RCI Hospitality Holdings Inc (RICK) Faces Earnings Challenges in Q2 2024

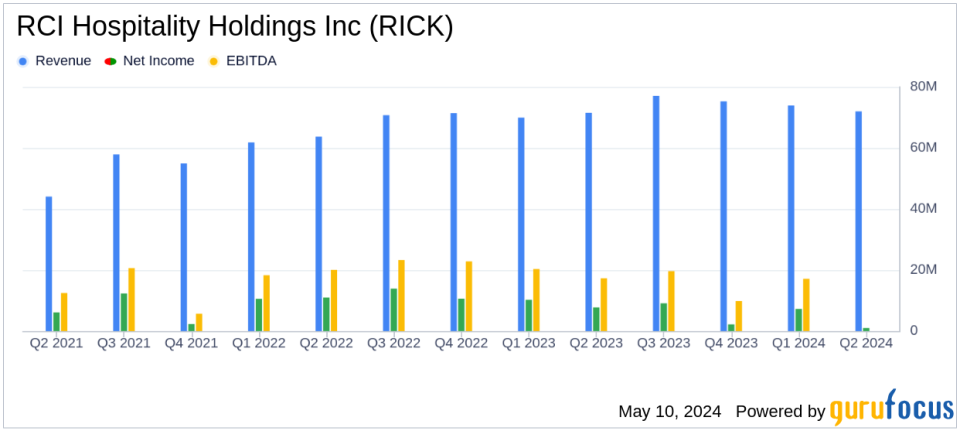

Revenue: Reported $72.3 million, slightly below the estimate of $73.14 million.

Net Income: $0.8 million, significantly below the estimated $9.43 million.

EPS: GAAP EPS at $0.08, and Non-GAAP EPS at $0.90, both falling short of the estimated $1.01.

Free Cash Flow: Achieved $8.8 million, compared to $14.8 million in the prior year.

Same-Store Sales: Declined in the Bombshells segment, contributing to lower segment revenue and profitability.

Store Locations: Continued expansion with new locations and upgrades to existing ones to foster growth.

Share Repurchases: Repurchased 27,265 shares for $1.5 million during the quarter.

On May 9, 2024, RCI Hospitality Holdings Inc (NASDAQ:RICK) disclosed its financial results for the second quarter of fiscal year 2024, which ended on March 31, 2024. The company, known for its adult nightclubs and sports bars-restaurants, reported a modest increase in revenue but a significant decline in earnings per share (EPS). The detailed financial outcomes were released in their 8-K filing.

Company Overview

RCI Hospitality Holdings Inc operates through various subsidiaries, managing establishments that offer live adult entertainment and dining experiences. The company's primary revenue sources include its Nightclubs and Bombshells segments, with the majority of its income derived from nightclub operations. These venues primarily generate revenue through the sale of alcoholic beverages, food, and merchandise, alongside cover charges and other service fees.

Financial Performance Insights

For Q2 2024, RCI reported revenues of $72.3 million, a slight increase from $71.5 million in the same quarter the previous year. This growth was primarily driven by the Nightclubs segment, which saw a revenue increase to $59.4 million from $57.0 million. However, the Bombshells segment experienced a decline, dropping to $12.8 million from $14.3 million in revenue.

The earnings picture was less positive. RCI reported a GAAP EPS of $0.08, a stark decrease from $0.83 in Q2 2023. This significant drop was largely due to a non-cash impairment charge of $8.0 million. Adjusting for non-GAAP items, EPS stood at $0.90, which still fell short of the previous year's $1.30 and missed analyst expectations of $1.01 per share.

Operational Challenges and Strategic Adjustments

The company faced several challenges during the quarter, including wage inflation and a doubled Texas patron tax, which impacted profitability. Despite these hurdles, RCI is actively pursuing improvements, particularly in the Bombshells segment, and is focusing on strategic acquisitions and stock buybacks to bolster its financial standing.

Balance Sheet and Cash Flow

RCI ended the quarter with $19.973 million in cash and cash equivalents. Net cash from operating activities amounted to $10.8 million, down from $16.8 million in the prior year. The company also reported a decrease in free cash flow to $8.8 million from $14.8 million.

Outlook and Investor Engagement

Despite the current economic uncertainties, RCI's management remains committed to its core nightclub business and is optimistic about its capital allocation strategy. The company has also planned investor engagement events, including a management meet-and-greet at one of its top revenue-generating clubs.

Overall, RCI Hospitality Holdings Inc faces significant challenges as it navigates through economic pressures and operational hurdles. The company's ability to adapt its strategies and improve its segments will be crucial in determining its future financial performance.

Explore the complete 8-K earnings release (here) from RCI Hospitality Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance