SI Research: 3 National Day Rally Stocks For Singaporeans

Soon after Singapore celebrated the nation’s 53rd birthday, Prime Minister Lee Hsien Loong addressed some of the more pressing concerns which have been on Singaporeans’ minds during the National Day Rally (NDR) 2018. In his speech, PM Lee devoted a large part of his time touching on the new schemes to alleviate housing concerns, new changes made to healthcare subsidies as well as the rising costs of living. With that in mind, we identified three stocks centered on the themes mentioned during NDR 2018 which we think could benefit from the new policies.

Listed on the Singapore Exchange (SGX) in July 2013, ISOTeam is an established player in Singapore’s building maintenance and estate upgrading industry with over 19 years of experiences. The group has successfully completed over 399 upgrading projects comprising more than 4,000 buildings since inception.

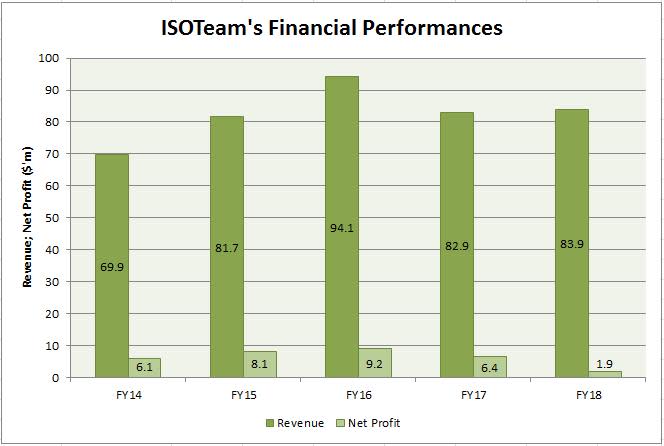

Over the last five years, ISOTeam’s top-line grew at a compounded annual growth rate (CAGR) of 4.7 percent to $83.9 million in FY18, attributable to the continued healthy expansion of the group’s Addition and Alteration (A&A) segment. Regrettably, the group’s net profit in FY18 declined by 70.7 percent to only $1.9 million because of the lower-margin projects as well as higher marketing and distribution expenses.

Source: Company’s Annual Reports

To allay fears of older flats losing their value as their leases run out, PM Lee unveiled plans to redevelop older estates a second time when they are about 70 years old. Under the existing Home Improvement Programme (HIP), only HDB flats built in the years up to 1986 will be upgraded. However with the introduction of the expanded HIP II scheme, more homes built in the years from 1987 to 1997 will also be included in the programme estimated to benefit an additional 230,000 flats in the next 10 years.

ISOTeam managed to secure its very first HIP project from the Housing Development Board (HDB) in January 2017 worth around $17.5 million. This has boosted the group’s A&A revenue by 32.8 percent to $32.4 million in FY17. Its A&A revenue grew 11.9 percent again in FY18 to $36.2 million, contributing approximately 43.2 percent to ISOTeam’s total revenue in that year. With more HIP projects up for tender coupled with ISOTeam’s proven track record that it can handle such projects well, the outlook for the group seems very promising.

Furthermore, homeowners in the estate undergoing HIP project may also be looking at renovating or repainting their homes at the same time. This is where ISOTeam may come in and take the opportunity to upsell its home maintenance and interior design services, thereby serving as additional incomes for the group’s other complementary segments.

As at August 2018, ISOTeam has a strong order book of $126.3 million to be delivered over the next two years. This has already provided some earnings visibility for the group amidst current challenging market conditions.

Raffles Medical Group

Raffles Medical Group (RMG) is a leading integrated private healthcare provider operating medical facilities in thirteen cities across Asia, including a tertiary hospital and a network of medicine and dental clinics.

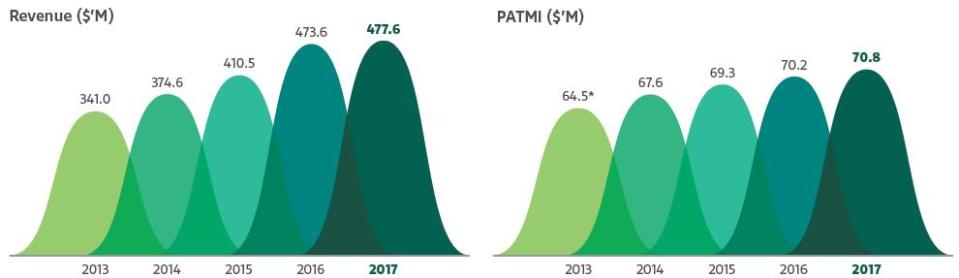

The group delivered a consistent and healthy growth over the last five years, with revenue and net profit expanding at a CAGR of 8.8 percent and 2.4 percent respectively.

Source: Company’s Annual Reports

RMG’s recent 1H18 results displayed a continuation of this trend reporting a 1.2 percent increment in net profit despite higher staff costs and other operating expenses, on the back of a 2.3 percent growth in revenue.

During the rally, PM Lee mentioned that the government will work out a Merdeka Generation Package to help Singaporeans born in the 1950s with their healthcare burdens. The package, which covers outpatient subsidies, MediSave top-ups and MediShield Life premium subsidies, will help to reduce some of the healthcare costs for some 500,000 Singaporeans in this age group.

Meanwhile, the Community Health Assist Scheme (CHAS) which currently provides medical subsidies to the pioneer generation (PG), lower and middle-income households for outpatient medical and dental care, will be extended to all Singaporeans with chronic conditions regardless of income.

Aided by the outpatient subsidies, patients will be more willing to turn to private healthcare providers for their medical needs because of their conveniences. RMG, which has been serving Singaporeans who are eligible for the CHAS and PG scheme through its extensive network of 80 clinics across the island, stood to be a direct beneficiary of the increased patient loads and enhanced CHAS scheme.

As at December 2017, revenue from the healthcare services accounted for approximately 40 percent of RMG’s FY17 total revenue.

Listed on the SGX for only slightly more than a year in March 2017, Kimly is the largest traditional coffee shop operator in Singapore operating and managing an extensive network of food outlets and food stalls.

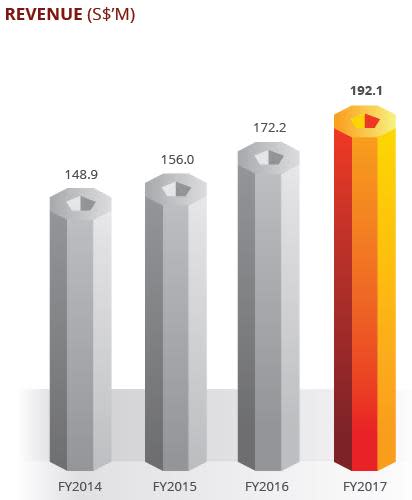

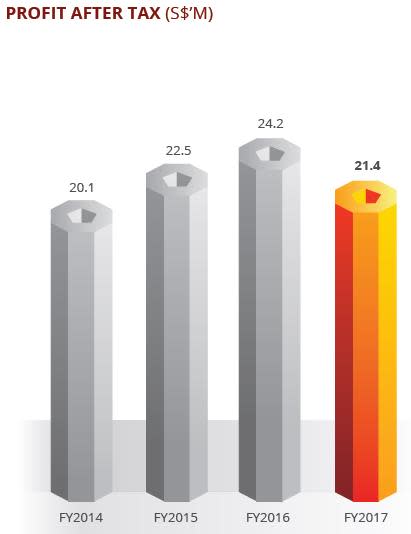

Over the last four years, revenue grew at a CAGR of 8.9 percent underpinned by broad-based growth in both the food retail and outlet management divisions. However, net profit dipped 11.6 percent in FY17 weighed down by increased selling and distribution expenses and administrative expenses to support business expansion.

Source: Company’s Annual Reports

Likewise, the group’s 9M18 net profit slid 1.6 percent to $16.2 million despite revenue climbing 4.9 percent to $149.2 million, owing to the same reasons cited above.

Calling hawker centres as Singaporeans’ “community dining rooms” which offer affordable dining options, PM Lee hoped to manage people’s cost of living by building more hawker centres.

This bodes well for Kimly’s prospects in terms of greater opportunities for the group to expand its network of food outlets and tap on economies of scale. In 2017, Kimly acquired the operating leases of a coffee shop in Bedok Reservoir and an industrial canteen in Woodlands, bringing the group’s portfolio to a total of 68 food outlets and 129 food stalls as at December 2017. As can be seen, the coffee shop operator is well on track on a trajectory for growth.

Yahoo Finance

Yahoo Finance