Rush Enterprises Inc (RUSHA) Q1 2024 Earnings: Performance Aligns with Analyst Projections

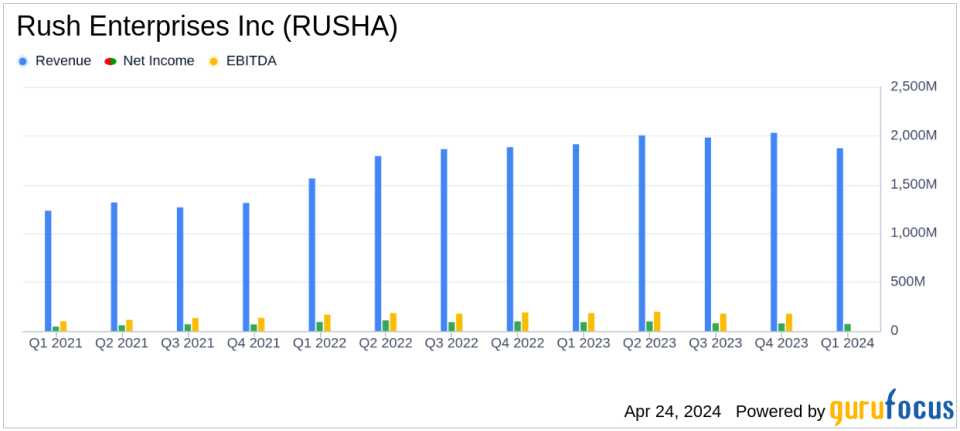

Revenue: Reported $1.872 billion, a slight decrease from $1.912 billion in the previous year, falling short of estimates of $1.871.94 million.

Net Income: Achieved $71.6 million, down from $90.5 million year-over-year, surpassing the estimated $62.56 million.

Earnings Per Share (EPS): Recorded at $0.88 per diluted share, exceeding the estimated $0.77.

Dividend: Announced a quarterly dividend of $0.17 per share, payable on June 10, 2024.

Commercial Vehicle Sales: New Class 8 truck sales declined by 20% year-over-year, reflecting softened market demand.

Aftermarket Products and Services: Slightly increased to $649.2 million from $648.2 million in the previous year, maintaining stable performance despite market challenges.

Stock Repurchase: Repurchased $5.6 million of common stock under the ongoing stock repurchase plan.

Rush Enterprises Inc (NASDAQ:RUSHA), a prominent player in the commercial vehicle industry, released its 8-K filing on April 24, 2024, announcing its financial results for the first quarter ended March 31, 2024. The company reported revenues of $1.872 billion and net income of $71.6 million, or $0.88 per diluted share. These figures closely align with analyst estimates which projected earnings per share of $0.77 and net income of $62.56 million on revenues of $1.871.94 million.

Rush Enterprises operates the largest network of commercial vehicle dealerships in North America, known as Rush Truck Centers. The company offers a comprehensive range of services including new and used vehicle sales, aftermarket parts, service and repair facilities, and financing options.

Financial and Operational Highlights

The company's earnings reflect a decrease from the previous year's figures, where it reported revenues of $1.912 billion and net income of $90.5 million, or $1.07 per diluted share. This decline is attributed to several market challenges including reduced demand for new Class 8 trucks due to stabilization in truck production and persistent low freight rates coupled with high interest rates.

Despite these challenges, Rush Enterprises saw a modest increase in aftermarket demand from public sector, refuse, and medium-duty leasing customers, which helped to offset some of the declines in other areas. The company's aftermarket products and services accounted for approximately 60.8% of its total gross profit, with revenues slightly up from the previous year at $649.2 million.

The company also declared a quarterly cash dividend of $0.17 per share, underscoring its commitment to returning value to shareholders despite the challenging economic environment.

Strategic Responses and Future Outlook

Addressing the current market conditions, Rusty Rush, Chairman, CEO, and President, emphasized the company's strategic initiatives including a focus on diversifying customer base and reducing expenses. These efforts are aimed at navigating the ongoing freight recession, which is expected to extend into late 2024. For the upcoming quarters, the company anticipates an improvement in Class 8 and Class 4-7 truck sales due to scheduled deliveries and expects steady demand for new medium-duty trucks.

The company remains vigilant about potential challenges such as production delays and component shortages that could impact delivery schedules. Furthermore, Rush highlighted the performance of the used vehicle market, noting a strategic execution that led to an 8.0% increase in used vehicle sales despite broader market pressures.

Comprehensive Financial Review

The balance sheet remains robust with total assets increasing to $4.629 billion from $4.364 billion at the end of 2023. The company continues to manage its debt effectively, with a notable portion of its debt structured to support its leasing and rental operations, which have shown resilience in the current economic climate.

In summary, Rush Enterprises Inc (NASDAQ:RUSHA) has demonstrated a strategic approach to managing market challenges, supported by a diversified service offering and a strong focus on operational efficiency. While the market conditions remain tough, the company's efforts to adapt and innovate position it well to navigate the uncertainties ahead.

For more detailed information, please refer to the full earnings report and financial statements available on the SEC's website.

Explore the complete 8-K earnings release (here) from Rush Enterprises Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance