RPC (RES) Lags on Q1 Earnings, Reiterates '24 Capex View

RPC Inc. RES reported first-quarter 2024 adjusted earnings of 13 cents per share, which missed the Zacks Consensus Estimate of 19 cents. The bottom line declined from the year-ago quarter’s 39 cents.

Total quarterly revenues were $377.8 million, down from the year-ago quarter’s $476.7 million. The top line also missed the Zacks Consensus Estimate of $397 million.

The weak quarterly results can be attributed to decreased activity levels and competitive pricing across various service lines.

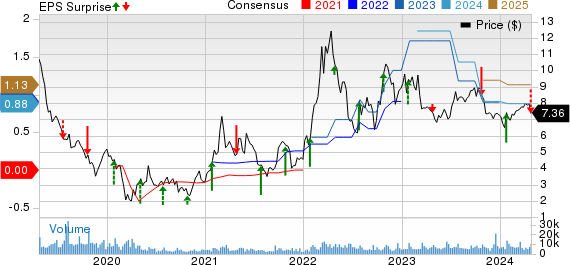

RPC, Inc. Price, Consensus and EPS Surprise

RPC, Inc. price-consensus-eps-surprise-chart | RPC, Inc. Quote

Segmental Performance

Operating profit in the Technical Services segment totaled $32 million, lower than the year-ago quarter’s $103.5 million. The results were primarily influenced by decreased activity levels and competitive pricing across various service lines, leading to negative impacts on fixed costs, especially labor, due to reduced leverage.

Operating profit in the Support Services segment amounted to $3.6 million, lower than the year-ago quarter’s $6.6 million. The decline was attributed to reduced activity within rental tools, accentuated by the high fixed-cost structure inherent in these service lines.

Total operating profit in the quarter was $32.3 million, down from $90.7 million reported in the year-ago quarter. The average domestic rig count was 623, marking an 18% decline from the year-ago quarter. The average oil price in the quarter was $77.46 per barrel, up 2% year over year. The average price of natural gas was $2.15 per thousand cubic feet, down 19.2% from the corresponding period of 2023.

Costs & Expenses

In the first quarter of 2024, the cost of revenues decreased to $276.6 million from $305.3 million in the prior-year period. Selling, general and administrative expenses amounted to $40.1 million, slightly lower than the year-ago quarter’s $42.2 million.

Financials

RPC’s total capital expenditure for the first quarter was $52.8 million.

As of Mar 31, the company had cash and cash equivalents of $212.2 million. The company managed to maintain a debt-free balance sheet.

Outlook

The company reiterated its capex guidance for 2024, maintaining $200-$250 million. However, it may lean toward the lower end of this range, contingent upon market conditions in the latter half of the year.

Zacks Rank & Stocks to Consider

RPC currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

SM Energy Company SM is an independent oil and gas company engaged in the exploration, exploitation, development, acquisition and production of oil and gas in North America.

The Zacks Consensus Estimate for SM’s 2024 and 2025 EPS is pegged at $6.15 and $6.73, respectively. The stock has witnessed upward earnings estimate revisions for 2024 and 2025 in the past seven days.

Hess Corporation HES is a leading oil and natural gas exploration and production company. The exploration and production company’s oil and gas proved reserves increased last year by more than 8% year over year.

The Zacks Consensus Estimate for HES’s 2024 and 2025 EPS is pegged at $8.62 and $11.45, respectively. The stock has witnessed upward earnings estimate revisions for 2024 and 2025 in the past seven days.

YPF Sociedad Anonima YPF is a vertically integrated energy company primarily engaged in the oil and gas sector. The company is associated with both upstream and downstream activities, including the exploration, production and refining of crude oil and natural gas.

The Zacks Consensus Estimate for YPF’s 2024 and 2025 EPS is pegged at $6.14 and $7.83, respectively. The stock has witnessed upward earnings estimate revisions for 2024 and 2025 in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hess Corporation (HES) : Free Stock Analysis Report

SM Energy Company (SM) : Free Stock Analysis Report

YPF Sociedad Anonima (YPF) : Free Stock Analysis Report

RPC, Inc. (RES) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance