Property value – will it be affected by the current Covid-19 crisis

Colliers International a leading real estate services agency says the impact on property value will differ among property types

Colliers International in an attempt to answer burning real estate questions in a time of the Covid-19 pandemic said: “property value will differ among property types”.

Ms Stella Seow, Executive Director & Head at Colliers International, answers 3 burning questions on property value:

“Has the value of my property been affected by the current situation?

The current pandemic has affected markets across the globe, with very few sectors surviving the turbulence unscathed.With regards to property values, the impact understandably differs among property types. The best avenue is to engage a professional Property Valuer to ascertain your properties current value. This will also be useful for refinancing purposes particularly while interest rates are expected to remain low.

I want to save on my property tax. How can I do this?

Saving on property tax has always been front of mind for many people. However, the desire for it during this climate has understandably been amplified. Here are some ways you can save on your property tax:Residential and Industrial

If the rental of the premises has been reduced as a result of the market situation, we suggest you inform IRAS in a timely manner to ensure the Annual Value can be revised downwards and property tax reduced accordingly.Retail

Provide regular updates on the tenancy, particularly when there is a downward revision of rent. During this period, landlords are given 100% property tax rebate and will have to pass this rebate to the tenants.Office

Saving on office property tax is similar to retail, however landlords are given only 30% property tax rebate and will have to pass this rebate to the tenants.I want to have my property valued now, but there are still restrictions in play. Can you still value my property?

Yes, absolutely! As we all continue to embrace new ways of communicating, Colliers has introduced virtual property valuation measures.We are conducting real-time inspections via WhatsApp or Facetime video calls with our Colliers experts. In addition to the virtual inspection, we will also require photographs of your premises as well as floor plans and floor areas for landed properties.

As always, the banks and financial institutions will still require a valuation to confirm the property’s market value before loan can be disbursed.”

Do you know enough about how property valuation is done in Singapore?

Knowing how to calculate the property value is of paramount importance to a home owner. It can help you determine whether you are overpaying for a home, or whether you have gotten yourself a real bargain. Paying the right price is just one way you can avoid overspending on your property.

Even when you are paying a premium for the home, you need to make sure that you are paying a premium for something in return (e.g. fully furnished home or soothing interior design). You can check with a valuer or you can check with a property agent that has access to a iValue tool at Home Loan Report.

Even when you are paying a premium for the home, you need to make sure that you are paying a premium for something in return (e.g. fully furnished home or soothing interior design). You can check with a valuer or you can check with a property agent that has access to a iValue tool at Home Loan Report.

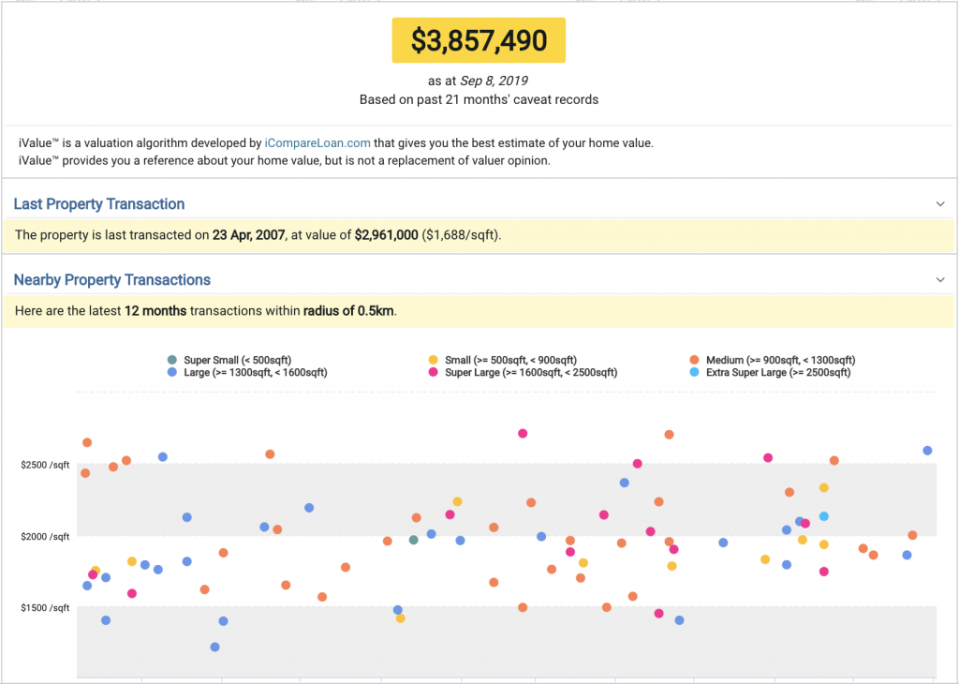

Picture 1: Property valuation is estimated for the Rivergate Condominium, home loan report by iCompareLoan.com

You can then use that as a first estimate of whether the property is worth buying, alternatively if your agent is telling you the price is 4 million, you can also see that the unit in question is estimated at around $ 3.86m, that gives you some level of guide as to whether the deal is possible or not. However if the agent is telling that the unit is $4.4m while the estimated value is only $3.86m, then it is very likely that the property agent is trying to “manage” you.

Ultimately, it is to help you make a better decision when it comes to choosing a home and also not to get ripped off by lousy sellers. Before you buy a property, you may also want to assess your property loan affordability and downpayment, so that you can be properly assured.

SAMPLE –> Property Buyer Report – Rivergate – iValue to get a feel of how a comprehensive property buyer report can SAVE you thousands or even hundreds of thousands from over-paying.

Ultimately you will not need to do the property valuation in Singapore yourself because there will be valuers who are experienced in doing that job. However the methodology is important to know, because it helps you to understand why a property price will go up or down and the reasons for it.

There are three methods that you can use for property valuation: Income; Direct Comparison (Comparative market analysis); and Residual method. To help our readers understand each of these property valuation methods, the iCompareLoan team has prepared this property valuation guide to dissect everything you need to know about property valuation.

The direct comparison method is probably the property valuation method that people are most familiar with. Among the three types of property valuation methods, direct comparison method is also the easiest to understand. This is one of the main reasons why direct comparison is a popular property valuation method.

You can read about the other property value comparison methods here: https://www.icompareloan.com/resources/property-valuation-singapore/

The post Property value – will it be affected by the current Covid-19 crisis appeared first on iCompareLoan Resources.

Yahoo Finance

Yahoo Finance