Regeneron (REGN), SNY Win FDA Nod for Kevzara Label Expansion

Regeneron Pharmaceuticals, Inc. REGN and partner Sanofi SNY announced that the FDA has approved a label expansion of the arthritis drug Kevzara (sarilumab).

The drug is now approved in the United States for the treatment of patients weighing 63 kilograms or more with active polyarticular juvenile idiopathic arthritis (pJIA).

The FDA approval is supported by evidence from adequate and well-controlled studies and pharmacokinetic data from adults with rheumatoid arthritis as well as a pharmacokinetic, pharmacodynamic, dose-finding and safety study in pediatric patients with pJIA.

Please note that Kevzara, an interleukin-6 (IL-6) receptor blocker, is already approved in the United States for treating adult patients with moderately to severely active rheumatoid arthritis (RA) after at least one other medicine, called a disease-modifying antirheumatic drug, has been used and did not work well or could not be tolerated. Kevzara is also indicated for adult patients with polymyalgia rheumatica, an inflammatory rheumatic disease.

pJIA is a form of arthritis that affects multiple joints at a time and can be painful for children.

Kevzara generated sales of $94.1 million in the first quarter of 2024. The figure was up 20% year over year. Approval in another indication should increase sales of the drug.

While Sanofi records global net product sales of Dupixent and Kevzara, Regeneron records its share of profit in connection with the global sales of these drugs.

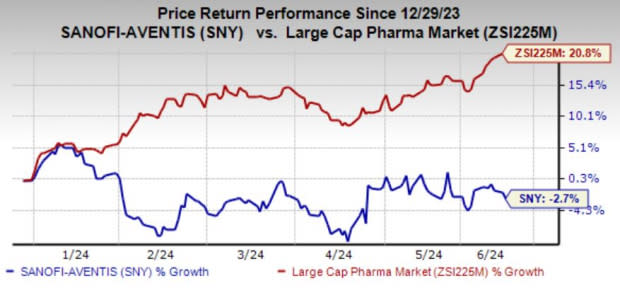

Sanofi’s shares have lost 2.7% year to date against the industry’s 20.8% growth.

Image Source: Zacks Investment Research

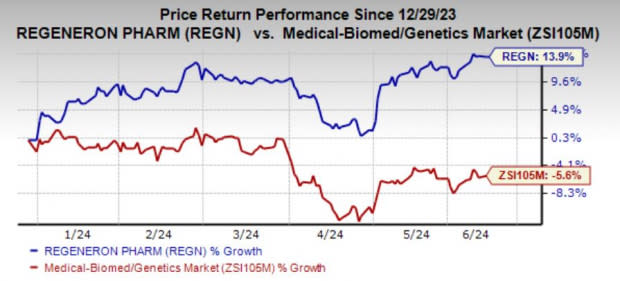

Regeneron’s shares have risen 13.9% year to date against the industry’s decline of 5.6%.

Image Source: Zacks Investment Research

Approval of new drugs and label expansion of the existing ones bode well for Regeneron as its lead drug Eylea faces challenges.

IL-6 is an immune system protein produced in increased quantities in patients with rheumatoid arthritis and has been associated with disease activity, joint destruction and other systemic problems.

Quite a few IL-6 inhibitors are approved by the FDA for a range of diseases. Among these, Roche's Actemra is also approved for the treatment of RA, pJIA, systemic juvenile idiopathic arthritis, giant cell arteritis and CAR-T cell-induced cytokine release syndrome.

Roche also has another IL-6 inhibitor in its portfolio, named Enspryng (satralizumab), approved for the treatment of patients with neuromyelitis optica spectrum disorder.

Zacks Rank and Stocks to Consider

Both REGN and SNY currently carry a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the biotech sector are ALX Oncology Holdings ALXO and Minerva Neurosciences, Inc. NERV, both carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has narrowed from $3.33 to $2.89. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.85 to $2.73.

ALX Oncology beat on earnings in two of the trailing four quarters and missed the mark in the other two, delivering an average negative surprise of 8.83%.

In the past 60 days, estimates for Minerva Neurosciences’ 2024 loss per share have narrowed from $3.57 to $1.89. Loss per share estimate for 2025 has narrowed from $4.54 to $3.60.

NERV’s earnings beat estimates in one of the trailing four quarters and missed the same in the other three, the average negative surprise being 54.43%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Sanofi (SNY) : Free Stock Analysis Report

Minerva Neurosciences, Inc (NERV) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance