SI Research: Ascendas REIT – Buy On Dips?

Ascendas Real Estate Investment Trust (A-REIT) was highlighted by UBS as one of the preferred REIT that was expected to do well due to its “resilient earnings and sustainable dividends”. 2017 has been a good year for A-REIT as its share price rallied from $2.25 per share in late December 2016 to as high as $2.74 on 16 June 2017, increasing by 21.8 percent before coming down slightly by 5.5 percent to the current trading price of $2.59.

In this issue, we will take a closer look to examine if investors should make use of the current dip in share price to enter the market and invest in A-REIT.

Diversified Business

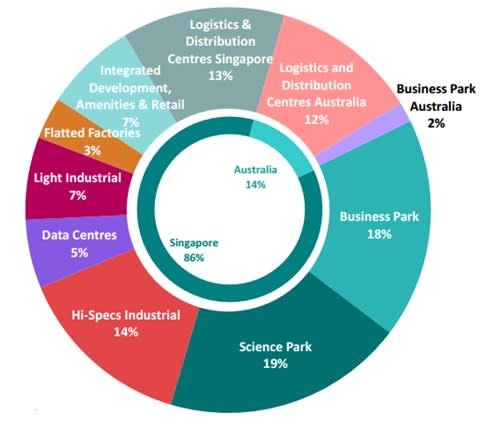

A-REIT is the largest REIT in Singapore, and it focuses on investing in business spaces and industrial properties. It owns 103 properties in Singapore and 29 properties in Australia. It has a well-diversified portfolio, with properties in 10 different industries. The diversity of its portfolio protects the trust from over-exposure to a particular sector, and investors can expect a more stable stream of passive income.

A-REIT boasts of a well-diversified tenant base with 1,390 customers from different industries. This reduces revenue volatility during unexpected circumstances since it is not overly dependent on any particular tenant. The top 10 tenants account for 20.8 percent of the portfolio’s gross rental income and no single property accounting for more than 5.4 percent of A-REIT’s monthly gross revenue.

Portfolio Profile

(Source: A-REIT Presentation Deck)

Financial Performance

In FY17, gross revenue increased by 9.1 percent to $830.6 million mainly due to increased contribution from Logistics and Distributions (L&D) Centres with 27 newly acquired logistics properties in Australia during 2H16. However, A-REIT also divested several of its properties during the year and decommissioned two other properties for asset enhancement works, slightly offsetting the increase in revenue from newly acquired properties.

Net property income for the year also increased by 14.5 percent to $611 million, mainly driven by an increase from the L&D centres as well as higher occupancy rate at Aperia and lower utility expenses from Hi-Specifications Industrial Properties. It is worth noting that though revenue was increased primarily because of acquisition of new assets, net property income also increased across all property types, except for Light Industrial Properties which dipped slightly by 0.8%.

DPU And Capital Gains

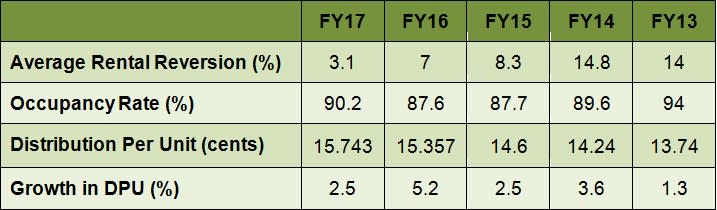

(Source: Shares Investment)

Most investors who invest in REITs are interested in the distribution yield. A quick glance at A-REIT’s distribution per unit (DPU) and one will notice a steadily increasing trend.

Given that the United States’ Federal Reserve (FED) has raised interest rates twice in 2017, and we would likely see other sovereign institutions following suit. In an environment of higher interest rates, cost of financing will increase, and more income will be used to repay debt obligations. Therefore distributable income may come down, and DPU may fall in the future.

Investors should also consider the capital gains made over time. Taking the unit price a year ago on 1 July 2016 at $2.30, investors would have made a 12.2 percent capital gain. Though the unit price of A-REIT has been climbing upwards steadily over the past year, one should note that this may not persist, as seen by the recent dip. Therefore it may be more prudent to project a more modest capital gain in the future.

Occupancy Rate And Rental Reversion

As REITs profit off rental income, investors should pay attention to its occupancy rate. A higher rate shows that the manager is capable of securing tenants, and a consistently high occupancy rate signals a much healthier and sustainable business.

We observed that occupancy rate has been declining over the years, but has picked up in the latest financial year. The improvement in occupancy in FY17 was primarily due to the divestment of all of A-REIT’s China properties in November 2016 which has dragged on the REIT’s occupancy rate.

Rental reversion has been positive over the years, albeit at a slower rate which is understandable given Singapore’s slowing economy with projected growth rate of one to three percent for fiscal 2017. Amidst a bleak economic outlook and an environment of shrinking demand for space, A-REIT’s improved occupancy rate and positive rental reversion suggest that the REIT’s managers are efficient.

Nonetheless, the trust has noted that “rental reversion is expected to be subdued or flat given the current global uncertainty, lower anticipated demand and excessive supply of industrial properties in Singapore”. Assuming a cautious approach of zero increase in rent charged by A-REIT would mean that income available for distribution is likely to plateau or increase minimally.

Lease Expiry

Lease expiry should ideally be longer-term to ensure consistent revenue or should be staggered over time such that the manager can renegotiate and rollover the expiring contracts. Analysing the portfolio lease expiry profile, we observe that the trust will be left with about 30 percent of its occupants by 2022. In the upcoming five years the manager will have to secure about 14.1 percent new or renewed leases per annum.

The trust’s current weighted average lease expiry (WALE) across the entire tenant portfolio stands at 4.3 years. This is an improvement from the previous 3.8 years in FY15 and 3.7 years in FY16. Given the declining demand climate for rental space, a higher WALE will be preferred to bring stability to DPU.

Valuation

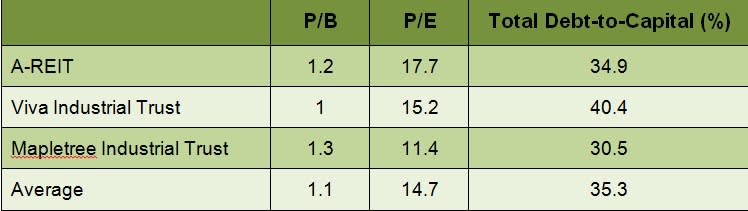

(Source: Shares Investment)

A-REIT’s total debt-to-capital stands at 34.9 percent and is lower than its selected peers’ average of 35.3 percent. Given that the maximum leverage is capped at 45 percent, the trust still has more financial headroom for more debt to capitalise on growth opportunities.

However, valuation-wise, A-REIT seems to be much more expensive than its peers, with price-to-book value of 1.2 times and price-to-earnings of 17.7 times. In other words, investors are paying a premium for A-REIT’s properties and may have less margin of safety in an unexpected downturn.

Conclusion

The most attractive part that lures investors to invest in A-REIT is its diversified business across 10 different industries which ensure the stability of revenue. Furthermore, lease expiry dates are well-staggered. However, despite the recent dip in share price, units of A-REIT are still rather expensive. At the current price of $2.59 with a DPU yield of 6.1 percent, the trust is not exactly the most appealing REIT to invest in compared to the average S-REIT yield of 6.6 percent.

That said, investors should keep watch of this counter and be patient for the right opportunity to jump on the REIT at a more compelling valuation.

Yahoo Finance

Yahoo Finance