SI Research: ComfortDelGro Corporation – Ready For A Mobility Revolution

The outlook is turning positive for ComfortDelGro Corporation (CDG) as pressures from private-hire car services have eased significantly following the merger between Uber and Grab in March 2018. On the ground, private-hire drivers complained of lower earnings mainly as a result of reduced incentives and many, who were formerly taxi drivers, have returned to their previous trade.

On top of that, only 51 percent of the private drivers who had obtained an Approval-to-Drive concession had passed the Private Hire Car Driver’s Vocational Licence test by the 30 June 2018 deadline. As a result, the pool of private hire drivers is now significantly smaller.

Despite reports from five brokerages putting the average target price for CDG’s shares at $3.09 in August 2017, we were not convinced that CDG’s shares have hit the bottom. Indeed the group’s shares continued on a downward trend, falling below $2 per share, before staging a recovery after news of the merger between the two ride-hailing giants emerged.

Previously, we viewed CDG negatively due to its lack of innovative solutions in the face of mounting pressures from the new competition in the industry. However, the transport giant recently announced a partnership with Finnish mobility firm MaaS Global to launch an application known as Whim which could revolutionise the public transport scene in Singapore.

Financial Performance

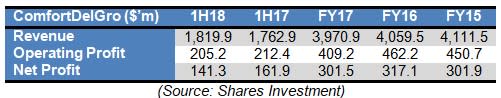

For 1H18, the group’s revenue increased by 3.2 percent led by a $131.1 million increase in revenue from the public transport services segment. However, the increase in revenue was offset by a 4.1 percent increase in total operating costs mainly due to higher staff costs as well as fuel and electricity costs. As a result, net profit was 12.7 percent lower at $141.3 million.

Going forward, the group’s operating environment is expected to remain challenging and it is unlikely that there will be a significant improvement in the second half of 2018.

Mobility Revolution

The bright side for CDG comes from Whim which will go on trial soon and is expected to launch in the first quarter of 2019.

Whim is designed to provide commuters with access to a variety of transport services based on the subscription model. For those who are familiar with the video on demand service known as Netflix, Whim sets itself to be the “Netflix of transport”.

The new service aims to bring together all means of transport such as taxi, bus, train, car rental and even bicycles. Through this service commuters will be have access to all forms of public transport, enhancing their travel experience. For example, a commuter travelling from his residence in the East to an industrial area in the West could start his journey with a bus ride to the train station followed by a train ride. To end off his trip, the commuter could have the option of taxi, which was previously not an integrated service, depending on the accessibility of the location.

Whim is already operational in Helsinki, Birmingham, Antwerp and Amsterdam, proving its commercial viability with about 60,000 active users and 1.85 million trips made to-date. However, while the idea holds huge potential, the implementation process in Singapore is vital to its success.

Implementation Challenges

For such a service, the service provider will need to negotiate terms with the various transport operators. This will certainly pose a huge challenge as Whim will need to ensure that its services are attractively priced while at the same time meeting the earnings expectations of the transport operators.

From a commuter’s point of view, Whim will have to provide the services at a lower cost for it to be attractive. This would mean that transport operators such as taxi drivers may see a decrease in earnings as fares would have to be lowered.

Naturally, if the service can prove to be a big game changer, an increase in the number of active users will compensate for the lower fares by increasing the trip volumes. In the initial phase, Whim is likely to incur high startup costs mainly related to marketing and promotional activities as well as incentives to compensate transport operators for the lower fares.

Conclusion

While it can be said that the worst is over for CDG, it remains to be seen how the group can execute its growth strategies going forward. In addition, the rising fuel and electricity cost will continue to put a dent in the group’s earnings.

At its current share price of $2.25, CDG’s shares are fairly valued at 16.2 times price-to-earnings with a dividend yield of 4.6 percent.

Yahoo Finance

Yahoo Finance