SI Research: Cityneon Holdings – Could Dinosaurs Pave The Way?

Entertainment has been around since the birth of the earliest human civilisations and it is inborne human nature to seek entertainment, which comes in various forms. Although the definition of entertainment is different amongst individuals, some of the most basic forms of entertainment are storytelling, music and drama. Evolving over several centuries, these basic forms of entertainment have integrated with modern technology leading to the development of films, video games and interactive exhibitions.

One company that has found much success in the entertainment industry is Cityneon Holdings (Cityneon).

In September 2015, Cityneon acquired Victory Hill Exhibitions (VHE), giving it the intellectual property rights and licenses to use the Avengers S.T.A.T.I.O.N until 2024. The Avengers S.T.A.T.I.O.N is an interactive exhibition which capitalises on the fifth highest grossing film, Marvel’s The Avengers.

Two months later, the group secured the rights to use the Transformers brand for a period until June 2023, for the development, staging, production, promotion, and advertisement of the exhibits. The Transformers film series is one of the highest-grossing film series with a total of US$4.2 billion.

The Largest Acquisition

Having delivered stellar results led by the Intellectual Property Rights (IPR) segment, comprising the aforementioned rights and licenses, the group is set to bring the largest creatures to ever roam the Earth back to life.

Through a US$25 million acquisition in September 2017, Cityneon secured the intellectual property rights of Jurassic World: The Exhibition, a licensed spin-off from the fourth highest grossing film, Jurassic World. The move is perfectly timed as a sequel, Jurassic World: Fallen Kingdom, which is slated for release in 2018, is ready to revive the dinosaur hype.

While acquisitions can be seen as a new stream of revenue for a company, whether it will be able to lift the bottom line largely depends on the ability of the company’s management to execute these projects.

Financial Performance

One way to determine whether Cityneon has the capabilities to turn the acquisitions into a money-making machine would be through looking its past financial performance.

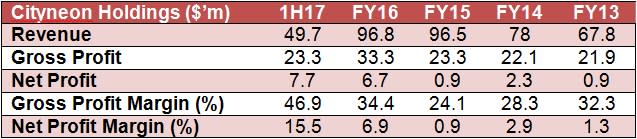

(Source: Shares Investment)

The group’s performance prior to the acquisition of VHE has been rather lacklustre, barely remaining in the black for FY13 and FY15. While gross profit margins were decent, net profit margins remained thin.

After the acquisition of VHE, margins improved significantly and Cityneon turned a net profit of $6.7 million for FY16, higher than the aggregate of the past three financial years.

The current year is set to be even more exciting for Cityneon as the group had delivered stellar results with a net profit of $7.7 million in just the first half of the year. Margins rose to record highs with net profit margin entering into the double-digit range.

Although Cityneon’s chief executive officer, Ron Tan, initially feared that the company was simply not cut out for the job, its success has launched the group’s market capitalisation over 10 times to $263 million. Cityneon does not run a factory that produces certain sword-wielding laser spewing robots, but we are much impressed with the group’s proven ability to transform the acquisitions into money-making machines.

Free Hype

Hype is extremely important for Cityneon’s business as it is the factor that drives the masses to its exhibitions. Undeniably, the movie industry has generated much of that needed hype, which comes at zero cost for the group.

A majority of well-known media franchises started off black and white on paper before being expanded onto the big screen, also known as cinemas. These coloured pixels with special sound effects appeal to a greater range of audience leading to increased popularity for the franchises.

Already the best form of advertisement for Cityneon’s IPR segment, these billion dollar blockbusters are not ready to stop anytime soon. Marvel has a long pipeline of films in store stretching all the way to 2020, almost all of them feature characters that can be found in the Avengers S.T.A.T.I.O.N. As for Transformers a spin-off is scheduled for 2018, and the sixth film in the series is to be released in 2019.

Valuation

Closing at $1.07 as at 11 September 2017, Cityneon’s share price registered a year-to-date gain of over 15 percent, inching ahead of the Straits Times Index which is up 11.6 percent.

Cityneon’s shares are currently valued at a seemingly high trailing 12 months price-to-earnings ratio of 39.4 times. In addition, the group has yet to pay out any dividends since FY14. However, we are of the view that relatively new IPR segment has much more room for improvement. This could potentially arise from higher margins as the business gains traction.

An interesting point to note before jumping on or off the bandwagon is that the group’s independent directors recently advised shareholders to reject a cash offer of $0.90 per share from Lucrum 1 Investment, a consortium led by Ron Tan. After the close of the offer, Lucrum 1 Investment is now Cityneon’s largest shareholder with a 69 percent stake.

Yahoo Finance

Yahoo Finance