SI Research: 5 Reasons To Like First REIT

Real Estate Investment Trusts (REITs) have become popular investment tools amongst Singaporean investors who have a penchant for property investing. Local-listed REITs have a requirement to distribute 90 percent of yearly-profits and thus making them good alternatives to bonds. For risk-averse investors, REIT-investing offers a stable and tax-free source of income without having to incur huge amount of initial capital for down payment as compared to investing in a physical property, while REIT holders or unitholders can also easily liquidate their investments which make the risks involved even more manageable.

In addition to the attractiveness as investment tools, Singapore’s REITs offer the highest yields amongst developed market. With Singapore’s economy returning to a more promising outlook, yield-hungry investors have flocked back to local REITs and that has propelled the FTSE ST REIT index to register a 14.3 percent gain since the beginning of the year.

That said, with attention coming back to local REITs, we look to local-listed healthcare trust, First REIT, and offer 5 reasons to like this REIT.

Solid Operating Sector And Markets

There are 18 properties currently under First REIT’s stable – 14 in Indonesia, three in Singapore and one in South Korea. Properties are predominantly healthcare-related – with a majority being hospitals – which makes First REIT highly resilient in a market downturn.

First REIT’s properties are strategically situated in Singapore, South Korea and Indonesia: Singapore and South Korea are known to be medical hubs, offering top-notch medical treatments not readily available in underdeveloped countries around the region. Meanwhile, Indonesia – its core market – is a rapidly developing country that the World Bank projects would grow by 5.2 percent in 2017. Hence there are ample growth opportunities in this market whereby patients have tended to seek treatments in Singapore.

Despite its booming middle-income class, Indonesians still face limited supply of healthcare space. In 2015, Indonesia’s Ministry of Health released a health profile report which detailed the ratio of hospital beds per 1000 population was only 1.2. This statistic is a far-cry from the Organisation for Economic Cooperation and Development countries’ average ratio of 4.7 hospital beds per 1000 population in 2015. As such, given that healthcare space (i.e. hospital beds) in Southeast Asia’s most populous country is a rather scarce commodity, services from First REIT’s hospitals should be well-demanded.

Strong Sponsor

First REIT is sponsored by PT Lippo Karawaci Tbk, the largest listed property developer in Indonesia under the behemoth conglomerate, Lippo Group. The REIT’s Indonesian properties operate under the brand of Siloam Hospitals Group, which is the most established and prominent hospital brand in the country.

Having mentioned that Indonesia’s healthcare space is scarce, the sponsor has a strong pipeline of over 40 healthcare properties that can be injected into First REIT’s portfolio. Naturally, First REIT also has the right-of-first-refusal to its sponsor’s healthcare properties, which is to say that the REIT is first in line for the purpose of acquisitions. We also noted that a number of projects in the pipeline of Lippo Karawaci are situated in hospital-deficient provinces such as West Java (0.84 hospital beds per 1000 population) and West Sulawesi (0.78 hospital beds per 1000 population).

The second advantage to having such a strong sponsor is that First REIT may tap into its sponsor’s existing relationships for sources of cheap financing. The sponsor may also provide credit to the REIT with its own funds should the need arises.

Undisputed Occupancy Rate

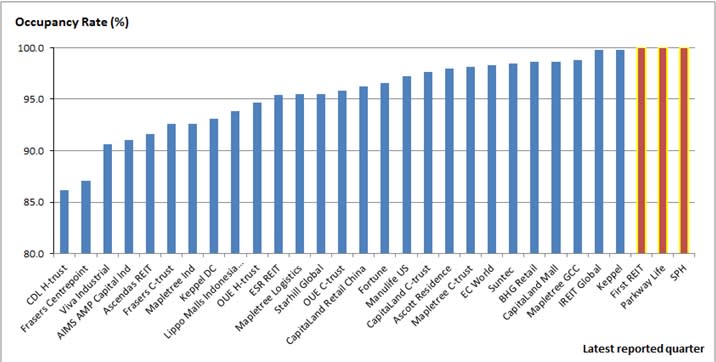

Occupancy rates provide a good indication for anticipated cash flow. High occupancy rates also support the valuations of the said properties. A growing portfolio with high occupancy rate will ultimately mean rising rental and distributable income to unitholders.

For First REIT, the REIT listed on the Singapore Exchange (SGX) in 2007 and started announcing its occupancy rate in 2008. Since then, the REIT has reported 100 percent total committed occupancy – a remarkable feat when compared to other dozens of REITs on listed SGX. Only two other REITs have sustained full occupancy, and they are Parkway Life REIT and SPH REIT.

(Source: Shares Investment)

Long Operating Lease

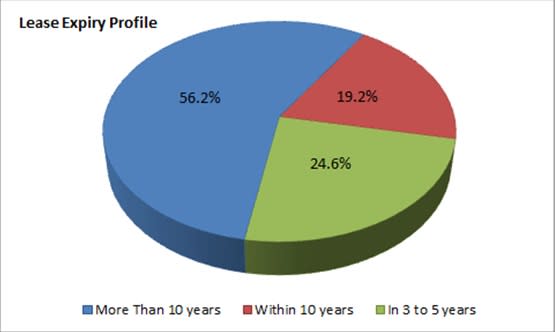

Apart from occupancy rate, another key metric that investors should pay attention to, for the sustainability of a REIT’s distribution, is its lease profile. Based on its latest 2Q17 results, First REIT has reported that a good 75.5 percent of leases will expire only after five years, of which 56.2 percent has a lease expiry of more than 10 years.

The long lease profile of First REIT indicates that the short-term risks of unfilled spaces are somewhat limited. Similarly, due to the long leasing period for First REIT’s properties, the REIT’s managers need to spend less time and resources to court for new tenants and can instead focus on its operations. Therefore, this should give investors the assurance that the current income that First REIT generates and distributes would be sustainable for years to come.

(Source: Shares Investment)

Rising Distribution Per Unit

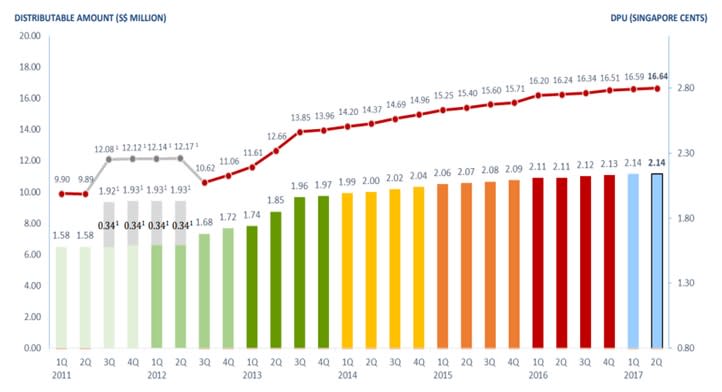

The Holy Grail of dividend investing is scouring for companies that can faithfully pay and increase their dividends year in and year out like clockwork. Of course, the ability to do so would depend on the company’s ability to outperform year after year. In this case, we see that First REIT’s distributable income has been increasing over the years from $9.9 million in 1Q11 to $16.6 million by 2Q17. As a result, First REIT has been able to dutifully pay incremental distributions to its unitholders through the years.

From 1Q11 to 2Q17, quarterly distribution per unit (DPU) has risen from $0.0158 to $0.0214, translating to a DPU growth of 35.4 percent. Based on the trailing twelve months DPU of $0.0853, units of First REIT offer an annualised distribution yield of about 6.4 percent at the current unit price of $1.34 as of 31 July 2017.

At 6.4 percent annualised yield, First REIT beats Parkway Life REIT’s (Parkway Life) 4.5 percent, which the latter is the only other healthcare REIT on our exchange. Meanwhile, First REIT’s total borrowings-to-total assets ratio is also lower at 31 percent compared to Parkway Life’s 37 percent. It would be good to highlight that 90.9 percent of First REIT’s borrowings are set on a fixed rate basis, meaning any interest rate hikes would have limited impact on its performance.

Source: First REIT 2Q17 Result Presentation

Key Takeaways

Whilst we have provided the 5 good reasons to like about First REIT, investors should look deeper into the REIT’s financials before making their investment decisions.

We also like to highlight that First REIT is also trading at a price-to-book value of 1.2 times or about 24 percent premium to its book. In contrast, a number of local-listed REITs are actually trading at a discount to their book value while at the same time offering more attractive yields. Therefore, First REIT might not be an ideal investment security for more aggressive investors.

Nonetheless, of the other local-listed REITs trading at a discount to book value, none has sustained full occupancy rate and boasted a distribution track record like First REIT. Due to its highly-resilient nature, healthcare REITs also tend to trade at premium.

In addition, unlike First REIT, some of these REITs may have highly-geared balance sheet and would be adversely impacted in a rising interest rate environment. As such, risk-averse investors willing to pay a premium for stability may just find many more reasons to like about First REIT.

Yahoo Finance

Yahoo Finance