Sabre (SABR) Stock Rallies 6% on Strong Recovery in Bookings

Sabre Corporation’s SABR shares rallied 6% on Wednesday after its latest update on key performance metrics reflected the accelerating recovery in bookings from the mayhem of the pandemic.

In a filing with the Securities and Exchange Commission ("SEC"), Sabre disclosed that gross bookings in August 2022 recovered to approximately 55% of the pre-pandemic level in August 2019.

The company reported an approximately 56% improvement in its net air bookings from the August 2019 level, while the number of boarding passengers reached nearly 86% of the pre-pandemic level. The travel-related software and solution provider further stated that transactions related to hotel central reservation system transactions recovered to around 112% in the last month.

Sabre stated in the filing that, "We are encouraged that, notwithstanding the operational challenges faced by the airline industry during the summer, both our net air bookings and passengers boarded reached their highest levels for us in the last week of August since the beginning of the COVID-19 pandemic's severe impact on the travel industry in mid-March 2020."

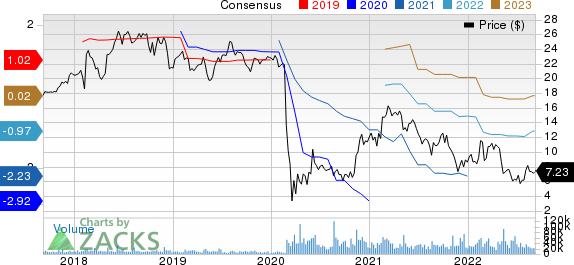

Sabre Corporation Price and Consensus

Sabre Corporation price-consensus-chart | Sabre Corporation Quote

Sabre Benefits From Improving Business Environment

Sabre’s latest reported key metrics reflect that the company is moving toward stabilization after the severe impacts of the COVID-led global economic crisis. With mass vaccination efforts and the weak effect of COVID-19 on human health, most countries have lifted travel restrictions.

Moreover, travelers have started resuming their summer and spring vacation plans, which they had postponed due to the pandemic. We believe that all these factors will aid in faster recovery for the travel industry, thereby boosting revenues for Sabre.

Last month, Sabre reported encouraging financial results for second-quarter 2022. The company recorded revenues of $658 million for the quarter, which is significantly higher than the $419.7 million posted in the year-ago quarter when the COVID-19 pandemic caused disruptions in the global travel industry.

Moreover, it recorded an approximately 12.3% sequential increase in its second-quarter top-line results. This surge in the top line reflects a continued gradual recovery in global air, hotel and other bookings.

Zacks Rank & Stocks to Consider

Sabre currently has a Zacks Rank #3 (Hold). Some better-ranked stocks from the broader Computer and Technology sector are Clearfield CLFD, Silicon Laboratories SLAB and Taiwan Semiconductor TSM. While Clearfield and Silicon Laboratories sport a Zacks Rank #1 (Strong Buy), Taiwan Semiconductor carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Clearfield's fourth-quarter fiscal 2022 earnings has been revised 10 cents north to 80 cents per share over the past 30 days. For fiscal 2022, earnings estimates have moved 36 cents north to $3.13 per share in the past 30 days.

Clearfield’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 33.9%. Shares of CLFD have increased 120.7% in the past year.

The Zacks Consensus Estimate for Silicon Laboratories’ third-quarter 2022 earnings has increased 22.9% to $1.02 per share over the past 30 days. For 2022, earnings estimates have moved 14.2% up to $4.18 per share in the past 30 days.

Silicon Laboratories’ earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 63.6%. Shares of SLAB have decreased 17.8% in the past year.

The Zacks Consensus Estimate for Taiwan Semiconductor's third-quarter 2022 earnings has been revised a penny southward to $1.69 per share over the past 30 days. For 2022, earnings estimates have moved 41 cents north to $6.30 per share in the past 60 days.

TSM's earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 3.9%. Shares of the company have decreased 34.8% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

Silicon Laboratories, Inc. (SLAB) : Free Stock Analysis Report

Sabre Corporation (SABR) : Free Stock Analysis Report

Clearfield, Inc. (CLFD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance