Retail Earnings in Focus This Week; Target Slashes Prices

The first-quarter earnings season is winding down. We’ve received results from more than 90% of S&P 500 companies, with year-over-year earnings growth representing the best pace we’ve seen in nearly two years. This week, we still have hundreds of companies reporting results including 15 S&P 500 members.

A host of retailers are set to report in the coming days. Last week’s beat-and-raise report from Walmart (which saw earnings and revenues climb 22% and 6% from the year-ago period, respectively) represented the second straight quarter of accelerating growth for the retail giant, and the best gain in three years. Walmart stock WMT, currently a Zacks Rank #3 (Hold), hit an all-time high on the news.

Image Source: StockCharts

Eyes now turn to competitor Target TGT. The big-box retailer is due to report Q1 results on Wednesday before the opening bell. Just yesterday, Target announced that it will lower prices on roughly 5,000 products ranging from groceries like meat and bread to staples such as paper towels and diapers. Many price reductions have already occurred, with thousands more coming in the next few months.

Target appears to be taking a shot at Walmart in an effort to boost both its grocery and merchandise business as competition heats up. Groceries account for approximately 60% of Walmart’s annual domestic sales.

Target Earnings Hit a Roadblock

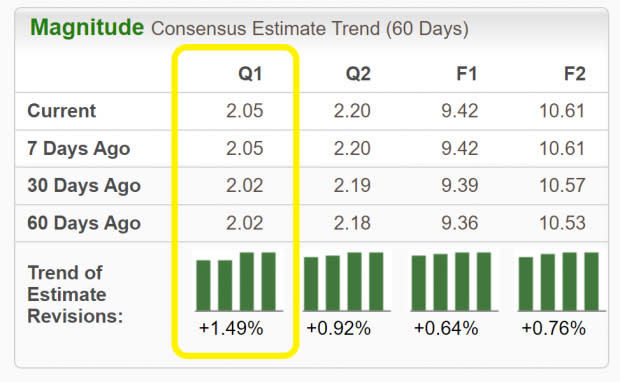

Target is expected to post flat earnings of $2.05/share. Over the past month, analysts have bumped up their Q1 estimate by 1.49%:

Image Source: Zacks Investment Research

Revenues are projected to decline 3.2% from the year-ago period to $24.5 billion. Target, also a Zacks Rank #3 (Hold), has exceeded the earnings mark in each of the past four quarters, delivering an average surprise of 27.1% over that timeframe.

There have been signs of a potential slowdown in consumer spending, which could possibly weigh on Target’s first-quarter performance. Consumers have been exhibiting increased caution in this high interest-rate environment, forcing individuals and families to prioritize essential purchases.

Walmart CFO John Rainey seemed to echo this sentiment despite the company’s stellar quarterly results last week, noting that shoppers’ “wallets are still stretched,” driving them to spend in areas such as groceries rather than general merchandise.

Still, Target has been proactive in adapting its business operations to remain competitive. The company’s strategic initiatives, store investments, and partnerships with popular brands are anticipated to have contributed to its overall performance during the quarter. In addition, Target is likely to have registered margin expansion thanks to clean inventory and lower supply chain and freight costs.

What the Zacks Model Reveals

The Zacks Earnings ESP (Expected Surprise Prediction) seeks to find companies that have recently witnessed positive earnings estimate revision activity. This more recent information can be a better predictor for future earnings and can give investors a leg up during earnings season.

The technique has proven to be quite useful for finding positive earnings surprises. In fact, when combining a Zacks Rank #3 or better with a positive Earnings ESP, stocks produced a positive surprise 70% of the time according to our 10-year back test.

Target is a Zacks Rank #3 (Hold) and boasts a +6.39% Earnings ESP. Another beat may be in the cards when the company reports results on Wednesday morning.

Other related companies set to report this week include membership warehouse club BJ’s BJ, department store chain Macy’s M, and off-price retailers TJX Companies TJX and Ross Stores ROST. Be sure to keep an eye on results as investors remain eager to examine the evolving consumer picture.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Macy's, Inc. (M) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

BJ's Wholesale Club Holdings, Inc. (BJ) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance