SEHK Top Industrial Dividend Paying Stocks

Industrial names generally suffer from deep cyclicality which can affect companies operating in areas ranging from machinery to aerospace to construction. Therefore, where we are in the economic cycle determines these companies’ level of profitability. Availability of cash flows also determines the level of dividend payout. In times of growth, these industrial companies could provide opportune income through dividend. Here are my top dividend stocks in the industrials industry that could be valuable additions to your current holdings.

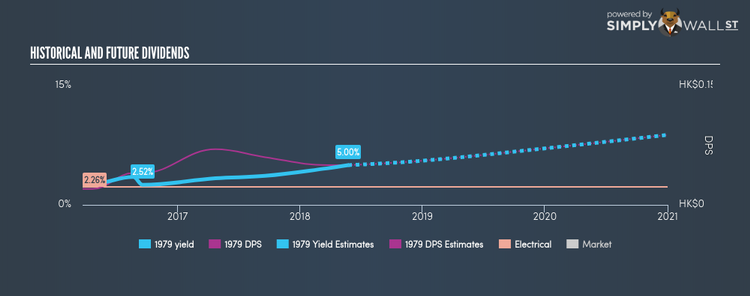

Ten Pao Group Holdings Limited (SEHK:1979)

1979 has an alluring dividend yield of 5.00% and pays 31.74% of it’s earnings as dividends , with analysts expecting the payout in three years to be 33.20%. Besides the potential capital gains, 1979’s yield alone is better than the low risk savings rate. Plus, a 5.00% yield places it amidst the market’s top dividend payers. The company’s future earnings growth looks promising, with analysts expecting earnings growth over the next three years to reach 68.16%. Continue research on Ten Pao Group Holdings here.

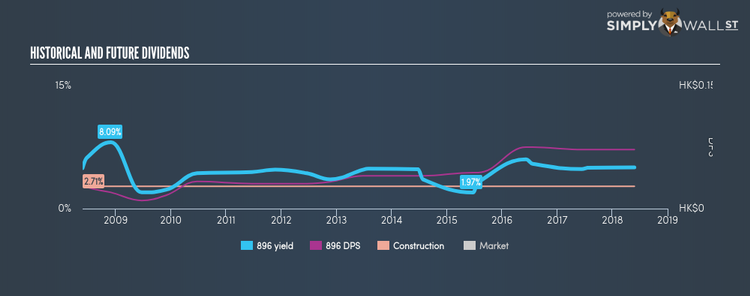

Hanison Construction Holdings Limited (SEHK:896)

896 has an appealing dividend yield of 5.04% and the company currently pays out 13.07% of its profits as dividends . While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from HK$0.033 to HK$0.072. The company has a lower PE ratio than the HK Construction industry, which interested investors would be happy to see. The company’s PE is currently 2.6 while the industry is sitting higher at 13.4. More detail on Hanison Construction Holdings here.

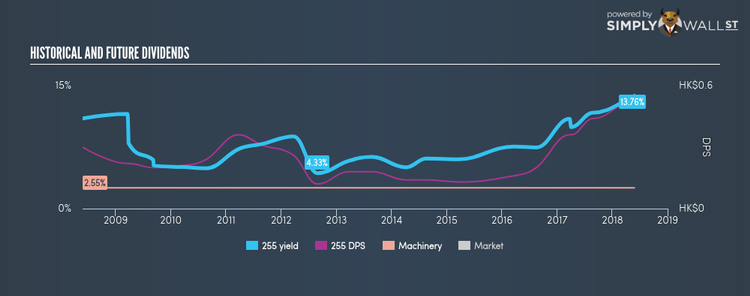

Lung Kee (Bermuda) Holdings Limited (SEHK:255)

255 has a large dividend yield of 13.76% and is distributing 63.56% of earnings as dividends . Although there has been some volatility in the company’s dividend yield, the DPS over a 10 year period has increased from HK$0.30 to HK$0.52. Lung Kee (Bermuda) Holdings’s earnings per share growth of 45.14% over the past 12 months outpaced the hk machinery industry’s average growth rate of 16.94%. Continue research on Lung Kee (Bermuda) Holdings here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance