Prospect Capital (PSEC) to Post Q4 Earnings: What's in Store?

Prospect Capital Corporation PSEC is slated to report fourth-quarter and fiscal 2022 (ended Jun 30) results on Aug 24, after market close. Its quarterly revenues and earnings are expected to have increased year over year.

In the last reported quarter, the company’s earnings surpassed the Zacks Consensus Estimate. Results benefited from an increase in total investment income, while higher expenses were on the downside.

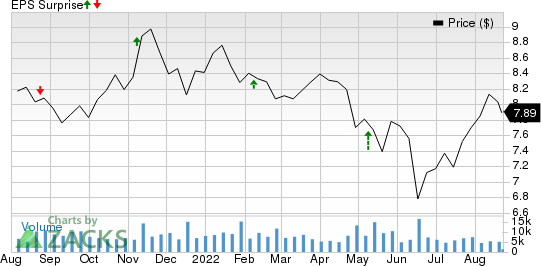

The company has a decent earnings surprise history, with an average beat of 11%.

Prospect Capital Corporation Price and EPS Surprise

Prospect Capital Corporation price-eps-surprise | Prospect Capital Corporation Quote

Activities of the company in the to-be-reported quarter were inadequate to win analysts’ confidence. As a result, the Zacks Consensus Estimate for fiscal fourth-quarter earnings of 19 cents has been unchanged over the past seven days. The estimate indicates a rise of 11.8% from the year-ago reported figure.

Further, the Zacks Consensus Estimate for sales of $179.7 million suggests a year-over-year increase of 14.2%.

Before we take a look at what our quantitative model predicts for the fiscal fourth quarter, let’s check the factors that are likely to have impacted the performance.

Factors to Influence Q4 Results

Given the expectations of higher prepayment activity in the to-be-reported quarter, total investment income is likely to have been positively impacted. Moreover, with the recent expansion in the LIBOR rates, Prospect Capital’s floating-rate debt investments, which are tied to LIBOR, are likely to have positively impacted investment income to some extent.

The company has been witnessing higher expenses over the past several quarters. As Prospect Capital has been investing in the venture growth stage companies, operating expenses are likely to have been elevated in the to-be-reported quarter as well.

Earnings Whispers

According to our quantitative model, it cannot be conclusively predicted whether Prospect Capital will be able to beat the Zacks Consensus Estimate this time. This is because it does not have the right combination of the two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Prospect Capital has an Earnings ESP of 0.00%.

Zacks Rank: The company currently carries a Zacks Rank #3. While this increases the predictive power of ESP, we also need a positive Earnings ESP to be sure of an earnings beat.

Stocks to Consider

A couple of stocks from the finance space worth a look at are Noah Holdings Limited NOAH and Blue Owl Capital Inc. OWL.

The Zacks Consensus Estimate for NOAH’s current-year earnings has been revised upward by 3.8% over the past 60 days. The stock has gained 11.2% in the past three months. NOAH currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Blue Owl’s earnings estimates for the current year have been revised 16.4 upward over the past 60 days. The stock has lost 0.2% over the past three months. OWL currently carries a Zacks Rank of 2.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Noah Holdings Ltd. (NOAH) : Free Stock Analysis Report

Prospect Capital Corporation (PSEC) : Free Stock Analysis Report

Blue Owl Capital Inc. (OWL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance