Procter & Gamble's (PG) Focus on Productivity Plans Bodes Well

The Procter & Gamble Company PG has been focusing on productivity and cost-saving plans to boost margins. The company’s continued investment in the business, alongside efforts to offset macro cost headwinds and balance top and bottom-line growth, underscores its productivity efforts. It is witnessing cost savings and efficiency improvements across all facets of the business.

With the introduction of the supply chain 3.0 program in fiscal 2023, the company has been driving improved capacity, greater agility, flexibility, scalability, transparency and resilience, along with increased productivity. It expects to benefit from tailwinds of $900 million after tax in fiscal 2024, attributed to favorable commodity costs.

In the third quarter of fiscal 2024, the core gross margin increased 310 basis points (bps) year over year to 51.3%, while the currency-neutral gross margin improved 400 bps to 52.2%. The increase in the gross margin was driven by 130 bps each of pricing gains and favorable commodity costs, as well as a 260-bps benefit of gross productivity savings. The operating margin rose 90 bps from the prior year to 22.1%. On a currency-neutral basis, the operating margin expanded 220 bps to 23.4%. The operating margin included gross productivity savings of 320 bps.

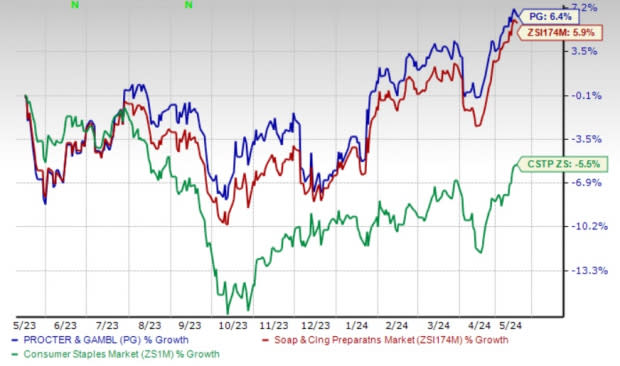

Shares of this current Zacks Rank #3 (Hold) company have gained 6.4% in the past year compared with the industry’s 5.9% growth. The consumer goods company also compared favorably with the sector’s decline of 5.5%.

The Zacks Consensus Estimate for PG’s current financial-year sales and earnings suggests growth of 2.8% and 11%, respectively, from the year-ago reported numbers.

Image Source: Zacks Investment Research

Other Factors Placing PG Well

Procter & Gamble’s products play a key role in meeting the daily health, hygiene and cleaning needs of consumers around the world. The company has also been gaining from robust pricing and a favorable mix, along with strength across segments. Continued business investments also bode well.

The company witnessed continued strong momentum in the fiscal third quarter, as reflected by underlying strength in brands and appropriate strategies, which aided organic sales growth. On an organic basis (excluding the impacts of acquisitions, divestitures and foreign exchange), revenues improved 3% year over year in the fiscal third quarter, backed by a 2.8% rise in pricing, 1.3% growth from the product mix and a 0.2% rise in volume.

Following the impressive fiscal third-quarter results, Procter & Gamble has maintained its sales and cash return view and raised its core and GAAP EPS view for fiscal 2024. It anticipates year-over-year all-in sales growth of 2-4%. Organic sales are likely to increase 4-5%. The company expects GAAP EPS to increase 1-2% year over year. Core EPS is expected to increase 10-11% year over year.

Hiccups on the Path

Procter & Gamble has been witnessing elevated SG&A expenses, owing to higher supply-chain costs, rising inflation and increased transportation expenses. Core SG&A, as a percentage of sales, expanded 210 bps from the year-ago quarter to 29.1%. Currency hurt the SG&A expense rate by 0.4%. The SG&A expense rate increased 170 bps to 28.7% on a currency-neutral basis. The increase was driven by a 330-bps rise in reinvestments, offset by 60-bps of productivity savings and 100-bps net sales growth leverage and other impacts.

Procter & Gamble’s outlook for fiscal 2024 continues to reflect supply-chain issues, higher transportation costs, geopolitical challenges, currency headwinds and rising inflation, which are likely to impact consumer confidence.

Stocks to Consider

Some better-ranked stocks from the broader Consumer Staples space are Vita Coco Company COCO, Colgate-Palmolive CL and PepsiCo PEP.

Vita Coco develops, markets and distributes coconut water products. COCO currently sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 25.3%, on average. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for COCO’s current financial-year sales and earnings indicates growth of 3.5% and 37.8%, respectively, from the year-earlier reported figures. The consensus mark for COCO’s EPS has moved up 7.4% in the past 30 days.

Colgate-Palmolive, a leading consumer goods company, currently carries a Zacks Rank #2 (Buy). CL has a trailing four-quarter earnings surprise of 4.4%, on average.

The Zacks Consensus Estimate for Colgate’s current financial-year sales and EPS indicates growth of 3.9% and 9.3%, respectively, from the year-ago reported number. The consensus mark for CL’s EPS has moved up by a penny in the past seven days.

PepsiCo, one of the leading global food and beverage companies, currently carries a Zacks Rank of 2. PEP has a trailing four-quarter earnings surprise of 5.1%, on average.

The Zacks Consensus Estimate for PepsiCo’s current financial year sales and EPS indicates growth of 3.4% and 7.1%, respectively, from the year-ago reported figure. The consensus mark for PEP’s EPS has moved up by a penny in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Procter & Gamble Company (The) (PG) : Free Stock Analysis Report

Vita Coco Company, Inc. (COCO) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance