Shaken Opec seeks to work alongside shale oil producers

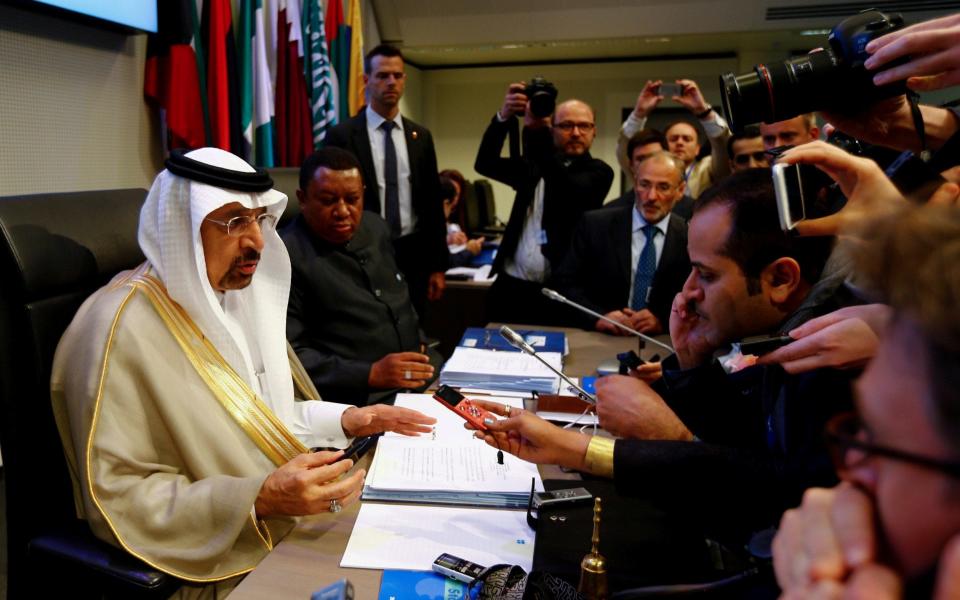

Khalid al-Falih makes for a softly spoken ringmaster. Energy minister of Saudi Arabia and president of Opec, last week he cracked the whip on the cartel’s latest oil market intervention. But instead of sluggish oil prices being shored up, the market dropped 4pc.

Opec was once a by-word for power. But its latest deal has laid bare the extent to which the US shale revolution has upended a decades-long market dominance. Instead Al-Falih, right, is quietly ushering in an unprecedented new co-operation between the world’s largest energy titans, with Opec at its centre.

“They have lost control of the market. They are no longer the world’s swing producer,” says Erik Norland, a senior economist at the commodities derivatives exchange CME Group. The group will extend the historic deal hammered out last November in Algeria between the world’s largest oil producers, who pledged to curb crude production by 1.8 million barrels a day until early 2018.

The Algiers Accord was the first between Opec and non-Opec countries in 15 years, and included co-operation from Russia. The oil states are now preparing to institutionalise this framework to cement the new working relationship.

Future Opec meetings may become more crowded still. US shale bankers also left their drilling rigs to attend the Vienna meeting, and are expected to host further talks in the US later this year. “We have to co-exist,” al-Falih said.

It is an extraordinary act of co-operation that could redefine the group which once single-handedly controlled the global oil market.

The Vienna-based cartel is made up of 14 of the world’s largest oil producing nations. Together, they control more than 80pc of the world’s proven oil reserves and supply almost half of global crude production.

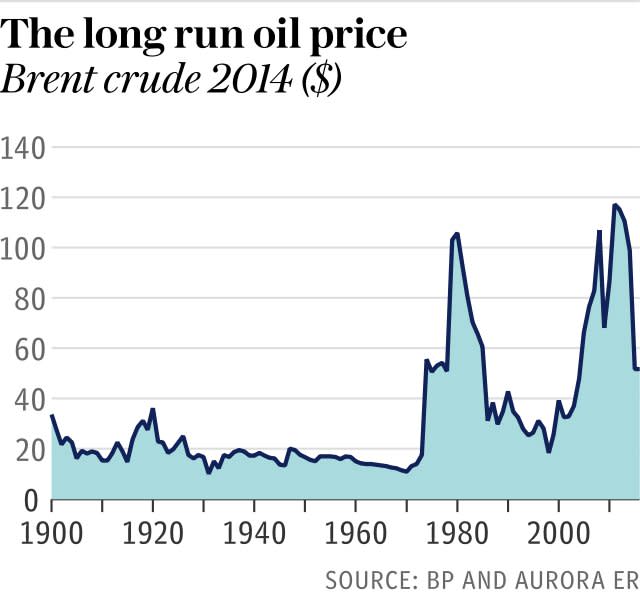

For over half a century the cartel has kept a firm grasp on the oil price by flexing this combined strength within the global market. It is a strategy that brought the US to its knees during the Arab-Israeli conflict in the early 1970s. Opec squeezed production, causing oil prices to quadruple, before imposing a ban on exports to the US altogether.

Desperate queues of US motorists would form at dawn and snake around gridlocked streets in the hope of securing fuel. Road speed limits were cut to preserve meagre petrol supplies. Daylight saving time was instituted year-round. The US energy crisis eventually triggered an economic recession.

Today US oil bosses old enough to remember the energy war waged by Opec in their youth are relishing the role reversal. The US shale revolution means North America may never need to import energy again. This new-found energy independence is driving many of Opec’s member states into economic ruin.

It is an irony that the Texas oil regulator has not shied away from. “The days of Opec using oil supplies and prices as a political weapon are gone,” said Ryan Sitton of the Texas Railroad Commission in the wake of the latest price slump.

“Texas shale producers forced Opec to extend its oil production cuts for nine months. Less Opec oil on the market enhances the opportunity for American energy to fill needs around the world, and will help us achieve energy dominance.”

The still-smouldering tension and opposing agendas raise serious questions over whether a co-operation between shale oil producers and Opec will be possible. But market commentators are unanimous in their verdict that Opec’s current attempt to flex its market muscle has revealed its limitations as a group more than its strength.

Allowing the market to return to the days of limit-free crude production would almost certainly trigger a price collapse. But cutting production too far could cause stocks to swell by incentivising the return of more US shale players.

“The big problem for Opec right now is that they are already losing market share to the US. They cut their production by over a million and a half barrels a day but the US, just since October, has added 900,000 barrels a day,” Norland says.

In late 2014 Opec stood back to allow global oil markets to buckle under the weight of US volumes, and prices fell below $28 a barrel. The hope was that a crash would all but wipe out the nascent US market.

“US frackers did go into retreat for a while. But in that time they figured out how to produce oil less expensively than they did before,” Norland says.

When Opec revealed plans to shore up the oil price by ending years of uninhibited oil production, prices slowly began to recover. But so did the US shale industry.

“As soon as prices returned to around $45 a barrel, US drilling companies expanded the number of operating rigs by 120pc from the end of May last year,” Norland says.

US shale production lags an increase in drilling rigs by about four months. The US has added around 184 operating rigs to its drilling battalion, meaning an additional 600,000 barrels of oil a day is expected by the third quarter, on top of the 900,000 extra a day it is currently producing.

“By September US producers will have completely replaced Opec’s production cuts. Imagine if they cut production further? They’d further boost the price and further incentivise more US investment and then lose more market share. It’s not desirable,” Norland says.

Michael Hsueh, an analyst at Deutsche Bank, says the rate at which oil production is rising in the US, and in other countries, could easily neutralise Opec’s cuts.

“At this pace, it will not be until at least the end of 2018, or indeed, 2019, when surplus inventories can be eliminated,” Hsueh says. “This is much later than Opec has said it believes, with some ministers suggesting that the end of 2017 or even the third quarter of this year is a possible date.”

Nonetheless, naysayers bemoaning the death of Opec may be missing the point. The cartel may have conceded absolute power over supply but it remains at the centre of what could prove a new dawn for global co-operation.

Norland’s prediction is that Opec “will continue to try to move prices in ways that are favourable to them – or at least less unfavourable to them.”

Yahoo Finance

Yahoo Finance