Private payrolls — What you need to know in markets on Wednesday

Wednesday will mark the first of three straight days of labor market data that investors will digest to cap the week.

On Wednesday morning, ADP will release its reading on private payroll growth for February. Economists expect private payrolls grew by 185,000 in February, down from the 246,000 we saw in January. This report comes two days ahead of the BLS’ official release of the U.S. jobs report on Friday morning, which is expected to show nonfarm payrolls grew by 190,000 while the unemployment rate fell to 4.7% in February.

Elsewhere in economic data on Wednesday, we’ll get an update on labor productivity in the fourth quarter and a reading on import prices in February.

Earnings in focus are expected to include Bob Evans (BOBE) and Valspar (VAL).

Investors will also continue to monitor the political haggling breaking out after House Republicans released a draft of an Obamacare replacement, called the American Health Care Act, which was widely panned by conservatives for, among other reasons, not being a full repeal of the Affordable Care Act.

Confidence

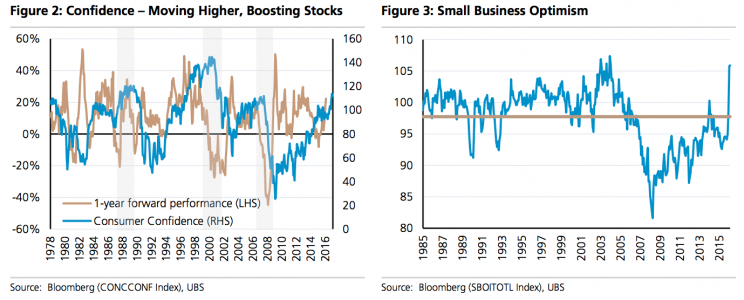

Stop me if you’ve heard this before: since Donald Trump’s election as president, confidence among consumers and businesses is up in the U.S.

So, will this matter?

In January we saw a pick-up in inflation and retail sales, indicating that perhaps the post-election confidence boost would turn into actual economic growth. But the latest GDPNow tracker from the Atlanta Fed forecasts first quarter GDP grew at an annualized rate of just 1.3%, almost a full percentage point below the consensus forecast.

Certainly, confidence and actual economic output can go different directions for a time, but eventually one must drive a cohesive economic narrative.

“While the general rise in confidence does not guarantee good times ahead, the few instances in which we’ve seen surges to these above-average levels have tended to coincide with a stronger economy and higher stock market over the following year,” writes Julian Emanuel at UBS.

“Albeit with increased volatility as in 1994 and 1996 or coming in the wake of 1987’s stock market crash, the last time a major market top occurred without a recession following on. This begs the question of whether or not such confidence surges are self-fulfilling prophecies for the economy and/or the equity markets.”

In our weekly look ahead post published Sunday, we noted that confidence among income cohorts has already started to go different directions, with those at the lower end of the income scale losing faith in the economy at last check.

And in a post on Bloomberg View published Tuesday, Conor Sen noted that all of this consumer confidence isn’t created equal when divided across generational lines. Confidence among Americans over 54 is up to 110 from 84.6 in October, while confidence among those under 35 has dropped from 124.1 to 116.3 over that same period.

As Sen notes, younger consumers are the ones forming families, buying homes for the first time, and trying to establish themselves professionally. Older consumers, meanwhile, are more likely to be established as a worker, as a consumer, and to be seeking a winding-down of economic participation rather than an expansion of that role.

The entire reason that confidence matters to stocks and the economy is that economics is the study of people. If people feel good, they spend money. If they don’t, they don’t.

The positive feedback loop economists and policymakers hope will be generated by consumers and workers who feel good is the kind of thing that can boost an economy out of a malaise. The inverse can lead to even more negative outcomes.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Yahoo Finance

Yahoo Finance