All About the Product Price

One of the most overlooked aspect of Structured Products is their product price – it works simply like stock and share prices.

So yeah, other than profiting from Coupons, investors can buy low sell high with Structured Products too. This is possible because Structured Products are daily tradeable. Investors can buy in or sell out of a Structured Product at any time, without any extra charges (other than the bid-offer spread).

“What’s the Catch?”, You Say

I want to say that there is not so much of a “catch”, as there is a detail we should watch out for (I only used “catch” as I was merely going for a catchy sub-header hee hee).

The consequence of exiting a Structured Product early is dependent on the product price. If the sell price is lower than the purchase price, the investor makes a loss (not considering any Coupons received).

Selling out of a Structured Product prematurely may not always be a sure-lose however. If the current sell price is higher than the purchase price, the investor makes a profit on top of all the Coupons he has received! Buy low sell high, right?

Factors that Affect Product Price

In an ideal world, everyone would be buying low and selling high. We would all be rich! It doesn’t work like that in reality however, but what we can do is to learn and make more informed decisions. Let’s first look at the major factors that affect a Structured Product’s price.

Product price is tied to the performance

The most common type of Structured Product has its performance tied to the Worst Performer in its basket of Equities / Indices. This means that its product price is largely dependent on the Worst Performer too.

Let’s look at this arbitrary basket for example:

Alibaba is performing at 98%

Amazon is performing at 117%

Apple is performing at 94%

The Worst Performer is Apple at 94%. In this case, we would expect the product price to be hovering in the 94% range too.

As there are things like time lag and imperfect information to consider, the product price will not be tracking the Worst Performer exactly to the decimal point. It could fluctuate by a small number of percentage points.

Approaching observation date

The above is how the product price behaves most of the time. When approaching an Observation Date however, things may change.

Using the same Alibaba, Amazon and Apple above, let’s say that the product has a 60% Coupon Trigger and the Observation Date is in 12 days. At present, all three are well within Coupon-paying range and the likelihood of a Coupon being paid out is very high – there are few factors that will cause any of these three firms to fall below 60% within such a short span of time.

As a result, the product price will start creeping above 94%, and beyond 100% too.

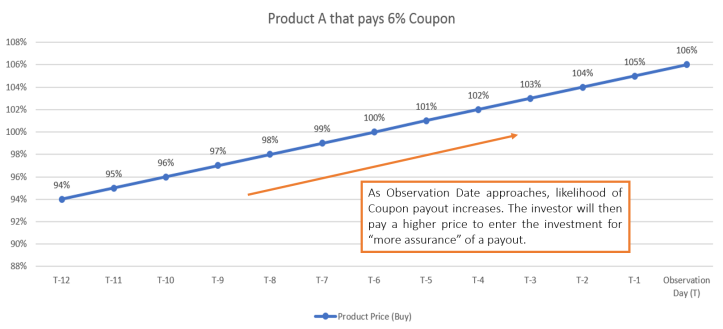

If the Coupon to be paid out is worth 6%, we would expect the product price to be close to 106% on Observation Date. Something like this:

As the Observation Date approaches and the Coupon looks increasingly likely to be paid out, the product price increases.

The reason for this is because the bank is trying to deter investors from buying into a product solely for the Coupon, and then selling out. With higher price, buyers are discouraged from entering as they wouldn’t want to buy high and erode profits.

This is parallel to the idea of investments – with less risk, investors get less returns too.

Opportunistic Sells

Because the product price can go beyond 100% during the term of the product, opportunistic sells are possible. Remember that product price can go all the way up to 100% + value of all unpaid Coupons?

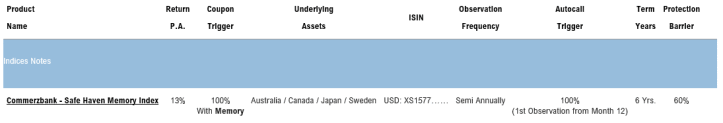

A Structured Product with a Memory feature can easily hit a product price significantly above 100%. Like this one for example:

All accrued Coupons are paid out only when the Note Autocalls. At 13% PA, if the Note Autocalls on Month 24, we will see the product price go all the way up to 126%.

An opportunistic sell arises when the product price gets very close to 126% significantly before Observation Date. If the product price is something like 125% at 2-4 weeks away from Observation Date, some investors would prefer to sell because

The ~1% is used to buy 2-4 weeks of extra time in the next reinvestment

The ~1% is used to secure the 25% profits, and avoid the possibility that the Note does not Autocall if Indices fall during the 2-4 weeks.

Opportunistic Buys

Other than selling high, we want to buy low to maximize profits too. A few times each year, we see the product price deviating from the value of the Worst Performer.

The Worst Performer can be 94% but the product price may stray to as low as 89%, 85%, 79%, etc – who knows! In a case like this, it could be an opportunistic buy as the investor will be paying less for a higher value.

When the price gets corrected and moves back up to the 94% range,

Possible sell to reap quick profits

The Worst Performer has room to fall to 89%, 85%, 79%, etc – whatever the buy price was – before there is danger for a premature sell, if the Underlyings start falling.

As with all <100% buy prices, the investor will also be entitled to bonus units too!

Moving Forward

To get the most out of their Structured Product investments, investors can painstakingly watch the product prices. No pain, no gain!

Of course, most people have tons of other things to do and 24 hours a day is simply not enough. NEBA understands this – which is why our investment team watches all our Structured Products for clients. We are always on the lookout for opportunistic buys and sells!

Our back office also prepares and provides regular, concise performance reports and sends them out. Investors and Financial Advisers can keep an eye out for prices that they deem opportunistic by their own terms too.

Related Articles

- That glass of water in your hand is worth more than the price you paid for it

- Gold price to reach US$1,350 in 2017

- Why tin prices will continue to “solder” on

Yahoo Finance

Yahoo Finance