SI Research: 3 Property Stocks At Attractive Valuations

Investors make use of several valuation indicators in the process of identifying investment worthy companies or setting a target entry and exit price. Some common indicators include price-to-earnings (P/E) ratio, price-to-book value (P/B) ratio and dividend yield.

In the previous issue of Shares Investment, we highlighted three net cash companies and illustrated how these companies can be valued using a modified price-to-earnings (P/E) ratio known as Ex-Cash P/E.

With much activity going on in Singapore’s property market, it is likely that market participants will be keeping a close watch for signs of a revival. Typically, investors tend to focus on the P/B ratio for property stocks due to the significant amount of assets on these company’s books, while P/E would not be relevant due to the cyclical nature of earnings in the property sector.

P/B is calculated by dividing the price of the company’s shares by the latest book value per share. Book value is the total value of a company’s assets that its shareholders would theoretically receive if the company was liquidated.

That said, it does not imply that fully acquiring and liquidating a company, which is trading below a P/B of one time would guarantee an instant profit. This depends largely on the liquidity of its asset in addition to the fact that certain assets may not be able to sell for as much as expected.

CapitaLand

One of Asia’s largest real estate companies, CapitaLand is also the owner and manager of a global portfolio worth over $85 billion, comprising integrated developments, shopping malls, serviced residences, offices, homes, real estate investment trusts (REITs) and funds.

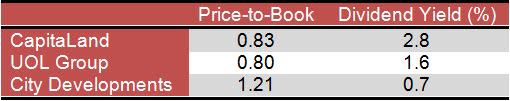

Based on the group’s latest financial results, CapitaLand has a book value per share of $4.29. This works out to a P/B of 0.83 times against the group’s current share price of $3.54.

Although CapitaLand’s shares are trading at a 17 percent discount to its book value, as mentioned earlier, this does not imply that one would make an instant profit from acquiring and liquidating the group, if it was even possible to do so.

Real estate companies typically trade at a discount to book value due to the illiquidity of real estate assets. As such, it would seem that CapitaLand does not fit perfectly into the category of “attractive valuations” as some may expect a larger discount. However, that might not be the case if taking into account one particular characteristic of real estate companies – revaluation.

For 9M17, CapitaLand recorded revaluation gains on investment properties amounting to $585.4 million as compared to just $285.5 million a year ago. As a further illustration on the importance of revaluation gains for CapitaLand, the figure alone made up around 45 percent of the group’s net profit for the same period.

While the property giant’s 17 percent discount might not seem significantly huge, investors who are able to make a good estimate of future revaluaton gains might see things differently.

UOL Group

With a track record of over 50 years, UOL Group (UOL) is another leading real estate company that deserves a mention. UOL holds an extensive portfolio of development and investment properties, hotels and serviced suites. Through its hotel subsidiary, Pan Pacific Hotels Group, the group owns two acclaimed brands namely Pan Pacific and PARKROYAL, with over 30 hotels and close to 10,000 rooms in Asia, Oceania and North America.

Based on the group’s latest financial results, UOL has a book value per share of $10.95. This works out to a P/B of 0.8 times against the group’s current share price of $8.73, or a 20 percent discount to book value.

For 9M17, UOL recorded fair value gains on investment properties amounting to just $12.2 million, an improvement from a loss of $19.6 million a year ago. Even after stripping out the fair value gains, as well as other gains of $529.6 million, mainly arising from the negative goodwill on acquisition of United Industrial Corporation (UIC), the group’s net profit would still record an improvement of around 26.7 percent.

Although UOL and CapitaLand have rather close valuations, it is notable that CapitaLand’s bottom line tends to be diluted by a significant portion of profit attributable to minority interests of around 30 percent. On the other hand, UOL’s dilution was less than five percent.

The fair value gains following the acquisition of UIC will result in a higher depreciation charge over the useful lives of these properties and the fair value uplift to development properties which include $56.1 million relating to Park Eleven and $18.7 million relating to The Clement Canopy. This means that it will result in a lower development profit to be recognised in future periods.

City Developments

Finally, City Developments (CDL) is our top pick for Singapore’s property sector for various reasons. Since our coverage in December 2015, the property developer’s share price has surged over 70 percent in less than two years to $12.16 as at 20 November 2017.

Similar to the abovementioned property giants, CDL holds a long track record of over 50 years in the real estate sector and the group’s main business also include residences, offices, hotels, serviced apartments, integrated developments and shopping malls.

Based on the group’s latest financial results, CDL has a book value per share of $10.38. This works out to a P/B of 1.21 times, or a 21 percent premium to book value.

(As at 20 November 2017)

In comparison, City Developments appears to be grossly overvalued and neither does its dividend yield offer much compensation. Despite that, the main reason why we favour CDL is due to the fact that the company does not revalue its properties each financial year. This means that the group’s property assets are recorded at cost less depreciation and impairments, which hardly makes any sense given the direction of real estate prices over the years.

Does that, however, justify CDL’s P/B of 1.21 times?

Take for example CapitaLand which has investment properties of almost $20 billion. CapitaLand typically records several hundred million in revaluation gains each year, approximately two to three percent the value of its investment properties.

As CDL holds an extensive portfolio of real estate, each one different from the rest, it would take a tremendous effort to survey and engage independent valuers across the world to accurately gauge the group’s revalued net asset value (RNAV).

Another way would be to work backwards. How much would the value of CDL’s investment properties need to be adjusted in order to meet the valuations of CapitaLand and UOL?

As at 30 September 2017, CDL had investment properties of $2.5 billion as well as investment in associates and joint ventures of $1.4 billion. On investment properties alone, a revaluation gain of approximately 83 percent would be needed to bring CDL’s valuation close to its peers. The figure would be much smaller if taking into account the revaluation of group’s investment in associates and joint ventures.

From this angle, CDL’s P/B becomes rather irrelevant and the concept of P/RNAV would be much more appropriate. In short, if you think that CDL’s investment properties should be valued at over 183 percent of its current value, then CDL would be undervalued when compared to its peers and vice versa.

Yahoo Finance

Yahoo Finance