RPM's Shares Jump on Better-Than-Expected Q4 Earnings

RPM International Inc.’s RPM shares gained 4.5%, following solid fourth-quarter fiscal 2019 earnings. The company’s earnings not only topped the Zacks Consensus Estimate but also increased impressively on a year-over-year basis. Notably, its 2020 Margin Acceleration Plan (“2020 MAP to Growth”) has started paying off.

RPM reported adjusted earnings of $1.24 per share, beating the consensus mark of $1.14 by 8.8%. The reported figure improved 21.6% year over year, backed by the company’s 2020 MAP to Growth operating improvement plan. Its recently implemented price increases and stabilizing raw material cost inflation added to the positives. Yet, continued increases in distribution and labor costs partly offset the positives.

Net sales of $1.601 billion missed the consensus mark of $1.604 billion by 0.2% but improved 2.8% from the prior year. The improvement is attributed to 3.5% organic growth and 1.9% contribution from acquisitions. However, foreign currency headwinds reduced sales by 2.6% from the year-ago quarter. The company’s two largest markets — North America and Europe — remained soft due to wettest spring months on record, causing delays in painting and construction projects.

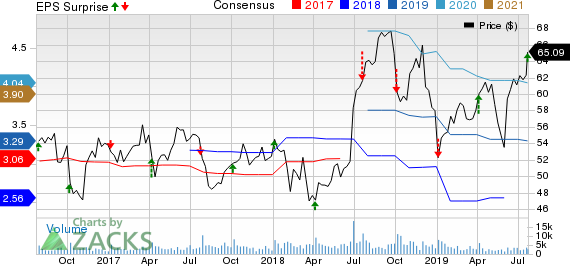

RPM International Inc. Price, Consensus and EPS Surprise

RPM International Inc. price-consensus-eps-surprise-chart | RPM International Inc. Quote

Operating Highlights

Gross margin increased 30 basis points (bps) year over year to 42.7% during the quarter. Adjusted earnings before interest and taxes (EBIT) came in at $241.4 million, up 22.4% year over year. The upside was a result of the company’s 2020 MAP to Growth operating improvement plan.

Segment Details

RPM has three reportable segments — Industrial, Specialty and Consumer.

Industrial Segment (contributing 50.5% to net sales): Sales in the segment were down 0.4% from a year ago to $809 million due to foreign exchange headwinds and extremely wet weather, which slowed down construction projects and strategic decisions (undertaken as part of 2020 MAP to Growth).

Organic sales improved 2% from the prior-year quarter, while acquisitions added 1% to net sales. However, foreign currency translation negatively impacted sales by 3.5%. Adjusted EBIT totaled $115.7 million, up 5.9% from the year-ago period.

Consumer Segment (36.5%): Segment sales improved 6.7% on a year-over-year basis to $585 million during the quarter, owing to 7% organic sales growth. Acquisitions contributed 1.5%, however foreign currency translation reduced sales by 1.8% from the year-ago quarter. Rust-Oleum and DAP businesses witnessed strong results in North America, despite wet weather and softness in Europe.

Notably, the segment’s adjusted EBIT increased 50.6% on a year-over-year basis.

Specialty Segment (13%): Sales of $207.4 million from the segment increased 5.3% from the prior-year period, backed by 6.7% contribution from acquisitions. However, foreign currency translation impacted sales by 1.2%. Organic sales remained flat during the quarter. The segment gained from the acquisition of Nudura, and strong performances of diesel additives and edible coatings businesses.

The segment’s adjusted EBIT totaled $32.3 million, lower than $33.7 million reported in the prior year.

Markedly, it has realigned the existing reporting structure into four reportable segments — Consumer Group, Specialty Products Group, Construction Products Group and Performance Coatings Group — to provide greater visibility into the business. From the beginning of the fiscal first quarter, the company will reclassify shipping costs paid to third-party shippers from selling, general and administrative expenses into cost of goods sold.

Balance Sheet

As of May 31, 2019, RPM had cash and cash equivalents of $223.2 million compared with $244.4 million at fiscal 2018-end.

Long-term debt (excluding current maturities) at the end of the year was $1.97 billion compared with $2.17 billion at fiscal 2018-end.

In fiscal 2019, cash from operations was $292.9 million compared with $390.4 million in fiscal 2018.

Fiscal 2019 Highlights

Earnings per share came in at $2.71 per share, reflecting a 3.4% increase from $2.62 a year ago. Net sales were $5.56 billion, reflecting an increase of 4.6% from fiscal 2018. For the full year of fiscal 2019, adjusted EBIT grew 0.7% to $567.5 million from $563.4 million a year ago.

RPM’s Industrial, Consumer and Specialty segments contributed 2.7%, 7.6% and 4.6% to net sales growth, respectively.

Guidance

RPM anticipates fiscal 2020 revenue growth to be relatively modest, mainly due to global macroeconomic factors. It believes that sales growth will drive strong leverage to earnings, backed by operating improvement initiatives and fiscal 2019 price increases. Raw material cost inflation is likely to be moderate.

For fiscal 2020, the company expects to generate revenue growth in the low-to-mid-single-digit range of 2.5-4%. It also expects to witness 20-24% adjusted EBIT growth, resulting in adjusted earnings within $3.30-$3.42 per share. The Zacks Consensus Estimate for 2020 is currently pegged at $3.29.

Segment-wise, sales in the Consumer Group are expected to grow in the mid-single-digit range, as a result of modest organic volume growth, the rollover impact of acquisitions, fiscal 2019 price increases and market share gains.

Specialty Products Group’s sales are anticipated to increase in the low-single-digit range, backed by expected geographic expansion and account penetration in wood finishes businesses, partially offset by year-over-year flat growth in edible coatings and restoration businesses.

Sales in the Construction Products Group are estimated to rise in the mid-single-digit range, owing to higher growth expectation in innovative technologies.

Performance Coatings Group revenues are expected to increase in the low-single-digit range, owing to weakness in international markets and the impact of exiting certain businesses.

For the first quarter of fiscal 2020, it anticipates revenues to be up 1-2%. Moreover, it projects 20% adjusted EBIT and EPS growth each.

Zacks Rank & Key Picks

RPM currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the Construction sector are Quanta Services, Inc. PWR, Arcosa, Inc. ACA and Armstrong World Industries, Inc. AWI, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Quanta Services, Arcosa and Armstrong World’s earnings for the current year are expected to increase 29.5%, 14.3% and 24.6%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

Quanta Services, Inc. (PWR) : Free Stock Analysis Report

RPM International Inc. (RPM) : Free Stock Analysis Report

Arcosa, Inc. (ACA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance