Price & Time: Important Time Relationship Developing in the Pound?

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be obtained.

Foreign Exchange Price & Time at a Glance:

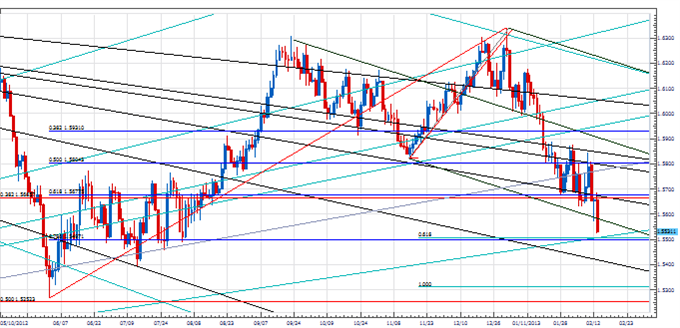

GBP/USD:

Charts Created using Marketscope – Prepared by Kristian Kerr

-CABLE has been in a defined downtrend since failing at the start of the year near the 1x8 Gann line from the 2007 high

- Recent weakness under the 38% retracement of the 2009 range in the 1.5670 area keeps focus lower

-A Fibonacci convergence of the 78.6% retracement of the June – January advance and a downside extension measured from the November – January move in the 1.5500 area now crucial support

-Budding Fibonacci time spiral and potential June Pi time relationship warn that Sterling is more prone to reverse over the next few days (See Focus Chart of the Day)

-Support turned resistance in the 1.5670 Fibonacci zone a key near-term pivot with strength above this level needed to signal stronger recovery

Strategy: With cycles suggesting that Cable is prone to a reversal we like tightening stops on short positions. Above 1.5670 we would start looking to get long.

EUR/CHF:

Charts Created using Marketscope – Prepared by Kristian Kerr

-EUR/CHF has been generally weak since last month’s failure near the 78.6% Fibonacci retracement of the 2011 decline

-However, support was found over past few days during a minor cyclical window below a convergence of the 50% retracement of the September to January advance and the 100% projection of the January decline in the 1.2275 area.

-Square root progression resistance near 1.2365 remains key with a close over this level needed to confirm that a cyclical low is in place and that a more important move higher is indeed underway

-Recent low in the 1.2255 area now important support with a clear breach of this level required to undermine burgeoning postive cyclical prospects

-Shorter-term focused cylical techniques urge caution over the next couple of days

Strategy: We woud look to get long above 1.2365, but with realtively tight stops as the near-term cyclical picture is a bit muddled.

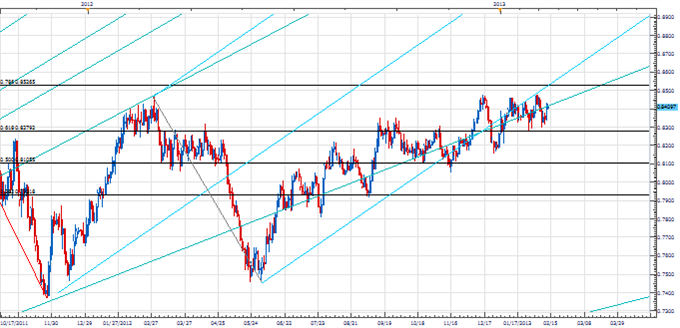

NZD/USD:

Charts Created using Marketscope – Prepared by Kristian Kerr

-Trading in NZD/USD continues to gravitate towards the critical 1x1 Gann line drawn from the 2009 low to the 2011 advance

-Recent consolidation above the 61.8% Fibonacci retracement from the 2011 high at .8280 keeps focus higher

-Aforementioned multi-year Gann line in the .8425 area now immediate resistance with a close over this level needed signal renewed push higher towards pitchfork and longer-term Fibonacci resistance near .8530

- The retracement at .8280 remains important support and only weakness below this level warns that a more important decline is underway

-A Pi relationship related to last year’s June low suggests next week could be important from a timing perspective

Strategy: We generally like the long side while above .8280, but a close over .8425 is now needed. Extreme prudence also required as we approach the time window next week.

Focus Chart of the Day: GBP/USD

A potential time relationship can be seen using Fibonacci where a simple bar count on the daily chart shows reversals materializing on both Fib sequence and ratio days (+/- a day) over the past few months. Potentially more significant is a spiral relationship developing with the November 15th low. We say this because Wednesday was a Fibonacci 62 trading days from this low and 61.8% of this equals 38 trading days which coincides with the reversal seen around the middle of December. A 161.8% relationship coincides with the turn seen in late September. All of this is a long winded way of saying that a clear relationship looks to be developing which could have an important impact on the pound over the next day or so.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To receive other reports from this author via e-mail, sign up to Kristian’s e-mail distribution list via this link.

New to forex? Sign up for our DailyFX Forex Education Series

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance