Price & Time: CAD Questions Remain

DailyFX.com -

Talking Points

USD/JPY rebound from Gann support continues

NZD/USD fails at key trendline

USD/CAD struggles higher on low volume

Get real time volume on your charts for free. Click HERE

Foreign Exchange Price & Time at a Glance:

Price & Time Analysis: USD/JPY

Charts Created using Marketscope – Prepared by Kristian Kerr

USD/JPY has traded steadily higher since finding support around a key Gann suport near 118.40 at the start of the week

Our near-term trend bias is lower while below 121.00

A move under 118.40/20 is needed to set off a more important move to the downside in the exchange rate

A very minor turn window is eyed early next week

A close over 121.00 would turn us positive on USD/JPY

USD/JPY Strategy: Like the short side while spot remains below 121.00

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

USD/JPY | *118.40/20 | 119.50 | 119.90 | 120.20 | *121.00 |

Price & Time Analysis: NZD/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

NZD/USD failed yesterday near a key trendline connecting the October/January highs at .7725

Our near-term trend bias is higher in the Kiwi while above .7450

A move through .7725 is neeeded to confirm that a new leg higher is underway in the rate

The middle of next week looks significant from a medium-term cyclical perspective

A daily close below .7450 would turn us negative on NZD/USD

NZD/USD Strategy: Looking to buy on further weakness over the next day or so.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

NZD/USD | *.7450 | .7520 | .7560 | .7615 | *.7725 |

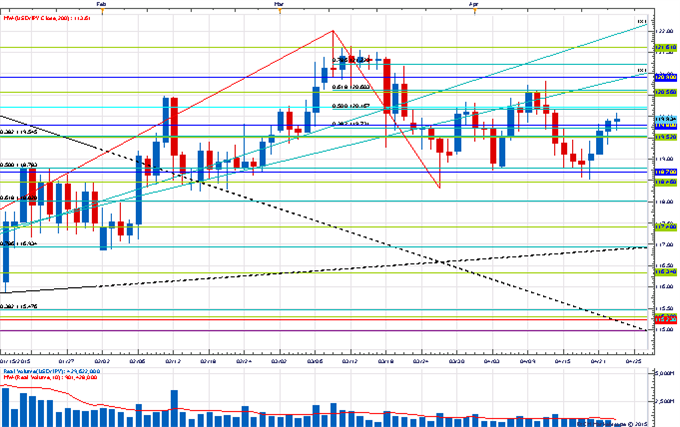

Focus Chart of the Day: USD/CAD

USD/CAD has settled into a tight range following last week’s aggressive decline on heavy volume. Many questions remain. Was last week’s move just a violent “shake of the tree” to clear out the weak hands before a resumption of the primary trend or is there still more weakness to come? Objectively the structure of the daily chart still looks rather negative and it would probably take a move north of the internal trendline around 1.2470 to convincingly turn things around for us. The well below average volume over the past few days isn’t really that supportive either and warns another leg lower is still very possible - if not likely. Last week’s closing low around 1.2175 looks like a key level in this regard with traction below needed to signal that a new leg lower is unfolding. From a cyclical perspective the next key window for Funds looks to be around the start of next month.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance