Report: only 13% of Chinese consumers will buy smartphones priced over $330

Today Sina released a report on consumer preferences for Chinese smartphone brands and pricing, and while Sina isn’t a market research firm and the survey isn’t perfect, the report still produced some interesting findings on how Chinese buyers perceive domestic mobile devices.

Sina sent out questionnaires to 800,000 recipients, asking consumers to state which domestic brands they have the ‘deepest impressions’ of, and list their preferred price points for domestic smartphones.

Of the 670,000 respondents, 18 percent of respondents claimed to be most familiar with Huawei, followed by Lenovo (17.9 percent) and Xiaomi (16.5 percent). These three brands are trailed closely by Coolpad, Meizu, and ZTE.

The news here is that Xiaomi, a company barely three years old, is now just as well-known as China behemoths Huawei and Lenovo. Meanwhile, Lenovo, a company best known worldwide for its stronghold in the PC market, remains well-known in China for its mobile devices. The company sells the majority of its phones domestically at the moment, and trails only Samsung in terms of sales figures in China.

Sina points out that these six brands received an aggregate of 97 percent of respondents’ votes, while only three percent of respondents claimed to have deep impressions of local brands Hisense, Haier, TCL, Gionee, Bubugao, and OPPO. The low brand recognition of OPPO comes as somewhat of a surprise, as that brand, like Xiaomi, has attracted the attention of the international tech media for its customized CyogenMod Android ROM, and for its global expansion ambitions.

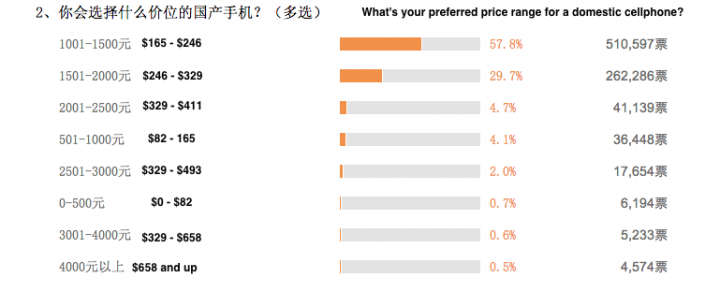

Meanwhile, as for pricing, an overwhelming maority of the 627,000 respondents expressed a preference for midrange phones.

As the above chart indicates, 57.8 percent of respondents would be willing to pay RMB1,000-1500 (between $165 and $246) for a Chinese phone, while almost 30 percent replied that they would shell out RMB1,501-2,000 (Between $246 and $329) for a domestic handset. Meanwhile, at price points above RMB2,000 (about $329), consumer acceptance of domestic devices drops significantly.

Challenges for domestic manufacturers

Of course, while Chinese companies appear to be best poised to sell to local consumers at the mid-range, most profits are made at the high end. Anything priced above $411 will have healthy profit margins, but will be pit against the ranks of Samsung and Apple – and consumers that are less price-sensitive might choose international brands over domestic counterparts.

This has led domestic manufacturers to push “premium budget” devices like the Huawei Ascend P6 and the Meizu MX3 (Xiaomi’s best devices also fit into this price range). Phones in this sub-category tend to feature quad-core processors, rear cameras of at least 8MP along with front cameras, and screen resolutions around 1280 x 720.

China’s smartphone market is the largest in the world, with 30 million handsets sold in the month of August alone.

(Source: Sina)

(Editing by Steven Millward)

The post Report: only 13% of Chinese consumers will buy smartphones priced over $330 appeared first on Tech in Asia.

Yahoo Finance

Yahoo Finance