SI Research: Cityneon Holdings – Riding On Strong Entertainment Demand

Films have been around for centuries, with the earliest films in the world in black and white, under a minute long and without sound. Today, high-definition films are widely available and some feature films have also been produced in 3D IMAX format for greater enjoyment.

In September 2017, Cityneon Holding’s (Cityneon) acquisition of the intellectual property rights of Jurassic World: The Exhibition for US$25 million caught our attention. The group’s shares, which last changed hands at $1.07 as at end of trading on 11 September 2017, subsequently made its all-time high of $1.26 on 27 October 2017, representing a gain of over 17 percent within two months.

Despite already having the intellectual property rights and licenses for the exhibits of three blockbuster movie franchises under its wholly-owned subsidiary, Victory Hill Entertainment (VHE), the group continues to expand its successful blockbuster exhibitions business.

Hungry For More

In May 2018, VHE entered into an exclusive worldwide touring exhibition license agreement with Lions Gate Exhibition (Lions Gate) for The Hunger Games: The Exhibition. The exhibition, which is based on The Hunger Games franchise, has been exhibited in places such as New York, Sydney, San Francisco and Louisville.

The agreement is for seven years and may be renewed for a maximum of a further seven years. Fees payable by Cityneon to Lions Gate comprise both fixed and variable components.

While the latest deal provides an outlet for immediate revenue streams and profits, it is probably not as accretive as the addition of Jurassic World: The Exhibition. Unlike the Jurassic Park franchise, which a sequel is set to be released in 2021, there has yet to be any announcement on the next instalment of The Hunger Games.

Second Jurassic World Exhibition Set

Building on the success of the Jurassic World: The Exhibition, Cityneon recently entered into an agreement with Universal to build the second exhibition set. Since its launch in 2016, the exhibition has toured Melbourne, Philadelphia and Chicago before making its fourth opening in Paris on 14 April 2018.

The timing for the second exhibition set could not be better. The fifth instalment of the Jurassic Park film series, Jurassic World: Fallen Kingdom, brought in an estimated US$150 million during its opening weekend in North America, making it the fourth biggest opening of the year. As a testament to the world’s love for dinosaurs, the film’s worldwide haul has crossed US$711.5 million since opening overseas earlier this month.

In addition, the tailwinds are likely to remain strong for Cityneon as an untitled sequel is set to be released in June 2021. The group is also in discussion for the third and fourth exhibition sets.

Financial Performance

Despite having a strong business model, it is also important to review a company’s financial performance to determine whether it actually has the capabilities to generate equally strong profits.

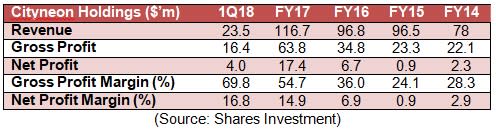

Excluding FY15 during which Cityneon incurred higher expenses for the acquisition of VHE, the group has a strong track record with a solid improvement in both top and bottom lines since FY14.

Cityneon’s margins have improved significantly as the Intellectual Property Rights (IPR) segment moves up to become the group’s top revenue contributor in FY17 at 43.5 percent from just 18.3 percent in FY16. As of 1Q18, the IPR segment’s contribution has increased to 62.2 percent, leading to a further improvement in both gross and net profit margins.

Going forward, Cityneon’s is expected to deliver stronger results as the group continues to expand the IPR business. By the end of 2018, the group expects to have a minimum of nine to 10 permanent and traveling sets across different parts of the world.

Valuation

Closing at $0.96 on 22 June 2018, Cityneon’s share price remains unchanged since the beginning of the year despite having changed hands mostly above the one dollar mark. Meanwhile, the Straits Times Index shed 4.2 percent during the same period.

Cityneon is currently valued at an attractive price-to-earnings ratio of 13.4 times significantly lower as compared to 39.4 times in September 2017. However, it is notable that the group has yet to pay out any dividends despite the strong FY17 performance, likely resulting in a dampening effect on its share price.

Yahoo Finance

Yahoo Finance