Red Rock Resorts (RRR) Q3 Earnings & Revenues Top Estimates

Red Rock Resorts, Inc. RRR reported third-quarter 2022 results, with earnings and revenues surpassing the Zacks Consensus Estimate. Earnings beat the consensus mark for the 10th straight quarter. However, the top and bottom line declined on a year-over-year basis.

Earnings & Revenues

In the quarter under review, adjusted earnings per share (EPS) came in at 84 cents, which beat the Zacks Consensus Estimate of 49 cents. In the prior-year quarter, the company had reported an adjusted EPS of 93 cents.

Quarterly revenues of $414.4 million beat the consensus mark of $408 million. However, the top line declined 0.8% on a year-over-year basis. Meanwhile, adjusted EBITDA in the quarter was $181.9 million, down 1.4% year over year.

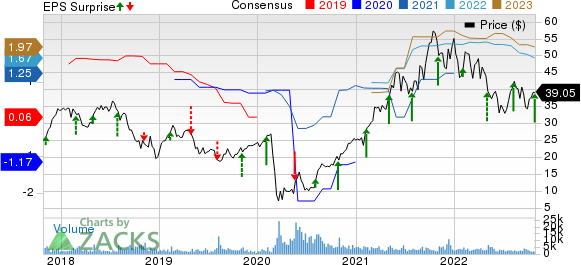

Red Rock Resorts, Inc. Price, Consensus and EPS Surprise

Red Rock Resorts, Inc. price-consensus-eps-surprise-chart | Red Rock Resorts, Inc. Quote

Segmental Details

Las Vegas Operations: In third-quarter 2022, revenues in the segment totaled $411.6 million compared with $412.7 million reported in the prior-year quarter. The segments' adjusted EBITDA was $199.9 million, down 0.9% on a year-over-year basis.

Native American Management: During the quarter under discussion, the company did not report any revenues in the Native American Management segment. The segments' adjusted EBITDA came in at $(0.1) million against $0.2 million reported in the prior-year quarter.

Other Financial Details

As of Sep 30, 2022, Red Rock Resorts had cash and cash equivalent of $101.1 million compared with $256.3 million reported in the previous quarter.

Outstanding debt at the end of the third quarter amounted to $2.91 billion compared with $2.88 billion reported in the previous quarter.

Zacks Rank & Key Picks

Red Rock Resorts has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the Zacks Consumer Discretionary sector are Live Nation Entertainment, Inc. LYV, Hyatt Hotels Corporation H and Crocs, Inc. CROX.

Hyatt sports a Zacks Rank #1 (Strong Buy). H has a trailing four-quarter earnings surprise of 798.8%, on average. The stock has inched up 6.5% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for H’s current financial year sales and EPS indicates a surge of 89.1% and 113%, respectively, from the year-ago period’s reported levels.

Live Nation sports a Zacks Rank #1. LYV has a trailing four-quarter earnings surprise of 70.7%, on average. The stock has declined 22.2% in the past year.

The Zacks Consensus Estimate for LYV’s current financial year sales and EPS indicates growth of 130.8% and 117.2%, respectively, from the year-ago period’s reported levels.

Crocs carries a Zacks Rank #2 (Buy). CROX has a long-term earnings growth rate of 15%. Shares of Crocs have decreased 53.1% in the past year.

The Zacks Consensus Estimate for CROX’s 2022 sales and EPS indicates a rise of 49.7% and 20.7%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

Red Rock Resorts, Inc. (RRR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance