Price & Time: The Curious Case of USD/JPY

DailyFX.com -

Talking Points

EUR/USD nearing key confluence

NZD/USD fails at Fibo

USD/JPY waiting on a catalyst

Get real time volume on your charts for free. Click HERE

Foreign Exchange Price & Time at a Glance:

Price & Time Analysis: EUR/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

EUR/USD traded at its highest level since early February on Friday

Our near-term trend bias is higher while above 1.1275

A conflluence of Gann and Fibonacci levels near 1.1500 is a clear near-term attraction/reaction zone for the exchange rate

A very minor cycle turn window is eyed Wednesday

A close below 1.1275 would turn us negative on the euro

EUR/USD Strategy: Like holding the long side while above 1.1275

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

EUR/USD | *1.1275 | 1.1335 | 1.1400 | 1.1465 | *1.1500 |

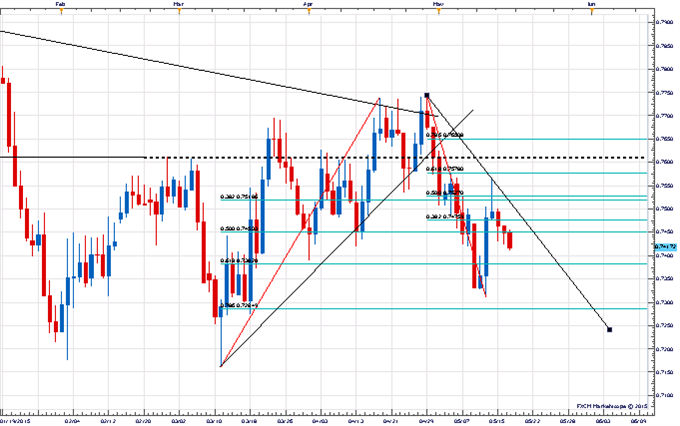

Price & Time Analysis: NZD/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

NZD/USDf ailed last week near the 50% retracement of the April – May decline

Our near-term trend bias remains lower while below .7525

A close under the 61.8% retracement of the March – April advance near .7380 is needed to set off the next leg lower in the rate

A minor turn window is seen mid-week

A daily close over .7525 would turn us positive on the Kiwi

NZD/USD Strategy: Like the short side while below .7525 (closing basis).

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

NZD/USD | .7285 | *.7380 | .7418 | .7475 | *.7525 |

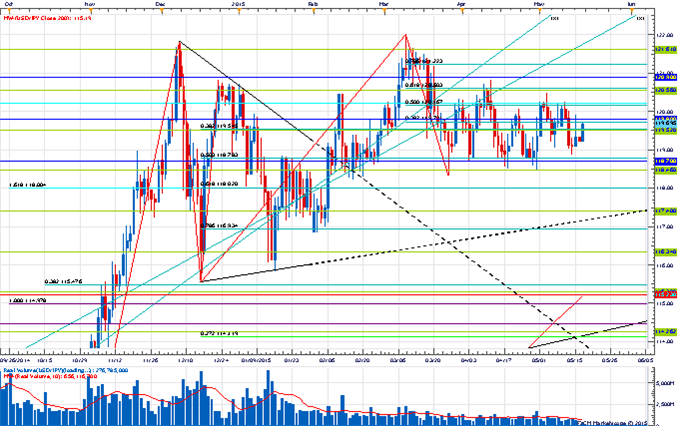

Focus Chart of the Day: USD/JPY

USD/JPY has proven remarkably steady over the past few weeks as the pair has remained confined to range between 120.50 and 118.40. Elsewhere USD has not been so fortunate as the FXCM US Dollar Index (which includes JPY in the basket) has fallen some 4% from the highs recorded in April. We see this resolving itself one of two ways. The general USD decline continues unabated and inevitably drags USD/JPY down with it or the long-term USD uptrend re-assets itself here shortly and USD/JPY is off to the races. It would seem the former is the least favored scenario at the moment by the market which the contrarian in us fears. There seems to be a lot of complacency with respect to USD/JPY and we can’t help but think that a move under 118.20 would get quite sloppy. Traction over 120.50 would re-focus attention on 122.00, but it is probably going to take a move over the 78.6% retracement of the 2002-2011 decline at 122.40 to trigger a more significant advance in USD/JPY.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance