Scalping GBPUSD Correction- Long Scalps in Play Ahead of BoE, NFP

DailyFX.com -

Talking Points

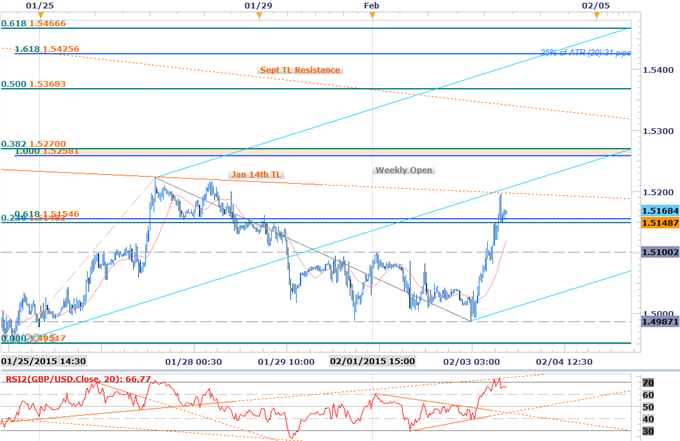

Breach above weekly opening range high puts long scalps in play

Outside day reversal candle suggests exhaustion low

GBP/USD Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

GBPUSD rebounds off 2015 LDC (low-day close) – 1.4989

Outside day reversal candle off key support- constructive

Resistance at median-line extending off Dec low & former 2009 TL support

Break targets resistance objective at 1.5321, 1.5383 & 1.5479

Constructive while within ascending pitchfork

Support break targets 1.4950, 1.4812 & 1.4679

Daily RSI divergence into the lows / resistance trigger-trigger break- bullish

Former Sept momentum support trigger now pending as resistance

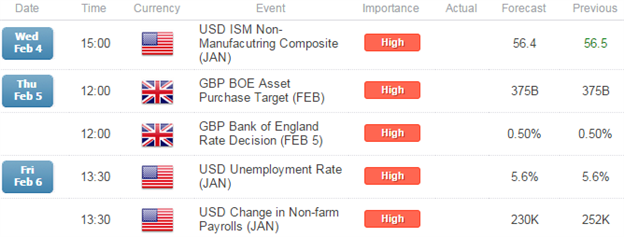

Event Risk Ahead: ADP & ISM Wednesday & NFPs, Unemployment Rate on Friday

GBP/USD 30min

Notes:The sterling has made an impressive outside day reversal off the yearly low-day close (LDC) with the rally breaching above the weekly opening range high. The break shifts the scalp focus to the topside while above the 1.51-handle with only a break below pitchfork support invalidating our near-term directional bias.

Bottom line: looking to buy pullbacks / resistance triggers in momentum while above the Sunday high with a breach above the January median-line opening up subsequent resistance targets into 1.5260/70 & 1.5320. A quarter of the daily average true range yields profit targets of 28-31 pips per scalp. Caution is warranted heading into key event risk this week with the BoE Interest Rate Decision and the highly anticipated US Non-farm payroll report likely to fuel added volatility in USD and sterling crosses.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Relevant Data Releases

Other Setups in Play:

Scalping USDJPY Opening Range Ahead of NFPs- Shorts Favored Sub-118

GBPAUD Weekly Opening Range Setup- Long Scalps at Risk Sub-1.92

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFXat 13:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance