Ryanair (RYAAY) Shares Jump Over 7% on Raised Traffic Forecast

Ryanair Holdings RYAAY has raised its five-year traffic growth forecast as it expects to take delivery of 210 Boeing 737 aircraft over the next five years. Following this, shares of the company jumped more than 7% at the close of business on Sep 16.

The company expects these aircraft, which would lower costs and reduce emissions, to accelerate its post-COVID growth.

In a statement, Ryanair said that it has increased its five-year traffic growth projection to 50% from 33% expected earlier. The carrier now expects traffic to grow to more than 225 million guests per year by March 2026, compared with 200 million predicted earlier. The company’s pre-coronavirus (fiscal 2020) traffic was 149 million guests. For fiscal 2022, the airline expects traffic in the range of 90-100 million, compared with 27.5 million guests in fiscal 2021.

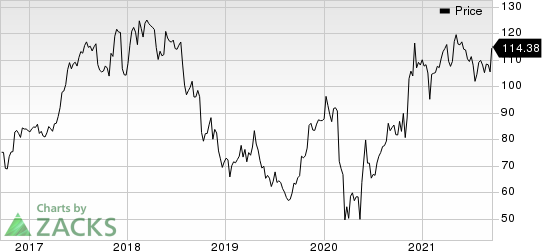

Ryanair Holdings PLC Price

Ryanair Holdings PLC price | Ryanair Holdings PLC Quote

Ryanair plans to open 10 new bases across Europe this year, thanks to the expected delivery of the new planes. With this, the carrier expects to create more than 5,000 new jobs for pilots, cabin crew and engineers over the next five years. Previously, the European low-cost airline opened a €50-million Aviation Training Centre in Dublin. It plans to open two additional training centers in Spain and Portugal over the next five years.

Zacks Rank & Key Picks

Ryanair carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the airline space are Controladora Vuela Compania de Aviacion, S.A.B. de C.V. VLRS, Copa Holdings, S.A. CPA and SkyWest SKYW, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of Controladora Vuela, Copa Holdings and SkyWest have rallied more than 100%, 33% and 36% in a year’s time respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryanair Holdings PLC (RYAAY) : Free Stock Analysis Report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

Controladora Vuela Compania de Aviacion, S.A.B. de C.V. (VLRS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance