SEI Investments (SEIC) Q3 Earnings Lag Estimates, AUM Falls

SEI Investments Co.’s SEIC third-quarter 2020 earnings of 75 cents per share lagged the Zacks Consensus Estimate of 81 cents. Moreover, the figure reflects a decline of 12.8% from the prior-year quarter.

While the results reflect a rise in revenues, higher expenses and a decline in assets under management (AUM) were headwinds.

Net income was $111.1 million, down 16% from the year-ago quarter.

Revenues Improve, Expenses Rise, AUM Declines

Total revenues were $425 million, up 2% year over year. This upswing reflects an increase in all components except for revenues from private banks and institutional investors. In addition, the reported figure surpassed the Zacks Consensus Estimate of $421.7 million.

Total expenses came in at $313.6 million, flaring up 6.1% year over year. This resulted from a rise in consulting and personnel costs, partially offset by a fall in travel and promotional costs.

Operating income slipped 7.7% year over year to $111.3 million.

As of Sep 30, 2020, AUM was $330.2 billion, reflecting a decline of 1.4% from the prior-year quarter. Client assets under administration (AUA) were $754.5 billion, up 14% year over year. The client AUA does not include $11.5 billion related to Funds of Funds assets that were reported on Sep 30, 2020.

Share Repurchases

In the reported quarter, SEI Investments bought back 2.1 million shares for $108.7 million.

Our Take

The company’s diversified product offerings are expected to continue boosting financials. Also, rising demand for the SEI Wealth Platform (“SWP”) across several financial institutions will likely support profitability.

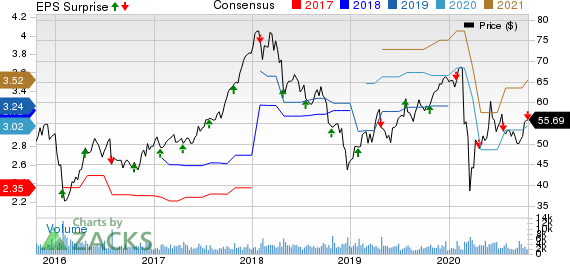

SEI Investments Company Price, Consensus and EPS Surprise

SEI Investments Company price-consensus-eps-surprise-chart | SEI Investments Company Quote

Currently, SEI Investments sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Performance of Other Companies

First Republic Bank FRC delivered a positive earnings surprise of 16.7% in third-quarter 2020 aided by solid top-line strength. Earnings per share of $1.61 surpassed the Zacks Consensus Estimate of $1.38. Additionally, the bottom line climbed 22.9% from the year-ago quarter.

Comerica CMA recorded a third-quarter positive earnings surprise of 65.5%. Earnings per share of $1.44 easily surpassed the Zacks Consensus Estimate of 87 cents. However, the bottom line came in lower than the prior-year quarter figure of $1.96.

Regions Financial RF reported third-quarter 2020 adjusted earnings of 49 cents per share, surpassing the Zacks Consensus Estimate of 34 cents. Also, results compared favorably with the prior-year period earnings of 39 cents.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regions Financial Corporation (RF) : Free Stock Analysis Report

Comerica Incorporated (CMA) : Free Stock Analysis Report

First Republic Bank (FRC) : Free Stock Analysis Report

SEI Investments Company (SEIC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance