ROKU's Q3 Earnings Beat Estimates, Revenues Increase Y/Y

Roku ROKU reported third-quarter 2021 earnings of 48 cents per share, outpacing the Zacks Consensus Estimate of 6 cents. The company reported earnings of 9 cents per share in the year-ago quarter.

Revenues increased 51% from the year-ago level to $680 million but missed the consensus mark by 0.4%.

Growth of the Roku Channel in both reach and engagement drove third-quarter performance.

Active accounts jumped 23% year over year to 56.4 million, driven by the popularity of Roku streaming players and Roku TV models. Streaming hours also jumped 21% year over year to 18 billion.

Also, average revenue per user grew 49% from the prior-year quarter to $40.1 (on a trailing 12-month basis).

For the third quarter, Roku’s monetized video ad impressions nearly doubled on a year-over-year basis owing to strong client acquisition and retention.

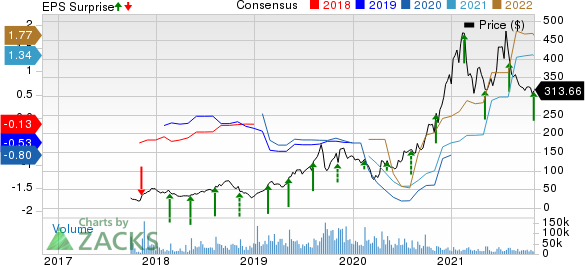

Roku, Inc. Price, Consensus and EPS Surprise

Roku, Inc. price-consensus-eps-surprise-chart | Roku, Inc. Quote

Quarter Details

Platform revenues (86% of revenues) surged 82% year over year to $582.5 million, driven by significant increases in both content distribution activities and advertising.

Player revenues (14% of revenues), however, decreased 26% from the year-ago level to $97.4 million.

In the third quarter, the company launched the all-new Roku Streaming Stick 4K and Roku Streaming Stick 4K+, which comprises the Roku Voice Remote Pro, Dolby Vision, and HDR10+.

It also introduced a new tool in the reported quarter that permits Shopify SHOP merchants to seamlessly build, buy and measure TV streaming advertising campaigns on the Roku platform.

Operating Details

Gross margin, as a percentage of total revenues, expanded 600 basis points (bps) from the year-ago quarter to 53.5%.

Operating expenses increased 45% year over year to 295.1 million. As a percentage of total revenues, the metric contracted 152 bps.

As a percentage of total revenues, research & development, and general & administrative expenses contracted 188 bps and 6 bps, respectively, while sales & marketing expenses expanded 42 bps on a year-over-year basis.

For the third quarter, adjusted EBITDA margin — as a percentage of total revenues — expanded 670 bps year over year to 19.1%.

Operating income was $68.8 million for the reported quarter compared with $12 million in the year-ago period.

Balance Sheet

As of Sep 30, 2021, cash and cash equivalents were $2.18 billion compared with $2.08 billion as of Jun 30, 2021.

As of Sep 30, 2021, the company reported total debt of $91.1 million compared with $92.3 million on Jun 30, 2021.

Guidance

For fourth-quarter 2021, Roku expects total net revenues between $885 million and $900 million. The Zacks Consensus Estimate is currently pegged at $948.7 million.

Gross profit is anticipated between $380 million and $390 million. The company expects adjusted EBITDA in the $65-$75 million band.

Zacks Rank & Stocks to Consider

Currently, Roku has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the consumer discretionary sector include PVH PVH and Vitru Ltd. VTRU. While PVH sports a Zacks Rank #1 (Strong Buy), Vitru carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rates for PVH and Vitru are currently projected at 59.1% and 29.6%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PVH Corp. (PVH) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

Roku, Inc. (ROKU) : Free Stock Analysis Report

Vitru Limited (VTRU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance