SI Research: 3 Defensive Stocks To Accumulate On The Cheap

The local equities market has been in the correction phase for quite some time now, as the benchmark Straits Times Index slid more than 11.2 percent after hitting a historical high of 3615.28 in May this year. While some may see this as an opportunity for bargain purchases, others are fearful that this may just be the beginning of a more devastating decline that is yet to come.

Since there is no way to ascertain if we are near the market bottom, adding on to positions of well-run companies in the defensive sectors could therefore be a sensible approach in times like this. Defensive businesses offer products and services which are needed by consumers all year round and hence their share prices are less likely to be affected during downturns.

SI Research identified three stocks in the waste management, healthcare and consumer staples industry respectively which we think are deserving candidates worthy of consideration.

800 Super Holdings (800 Super) is one of the four licensed public waste collectors appointed by the National Environment Agency to provide waste management services, apart from SembWaste, Veolia ES Singapore as well as Colex Environmental. The group was awarded public waste collection contracts for the provision of refuse collection services to domestic and trade premises in two out of the six sectors divided across Singapore, namely the Ang Mo Kio-Toa Payoh sector and the Pasir Ris-Bedok Sector.

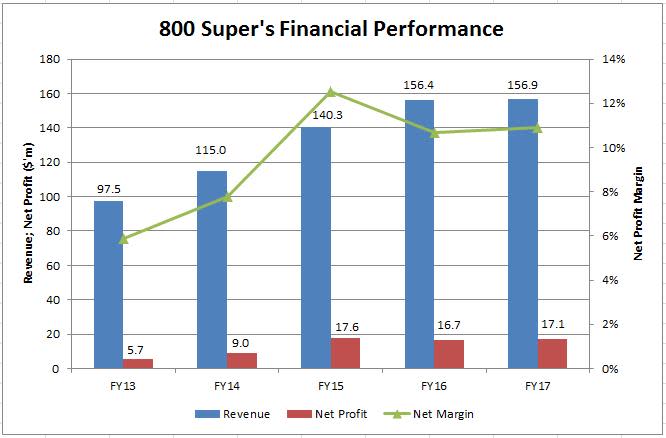

Over the last five years, 800 Super’s revenue grew at a compounded annual growth rate (CAGR) of 12.6 percent to $156.9 million in FY17. Correspondingly, net profit also jumped to $17.1 million at a CAGR of 31.5 percent. In addition, it is noteworthy that the group’s dividend payout had quadrupled over the same period from $0.01 in FY13 to $0.04 in FY17. This was sustained by 800 Super’s growing business as well as the strong cash flow generating capability from its operations.

Source: Company Annual Reports

Sadly, 800 Super’s latest quarterly results were not as robust as the track records the group used to display. 9M18 revenue dipped 4.3 percent to $113.2 million attributable to the renewal of certain contracts at more competitive prices. Compounded with higher employee benefit expense, purchase of supplies and disposal charges as well as other expenses, net profit sank 24.9 percent to $10.8 million.

FY18 could turn out to be the first year 800 Super registers a decline in both revenue and profit since its listing in 2011, which could partly explain the fall in its share price from $1.375 in May 2017 to $1.02 as at 17 August 2018. However despite it being in the business of waste management, we think that 800 Super is definitely not a counter which one should simply discard from their watchlists, in view of its defensive business, strong operational cash flow and attractive dividend yield.

Singapore O&G (SOG) is a leading group of specialist medical practitioners dedicated to women’s and children’s health and wellness with an established track record in the Obstetrics and Gynaecology (O&G) field in Singapore. Not only is the group’s medical services needed at all times, its business is also in line with the government’s policy in encouraging population growth.

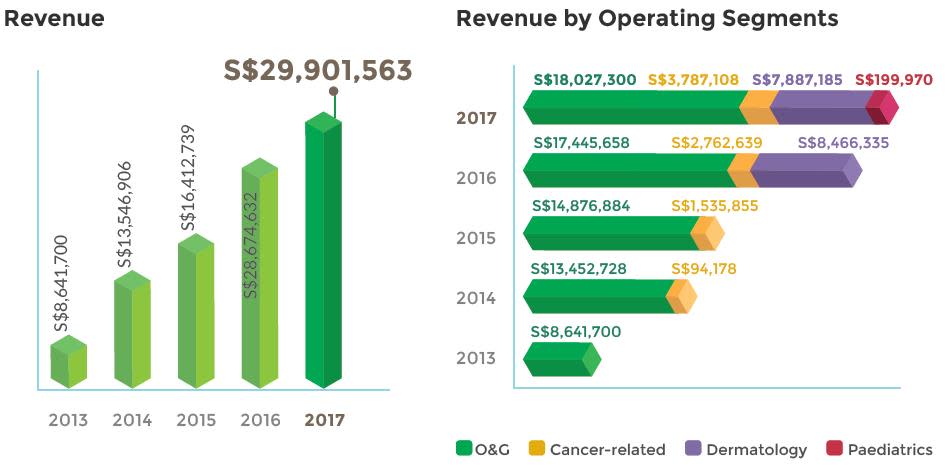

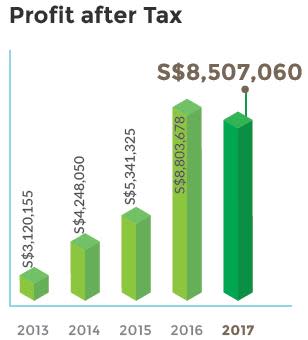

From $8.6 million contributed solely from the O&G segment in FY13, SOG’s revenue has since expanded at a CAGR of 36.4 percent to $29.9 million in FY17 comprising income from O&G, Cancer-related, Dermatology as well as Paediatrics segments. Although net profit dipped slightly by 3.4 percent in FY17 attributable to lower operational profit from the Dermatology segment and higher operating costs, net profit in FY17 still grew at a CAGR of 28.5 percent to $8.5 million over the last five years.

Source: Company Annual Reports

We favour the strength in SOG’s financial position in addition to its financial performances. As at 30 June 2018, the group holds $18.2 million of cash assets in its balance sheet without any borrowings and debts. Furthermore, debt-to-equity ratio remained very healthy standing at merely 0.1 times.

SOG’s 1H18 revenue rose 18.1 percent to $16.8 million due to increased revenue from both O&G and Cancer-related segments as well as contribution from the group’s new Paediatrics segment. Taking into account the receipt of $1.25 million of settlement amount from a former lead independent director, net profit soared 50.4 percent to $6.2 million despite higher employee remuneration expense and consumables and medical supplies used.

However, the group’s share price has since plunged more than half from a high of $0.73 in May 2017, which we think is not reflective of its financial performances. Trading at a price of $0.35 as at 17 August 2018, the shares offer an attractive price-to-earnings valuation of 13.4 times and a dividend yield of 4.3 percent, based on the annualised 1H18 earnings-per-share of $0.0131 and FY17 dividend payout of $0.015 respectively.

3. Thai Beverage Public Company

Thai Beverage Public Company (ThaiBev) is not only Thailand’s leading beverage producer with its flagship Chang Beer dominating a significant market share of Thailand’s beer market, but also one of Asia’s largest producers of alcoholic and non-alcoholic beverages.

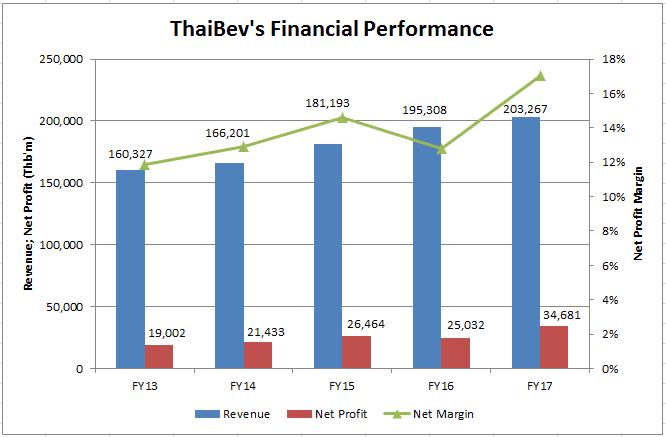

Underpinned by greater consumer purchasing power as the region undergoes economic growth, ThaiBev’s revenue rose at a CAGR of 6.1 percent to THB203.3 billion in FY17 over the last five years. Likewise, net profit also expanded at a CAGR of 16.2 percent to THB34.7 billion.

Source: Company’s Annual Reports

The group made a number of aggressive acquisitions of late. In the last quarter of year 2017, ThaiBev completed altogether four purchases which include interests in Spice of Asia to operate restaurants serving hotpot and Thai food, Myanmar Supply Chain and Marketing Services to operate spirits business in Myanmar, 252 existing KFC stores in Thailand by The QSR of Asia as well as Saigon Beer to operate beer business in Vietnam. Subsequently in the first quarter of this year, the company again bought 75 percent interest in Havi Logistic which operates logistic businesses for food services in Thailand.

ThaiBev’s latest 9M18 revenue advanced 22.1 percent to THB173.9 billion due to increased sales of spirits business, beer business and food business. Regrettably, net profit sank 48.3 percent to THB15.2 billion pulled down by higher operating expenses, considerably higher finance costs and additional cost relating to business acquisition.

Furthermore, ThaiBev’s financial strength took a dent as the group’s borrowings and debts ballooned more than five times from a year ago to THB235.3 billion as at 30 June 2018 to fund its acquisitions. At the same time, liability-to-equity ratio also climbed to 1.85 times from 0.47 times at the end of FY17.

Nevertheless, we identify with ThaiBev’s vision to become the region’s leading beverage company and hence deem the group’s recent weakness in financial performances arising from business expansions as necessary evils. Trading at $0.645 as at 17 August 2018 which has already corrected 38.6 percent from its $1.05 high in August 2016, the group offered an attractive yield of 4.3 percent based on its FY17 dividend payout of THB0.67 per share. That said, we regard ThaiBev’s price weakness as an opportunity to accumulate this quality company at a bargain.

Yahoo Finance

Yahoo Finance