Roger Tan: 3 Things about the Global Economy to Worry About Now

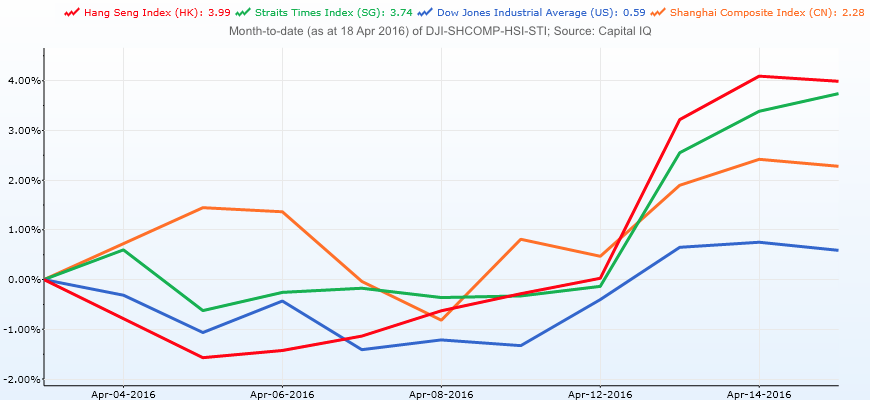

Most major indices and Singapore’s Straits Times Index (STI) shot up quite significantly just last week.

While this looks like a good sign that the global economy is recovering from what seemed like a bear market, local experienced financial analyst and Voyage Research founder Roger Tan thinks otherwise.

As much as charts do not lie, in a recent chat with Roger revealed that the recent recovery in major markets might be very short-lived.

We had summed up three main things about the global economy that investors might need to worry about in the coming months or so.

Roger Tan will be speaking at our half-yearly Shares Investment Conference 1H2016 (SIC1H2016) more in-depth about his insights regarding the global economy, emphasising on Singapore’s stock market.

1. US Federal Reserve Interest Rates & US Economic Data

When asked about interest rate hikes this year, Roger believes that the US Fed will not only lower expectations for rate hikes this year but also possibly delay it to as late a date as possible.

The outlook for the global economy looks weak, though Asian currencies and markets have been performing slightly above expectations.

The main concern now lies with Europe and possibly Japan, where negative interest rate policies (NIRP) were implemented recently.

Roger thinks that the US Fed is no longer just worried about US core inflation rates, but also how the rest of the markets would be able to adapt to interest rate hikes.

Nevertheless, low unemployment rates and core inflation would still be the first green light for the US Fed to make any decisions or forecasts regarding interest rates.

2. OPEC & Non-OPEC Oil Agreements

After more than 30 years of sanctions on Iran were lifted, the Iranians started pumping oil as much as they can to make up for the lost income.

Just as Iran was starting to pump more oil to save its economy, Saudi Arabia demanded that the former stop so as to boost oil prices from historical lows.

If you were in Iran’s shoes, would you do that? Iran most certainly refused and the agreement fell apart.

As soon as the meeting between major oil producers all over the world fell apart on Sunday (17 April 2016), economists are worried that the supply-and-demand problem might become imbalanced again.

In Roger’s opinion, the oil price fall might be a strategic political move by Saudi Arabia — they do not want Iran to take advantage of high oil prices to make more money.

Thus, Roger thinks that we would expect an oil recovery to be unlikely and prices to hover between US$40 and US$50, volatility to remain very high.

3. Singapore’s Tight Monetary Policies & Modest Fiscal Spending

In Roger’s opinion, the Singapore market’s recent gains were largely due to the momentum spilled over from the US market and not supported by fundamentals.

In other words, Roger sees that the Singapore market would soon experience a correction again, something that we should not be too surprised in the current volatility.

Furthermore, our economy is weak because of our current tight monetary policies and modest fiscal spending, two of which Roger thinks investors should watch closely.

As such, for investors who are interested in defensive dividend-yielding stocks, Roger believes that this is the time to start shopping in the stock market.

In particular, Roger thinks that blue chip stocks are starting to get cheap and investors can buy in slowly.

Nevertheless, we must bear in mind that the market is very volatile now so we still need to be careful and critical of what we buy; cost averaging strategies should work.

Meanwhile, Roger Tan will be sharing more insights about the Singapore market and how we will be affected by the US Fed’s decisions and economy at our upcoming Shares Investment Conference 1H2016. Click on the button below to learn more.

Yahoo Finance

Yahoo Finance