SAP Build to Aid Users to Create Enterprise Applications

SAP SE SAP has announced the launch of SAP Build at the company’s TechEd conference.

SAP Build is a low-code solution that leverages the company’s Business Technology Platform to assist customers in easily creating and developing enterprise applications, automating processes as well as constructing and enhancing business sites without the extensive need for technical expertise.

The platform is also based on SAP Signavio solutions, giving users comprehensive visibility into their processes so they can decide where to concentrate their efforts as they innovate and automate.

SAP SE Price and Consensus

SAP SE price-consensus-chart | SAP SE Quote

The SAP Builders programme also aids users in connecting with others via forums and hands-on workshops to exchange best practices. SAP Build is also compatible with non-SAP systems, added the company.

The company has announced a partnership with Coursera to provide entry-level professional certificates for the most in-demand fields. The alliance aims to triple the amount of free learning available on the SAP Learning website, helping the firm achieve its goal of upskilling 2 million developers globally by 2025.

SAP provides enterprise resource planning software, which caters to the needs of small and medium businesses to large global enterprises. SAP solutions allows its users to analyse and efficiently design the value chain. The company also provides an end-to-end suite of applications and services.

The company reported third-quarter 2022 non-IFRS earnings of €1.12 per share ($1.13), down 36% from the year-ago quarter’s levels. The downside was caused by tougher year-over-year comparisons pertaining to the contribution from Sapphire Ventures.

Total revenues, on a non-IFRS basis, of €7.841 billion ($7.903 billion), up 15% year over year (up 5% at constant currency or cc), driven by strength in the cloud business.

Software licenses and support revenues totaled €3.422 billion, down 3% (down 9% at cc) year over year. Non-IFRS software license revenues of €406 million declined 38% (down 42% at cc) year over year.

However, the company expects a negative impact of approximately €250 million at constant currencies due to a lack of new business and discontinuation of the existing business.

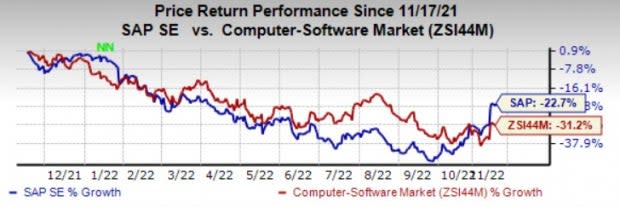

SAP currently carries a Zacks Rank #3 (Hold). Shares of the company have lost 22.7% compared with the industry’s decline of 31.2% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are Arista Networks ANET, Pure Storage PSTG and Jabil JBL. Jabil and Arista Networks currently sport a Zacks Rank #1 (Strong Buy), whereas Pure Storage currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

The Zacks Consensus Estimate for Arista Networks 2022 earnings is pegged at $4.33 per share, up 7.2% in the past 60 days. The long-term earnings growth rate is anticipated to be 17.5%.

Arista Networks earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 12.7%. Shares of ANET have decreased 0.5% in the past year.

The Zacks Consensus Estimate for PSTG 2022 earnings is pegged at $1.18 per share, unchanged in the past 60 days. The long-term earnings growth rate is anticipated to be 35.5%.

Pure Storage’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 171.8%. Shares of PSTG have increased 10.5% in the past year.

The Zacks Consensus Estimate for Jabil’s fiscal 2023 earnings is pegged at $8.18 per share, rising 3.8 in the past 60 days. The long-term earnings growth rate is anticipated to be 12%.

Jabil’s earnings beat the Zacks Consensus Estimate in three of the last four quarters, the average being 9.3%. Shares of JBL have increased 2.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SAP SE (SAP) : Free Stock Analysis Report

Jabil, Inc. (JBL) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Pure Storage, Inc. (PSTG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance