SI Research: CITIC Envirotech – Should You Include This Water Stock In Your Portfolio?

It’s hard to imagine a city running out of water in modern times, but it could happen. Chennai, India is the latest city to have almost run out of water as the main reserve is drying up. Not long ago, Cape Town, South Africa also nearly became the first city to run out of water in early 2018.

Many of the world’s major cities face water stress as population booms, urban development increases and climate change intensifies. To tackle the water crisis, one of the immediate solutions is waste-water reuse. As water is a precious commodity, many would consider the water-treatment industry as a good investment.

This led us to take a look at CITIC Envirotech (CEE), a Singapore-listed environmental company whose primary business resolves around industrial water and wastewater treatment in China. The company’s business segments are categorically: Engineering, Procurement and Construction (EPC), Investment, and Membrane Technology.

Financial Performance

For the past five years, FY14 to FY18, CEE’s top line has risen every year. From $329.8 million in FY14, revenue has grown at a compounded annual growth rate (CAGR) of 31.8 percent to $994.5 million by FY18. Performance at the bottom line was also impressive. Over the same period, net profit has grown steadily from $50.6 million to $105.1 million, representing a CAGR of 20.1 percent.

In the latest earnings release, CEE’s 1Q19 revenue and net profit declined 72.2 percent and 92.2 percent to $72.1 million and $3.1 million respectively. The weak 1Q19 was due to the Meigu EPC project that is worth Rmb2.5 billion put on hold due to adverse wintry condition. In addition, the Group entered a mutual agreement with the local authority of Lanzhou City to terminate the land remediation within the Public-Private-Partnership (PPP) project which amounted to Rmb1.8 billion of the total contract value of Rmb4.6 billion.

Despite lower revenue, the gross margin doubled to 70.6 percent due to membrane system sales with a relatively higher gross profit margin. However, the net margin declined from 15.2 percent in 1Q18 to 4.3 percent in 1Q19.

Balance Sheet

Based on the latest set of results in 1Q19, the company has a cash pile of $397.1 million and a total debt of $1.5 billion. This translates to a net debt position of $1.1 billion and the net-debt-to-equity ratio stood at 0.93 as compared to 0.05 in FY16. Meanwhile, the return-on-common-equity (ROE) is also lower at 4.7 percent as compared to 8.5 percent in FY16.

On the cash flow front, the company has been generating negative cash flow from operations in each year since 2015. The high net debt ratio and negative cash flows were due to the higher cash outflow for the construction of the investment projects and Build-Transfer projects. The capital-intensive nature of the water treatment industry coupled with the debt pile and negative cash outflow may deter investors.

Notable Contract Wins

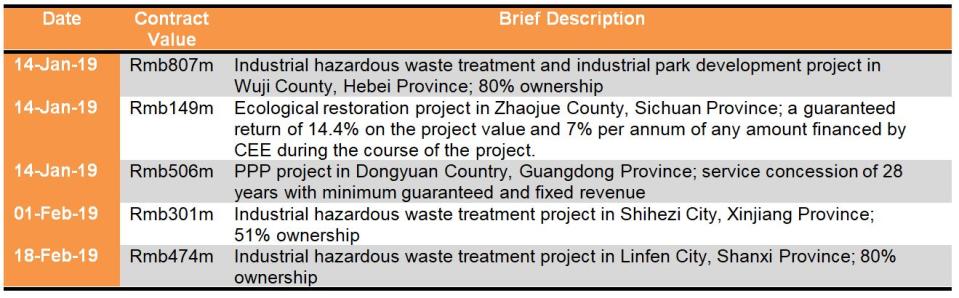

In FY18, CEE secured project wins in excess of Rmb6 billion, which will be progressively delivered over the coming two years, proving growth visibility. In addition, CEE clinched five more projects with a combined value of more than Rmb2 billion.

Source: SGX Announcements

Valuations

(As at 01 July 2019)

The share price of CEE fell 27.3 percent to $0.32 since its weak 1Q19 results announcement on 29 April 2019. However, CEE is currently trading at 17 times earnings and 0.8 times book value.

Comparatively, we observe that the current valuation appears to be somewhat demanding whether in terms of P/E or P/B. Moreover, CEE delivered an inferior dividend yield and ROE compared to its peers. As such, investors looking to accumulate CEE should wait for prospects to improve before buying into the stock.

Yahoo Finance

Yahoo Finance