SI Research: Asia Enterprises Holdings – Value Stock Or Value Trap?

Value investing has been gaining in popularity due to the success of famous investors, resulting in the rise of books, seminars, courses and articles relating to this investing strategy. While value stocks refer to stocks that are trading at a lower price than it is actually worth, value traps are stocks that are cheap due to one or more other reasons that cause the share price to be “undervalued”.

As more investors join the hunt for value stocks, naturally, more are falling into value traps as well. However, value is often subjective and in theory, the value of an object could increase by the transfer of ownership of it to an owner who regards the object at a higher value. That said, could the same perceived value trap turn out to be a value stock in the hands of a different owner?

Asia Enterprises Holdings (Asia Enterprises), a steel trading company, makes a great example.

The Business

Asia Enterprises is a major distributor of steel products to industrial end-users in Singapore and Asia-Pacific. Incorporated in 1961, the company listed on the Mainboard of the Singapore Exchange in 2005.

Having built a strong reputation over the past 50 years, the group presently operates two warehouses and a steel processing plant with a combined land area of 45,934 square metres. Complementing its distribution business, the group also provides value-added precision steel processing services through its steel service centre, which is a joint-venture with Marubeni-Itochu Steel.

The group’s customers are primarily involved in the marine and offshore, oil and gas, construction as well as the precision metal stamping, manufacturing and engineering industries. In particular, the performance of the overall marine and offshore industry is a key factor to the group’s performance as the segment accounts for 47 percent of total revenue for FY17.

Financial Performance

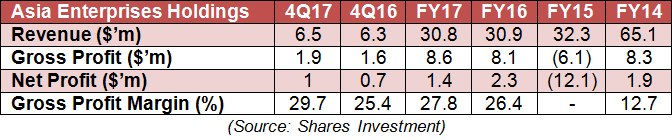

Gross profit margin is an important financial metric for all companies. For trading companies such as Asia Enterprises, gross profit margin typically fluctuates across quarters during a financial year for many reasons. Some factors include changes in selling prices due to seasonal factors and market conditions, sales mix, and changes in its average cost of inventory sold.

Asia Enterprises ended FY17 with a net profit of $1.4 million, mainly due to additional depreciation charges of $1.8 million following the completion of a warehouse redevelopment at the end of FY16.

Despite the depreciation charges, the group has done well to remain profitable. This was largely due to the fourth quarter where the group recorded significantly stronger performance.

Though the worst could be over for the offshore and marine sector, uncertainty remains and it cannot be safely said that the outlook is bright.

How Much Cash Is Too Much?

Despite reporting a net loss of $12.1 million for FY15, Asia Enterprises was able to stand its ground and tide through the downturn of the global steel industry due to its strong balance sheet.

As at 31 December 2017, on top of the fact that Asia Enterprises had zero borrowings, the group had cash and equivalents of $57.2 million. This means that the group does not face a risk of rising interest rates while maintaining the available cash needed to tide the business through tough times.

While there are good reasons for holding extra cash, bad reasons are plenty as well. The amount of cash held by Asia Enterprises could be an indicator of a lack of investment opportunities or that the management does not have plans for the cash at the moment.

In theory, idle cash results in an opportunity cost, which is the difference between the interests gained from bank balances and the cost of equity. For instance, Asia Enterprises announced a final dividend of 0.5 cents for FY17, representing a dividend yield of 2.9 percent based on the current share price of $0.175. In comparison, based on Asia Enterprises’ interest income of $0.6 million, we estimate the interest received on the group’s cash balances to be around 1.1 percent. This simple illustration shows the opportunity cost, it cannot conclude whether the group is holding too much cash.

To support the argument of excess cash, it is also important to consider other components such as cost of sales, operating expenses as well as receivables and payables. Cost of sales for FY17 amounted to $22.2 million while operating expenses amounted to $7.8 million. Assuming that all of the Asia Enterprises’ customers did not pay up during the year and that the group paid in full for all costs and expenses, the group would still have remaining cash of around $27 million.

Potential Target For Privatisation

The group’s current net asset value per share stands at 27.43 cents, which includes cash and cash equivalents of 16.48 cents per share. Assuming that a single investor is able to purchase the group at the current share price of $0.175 or market capitalisation of $59.7 million, the investor would only have paid about $2.5 million for all the remaining assets and future earnings potential of the business.

However, the above action is probably impossible for retail investors and the stock might eventually turn into a value trap instead.

But as mentioned, value is subjective and this makes Asia Enterprises an attractive target for an owner who regards the business at a higher value. Shipbuilders, rig builders or any other business that utilises a large quantity of steel could find much value in Asia Enterprises, as the steel trading company fits into their supply chain.

Share Buybacks

While paying higher dividends can certainly make shareholders happy, based on the attractive valuations, Asia Enterprises could perhaps seek to repurchase its shares instead as this also provides the group with a certain degree of flexibility.

Yahoo Finance

Yahoo Finance