SAGE's Huntington's Disease Study Meets Primary Endpoint

Sage Therapeutics SAGE announced that the phase II SURVEYOR study evaluating its lead neuropsychiatric candidate, dalzanemdor (SAGE-718), as a potential treatment for patients with cognition dysfunction caused by Huntington’s disease (HD), met its primary endpoint. Shares of the company were however down 2.8% on Jun 11 following the announcement of the news.

The SURVEYOR study compared dalzanemdor versus placebo in participants with HD for a 28-day treatment period.

The three main objectives of the SURVEYOR study were to evaluate the safety of dalzanemdor in participants with HD, to understand the extent of cognitive impairment in HD compared to healthy participants, as well as to better understand the relationship between changes in cognition and changes in function.

The study met its primary endpoint by demonstrating a statistically significant difference as measured by the HD-Cognitive Assessment Battery (HD-CAB) composite score at baseline between healthy participants and participants with HD prior to any treatment with dalzanemdor or placebo. The study demonstrated a small numerical difference in comparing dalzanemdor to placebo on the HD-CAB composite score at day 28 of treatment.

Eleven participants with HD experienced treatment-related adverse events, which were mild to moderate in severity, while there were no discontinuations due to the adverse events.

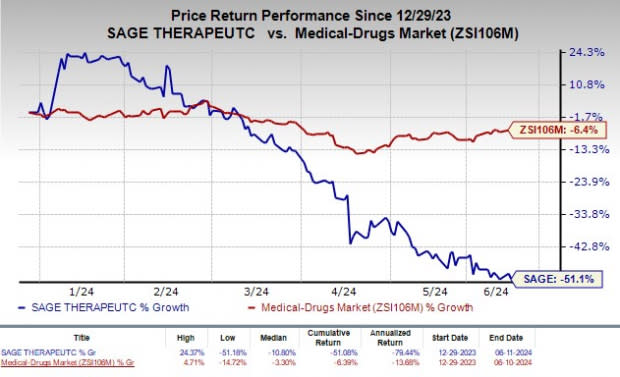

Shares of Sage have plunged 51.1% so far this year compared with the industry’s decrease of 6.4%.

Image Source: Zacks Investment Research

Per the company, the SURVEYOR study is designed to generate evidence linking changes in cognition and changes in function and is not designed or powered to show a statistically significant difference between dalzanemdor and placebo.

SAGE is also investigating dalzanemdor in the larger placebo-controlled phase II DIMENSION study, which is designed to evaluate the efficacy of dalzanemdor dosed over a 12-week period in people with cognitive impairment associated with HD. Data from this study is expected in late 2024.

An inherited disorder, HD causes nerve cells (neurons) in brain parts to gradually break down and die. Cognitive impairment is one of the most under-recognized aspects of HD. Currently, no treatment options are available to improve HD-related cognitive effects.

Dalzanemdor is also being evaluated in the phase II LIGHTWAVE study for treating mild cognitive impairment and mild dementia associated with Alzheimer’s disease. Top-line data from this study is expected later this year.

In April 2024, Sage shared top-line results from the mid-stage PRECEDENT study on dalzanemdor in certain patients with Parkinson’s disease (PD). The study failed to achieve its primary endpoint. Based on this outcome, management decided not to pursue the development of dalzanemdor in the PD indication going forward.

Zacks Rank & Stocks to Consider

Sage currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are Acrivon Therapeutics, Inc. ACRV, Marinus Pharmaceuticals, Inc. MRNS and Minerva Neurosciences, Inc. NERV, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Acrivon Therapeutics’ 2024 loss per share have narrowed from $3.42 to $2.47. Loss per share estimates for 2025 have narrowed from $3.36 to $2.55. Year to date, shares of ACRV have surged 50.4%.

ACRV’s earnings beat estimates in three of the trailing four quarters and missed the same on the remaining one occasion, the average surprise being 3.56%.

In the past 60 days, estimates for Marinus Pharmaceuticals’ 2024 loss per share have narrowed from $2.43 to $1.87, while loss per share estimates for 2025 have narrowed from $1.97 to 90 cents. Year to date, shares of MRNS have plunged 85.7%.

MRNS’s earnings beat estimates in two of the trailing four quarters, met the same once and missed the same once, the average surprise being 3.27%.

In the past 60 days, estimates for Minerva Neurosciences’ 2024 loss per share have narrowed from $3.57 to $1.89. Loss per share estimates for 2025 have narrowed from $4.54 to $3.60. Year to date, shares of NERV have declined 47.1%.

NERV’s earnings beat estimates in one of the trailing four quarters while missing the same on the remaining three occasions, the average negative surprise being 54.43%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Minerva Neurosciences, Inc (NERV) : Free Stock Analysis Report

Sage Therapeutics, Inc. (SAGE) : Free Stock Analysis Report

Marinus Pharmaceuticals, Inc. (MRNS) : Free Stock Analysis Report

Acrivon Therapeutics, Inc. (ACRV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance