving greater economies of scale from an increased number of outlets opened across the island, as well as a stronger ability to command higher rebates and better buying prices from its suppliers.

Source: Companies’ Annual Reports

Room For Growth

From 34 supermarkets outlets totaling 404,000 square feet of retail space at the end of year 2014, Sheng Siong’s store count has since increased notably to 54 outlets in FY18 with total retail area of 496,000 square feet. In addition, the group is also looking to set its footprints outside of Singapore following the opening of its first overseas outlet in Kunming China in November 2017. In line with the increased outlets, Sheng Siong’s net profit rose at a compounded annual growth rate (CAGR) of 10.3 percent to $70.5 million in FY18 on the back of a 5.3 percent annual increment in revenue to $890.9 million.

On the other hand, Dairy Farm’s top line growth appeared modest in comparison with 1.6 percent per annum growth over the same period to US$11.7 billion in FY18. In spite of this, FY18 net profit took a plunge sinking 80.2 percent year-on-year to US$77.6 million. This was attributable to the group recognising US$453 million of food business restructuring costs relating to the exit of various underperforming stores and stock clearance as Diary Farm embarked on a multi-year transformation plan to re-shape its food business in Southeast Asia. In contrast to the nimble Sheng Siong set on the trajectory path of growth, Dairy Farm appeared heavy and slow to adapt to the changing consumer dynamics.

Source: Companies’ Annual Reports

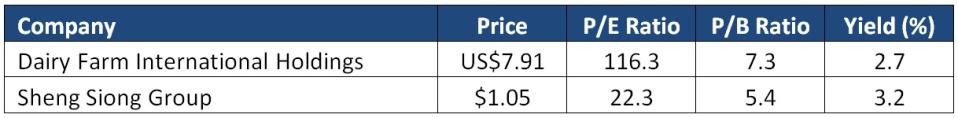

Financial Strength And Valuations

In terms of financial health, Sheng Siong is undoubtedly the far more superior option. As at 31 December 2018, Sheng Siong’s balance sheet remained robust in a net cash position of $87.2 million and zero borrowings. Concurrently, Dairy Farm’s net debt at the end of 2018 climbed 23.5 percent to US$744 million, due to increased borrowings for the additional investments in the Philippines.

That said, although Sheng Siong may seem promising in light of its potential for further growth, current valuations do not look cheap with its price-to-book ratio standing elevated at 5.4 times and price-to-earnings ratio at 22.3 times. Current price of Dairy Farm may have become slightly more attractive following the correction, but in the foreseeable near-term the group could continue to struggle with the challenges arising from increasing costs and intensifying competition in the retail markets.

Source: Author’s Compilation, updated 25 March 2019

Yahoo Finance

Yahoo Finance