Private home sales up 8.2% in July, second consecutive m-o-m increase

Treasure at Tampines was the best-selling project in July, with 112 units sold.

New private home sales in Singapore continued to climb for the second month in a row after the government allowed the reopening of showflats.

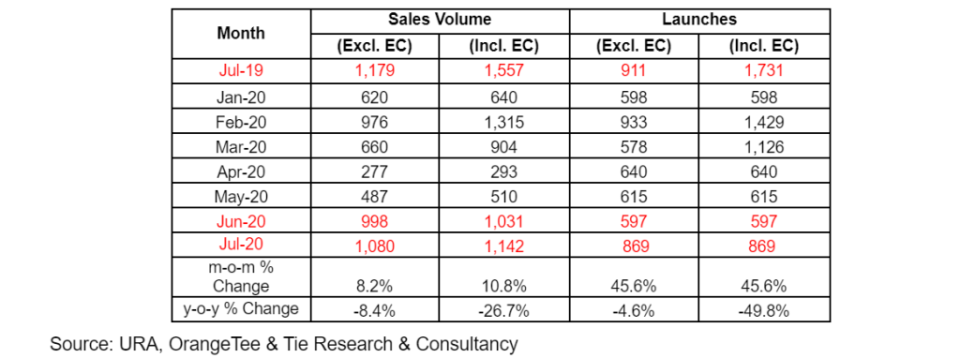

Excluding executive condominiums (ECs), new home sales rose 8.2% month-on-month to 1,080 units in July from June’s 998 units, according to Urban Redevelopment Authority (URA) data. This figure is the highest monthly sales this year. Including ECs, month-on-month sales increased by 10.8% from 1,031 to 1,142 units.

On an annual basis, however, new private homes sales, excluding ECs, fell 8.4%.

Treasure at Tampines emerged as the best-selling project last month, with 112 units sold. It was followed by Parc Clematis, The Florence Residences, JadeScape and Daintree Residences.

“Demand continued to strengthen in July as investors continue to throng the property market in search of safe-haven assets amid the growing economic uncertainties and turbulent equity markets,” said Christine Sun, Head of Research & Consultancy at OrangeTee & Tie.

She believed that some buyers are capitalising on the falling interest rates, while others may be rushing to acquire a property ahead of the Hungry Ghost month which starts in August.

Properties sold above $2 million the highest in seven years, with more buying in the OCR and RCR

With this, sales of pricier homes, which were bought by investors and high-income Singaporeans, hit a seven-year high in July, with 150 non-landed homes (excluding ECs), shifted above $2 million. Of these, 69 were located in the Rest of Central Region (RCR), 34 were in the Outside of Central Region (OCR) and 47 were in the Core Central Region (CCR).

“While the majority of buyers bought homes in the OCR and RCR areas last month, we observed more buyers purchasing ‘pricier’ homes in these two regions. This came as a surprise as most buyers especially those purchasing homes in the mass market region would prefer more affordable housing options, given the current macroeconomic uncertainties,” said Sun.

In fact, of the two private homes sold above $10 million, one was located in RCR. This was a 527 sq m freehold MeyerHouse condo that was transacted for $13.8 million. The other was a 462 sq m unit at 15 Holland Hill within the CCR, which was sold for $13.4 million.

Not including ECs, URA Realis data also showed that the proportion of non-landed private homes transacted above $2 million in the RCR rose to 16.8% in July from 12.8% in June.

“In terms of absolute numbers, the number of transactions rose 27.8% month-on-month from 54 units to 69 units over the same period, which was the highest number recorded since September 2019 (85 units),” noted Sun.

Among the RCR projects with above $2 million transactions include Stirling Residences, Jadescape and Parc Esta.

Meanwhile, in the OCR, sales of non-landed private homes sold above $2 million also increased to 34 units in July from 27 units in June. Some of the OCR projects with above $2 million transactions include Parc Clematis, Treasure at Tampines, The Florence Residences and Grandeur Park Residences.

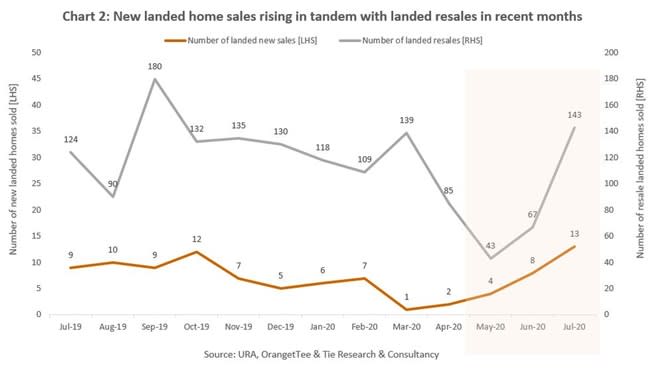

Sales of landed properties also saw a huge jump

Sun noted that landed properties were “flying off the shelves”, with 156 units sold in July (from 67 sold in June). Of this, 143 were resales, while 13 units were new properties.

“Although July’s new sale numbers were not as large as resales, they were the highest number of new properties inked in 10 months.”

More are buying bigger homes

Lee Sze Teck, Director of Research at Huttons Asia, also believed that the COVID-19 pandemic “which have brought about more people working from home (WFH) may have triggered buyers’ desire for more space”.

An analysis of caveats showed that the average size of units acquired since April 2020 has steadily increased in the past few months.

“This trend may continue as WFH becomes a permanent arrangement for some employees.”

Meanwhile, Sun noted that Singaporeans continue to account for the bulk of buyers in July.

Excluding ECs, the number of new non-landed homes acquired by Singaporeans increased to 884 units in July from 785 units in June, or making up 84.4% of total sales.

The number of homes purchased by Singapore permanent residents rose further to 130 units last month from 123 units in June, while those acquired by non-permanent residents dipped to 34 units in July from 46 units previously.

Looking ahead, Lee expects August to be a “blockbuster month for developer sales”.

“Forett at Bukit Timah, the first major launch after the circuit breaker with a virtual sale balloting process is estimated to sell close to 40% in August. Developer sales in August could be even higher than September 2019’s 1,270 units,” he said.

Looking for a property in Singapore? Visit PropertyGuru’s Listings, Project Reviews and Guides.

Victor Kang, Digital Content Specialist at PropertyGuru, edited this story. To contact him about this or other stories, email victorkang@propertyguru.com.sg

Yahoo Finance

Yahoo Finance