The real world is increasingly rough for 30-year-old Americans

It’s relatively tough out there for American 30-year-olds.

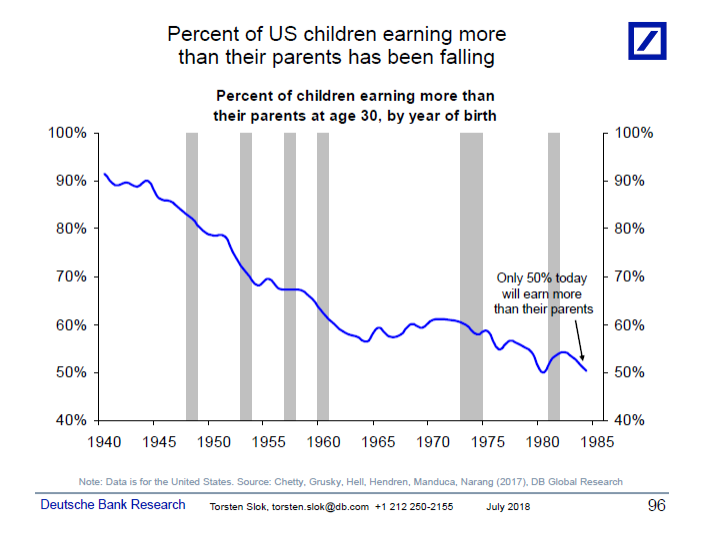

Deutsche Bank’s Torsten Slok sent around a chart showing the overall decline in earning power for 30-year-old Americans over the last few decades. Slok noted that the “percentage of children earning more than their parents has been falling steadily since 1945.”

And although the original data are from December 2016, more recent reports indicate that the general trend continues.

‘Weighed down by student debt and stagnant wages’

In 1955, 70 percent of 30-year-olds were earning more than their parents. Today, only 50 percent of millennials are expected to earn more, with that number likely to go down.

Bloomberg recently used Federal Reserve Bank of St. Louis data to highlight how today’s young people “are weighed down by student debt and stagnant wages.”

Over the weekend, Axios published several charts to show how more of today’s 30-year-olds are living with their parents, paying higher college tuition, taking on significant debt, and buying fewer homes than 30-year-olds four decades ago.

And last year, the Guardian created an interactive tool to compare wage gains between different age groups. The data showed that, over time, “people 25 to 29 years have lost, relative to the national average. The highest earners are now aged 55 to 59 years and they have gained in relative terms since 1979.”

‘The best way to get rich in America’

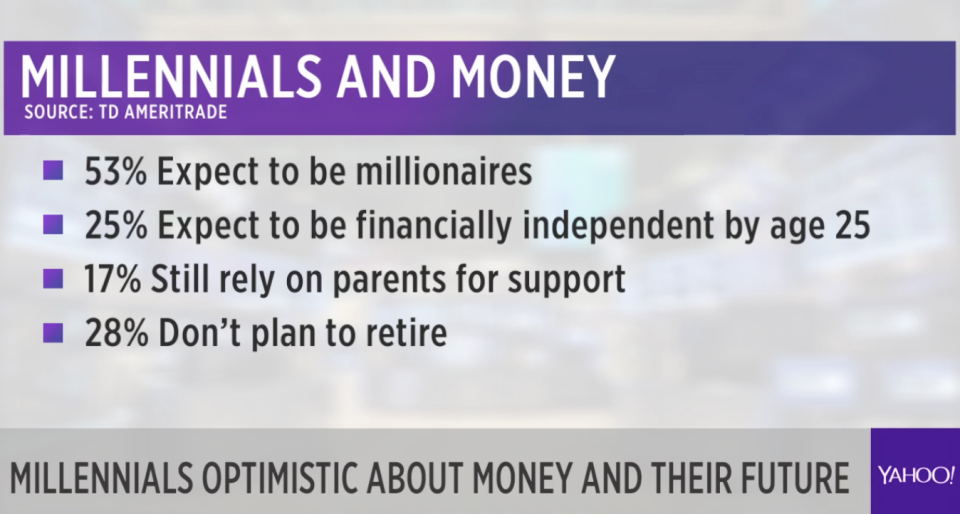

Despite the bleak outlook for Gen Y, many people born between 1982 and 2000 are still optimistic when it comes to their own earning potential.

As Yahoo Finance’s Melody Hahm, Ethan Wolff-Mann, and Andy Serwer recently discussed (in the video above), half of those in the millennial generation expect to become millionaires — but many don’t plan on saving for retirement until 36.

“I’m not exactly sure where all of this positive sentiment is coming from,” Wolff-Mann said. “I’m not sure whether the stagnant wages are contributing to this or anything like that. I do think … people [are] just hoping that something comes along that they walk into luck.”

Hahm noted that some young people “think they can become influencers or they can sort of get a following, perhaps have a YouTube channel, perhaps be on Instagram and get $5,000 to pose with a bag or a beauty product.”

Unfortunately, the power of social media, and the “Hail Mary shot” it presents (as Wolff-Mann calls it), works for only a fraction of those hoping to get rich quick.

Serwer, Yahoo Finance’s editor-in-chief, added a piece of advice for the younger generations: “Get real, work hard, and don’t spend money. The best way to get rich in America is not to spend money.”

READ MORE: Warren Buffett makes multi-billion dollar donation as Bezos net worth hits $150 billion

Yahoo Finance

Yahoo Finance