Price & Time: Wednesday is Key for Near-Term Cyclical Picture

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be obtained.

Foreign Exchange Price & Time at a Glance:

EUR/USD:

Charts Created using Marketscope – Prepared by Kristian Kerr

-EUR/USD failed at the beginning of February near a convergence of the 1x3 Gann line from the 2011 high and the 1-year standard deviation channel

- Subsequent weakness has so far been contained by support near the 1x2 Gann line from the 2011 high now in the 1.3370 area

-Focus remains lower with a clear breach of this level the likely trigger for a deeper decline towards a slew of Fibonacci related support in the 1.3200 area

-Key resistance seen around 1.3500 as this area marks a clear confluence of several minor and major retracements as well as the 1x2 Gann line from this year’s high with strength above needed to turn outlook positive

-Near-term cycle studies warn downside resumption possible over next couple of days

Strategy: Still prefer to sell on strength, but keep stops tight. Too much further strength on Wednesday alters the near-term cyclical picture.

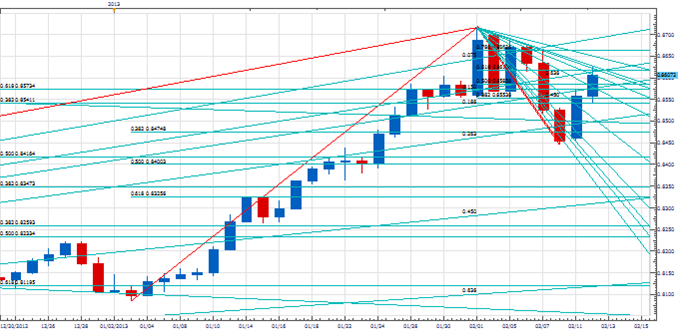

EUR/GBP:

Charts Created using Marketscope – Prepared by Kristian Kerr

-EUR/GBP recovered sharply over the past couple of days from just below the 38% Fibonacci retracement of the year-to-date range

-Recent push over .8500 convergence of 1x1 Gann angle from 2011 high and 2x1 angle from last year’s low puts the cross in a more postive position

-Focus now on resistance in the .8630 area which is the second square root prrogression from last Friday’s low

-Close above there needed to signal broader move higher underway

-We should note that the next couple of days is a minor cylical window where downside pressure could abate

- Support level to watch is longer-term Fibonacci retracement in the .8540 area with weakness below this area needed to re-focus attention lower

Strategy: Longs should move stops up as cycles are turning negative over next few days.

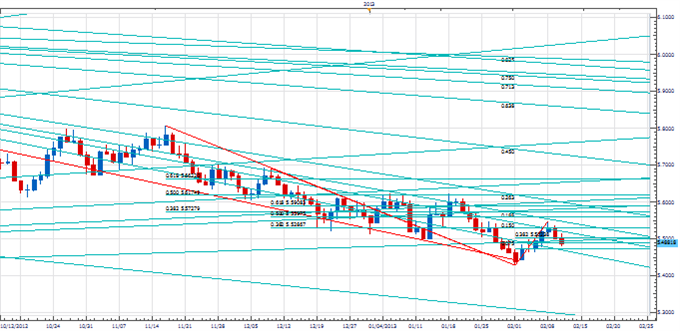

USD/NOK:

Charts Created using Marketscope – Prepared by Kristian Kerr

-USD/NOK remains in a strong downtrend since failing below the 1x2 Gann fan line from the 2008 high in early June of last year

-Focus remains lower with weakness below minor retracement and Gann line support between 5.4730 and 5.4680 needed to prompt more aggressive decline

-A 3x1 Gann line from the June high in the 5.5500 is a key near term pivot with strength above required to shift near-term attitude on the pair

- On the downside the 1x2 Gann line connecting last November’s closing low with this month’s high in the 1.2940 area is important support with weakness below this level required to prompt a more serious decline

-A Pi relationship to the June high indicates next week could have cyclical importance

Strategy: Like selling on breaks while below 5.5500

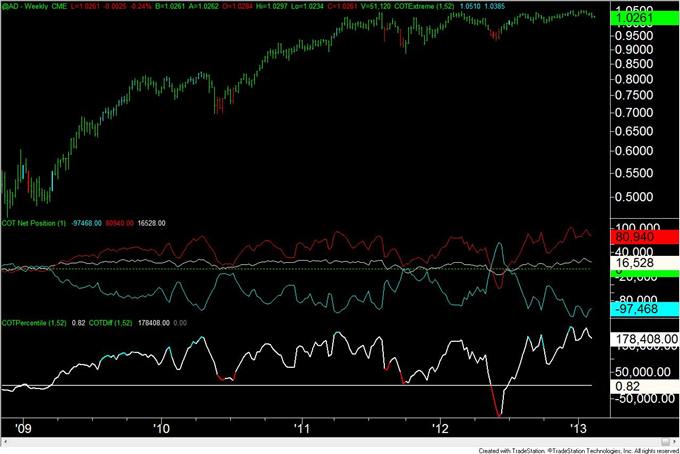

Focus Chart of the Day: AUD/USD

As we mentioned yesterday a Pi relationship from early June has potential to impact the foreign exchange markets next week with focus on the commodity block and emerging markets. Such time windows should be monitored closely as there is a high propensity for the market to turn and/or accelerate during this time – at least according to our cyclical methodology. Currency pairs stretched from a positioning and sentiment standpoint ideally make the best candidates. With net positioning in the Australian dollar still extremely high, the currency looks more susceptible to embark on a move of importance should the time relationship influence.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To receive other reports from this author via e-mail, sign up to Kristian’s e-mail distribution list via this link.

New to forex? Sign up for our DailyFX Forex Education Series

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance