PPG Industries' (PPG) Q1 Earnings In Line, Sales Lag Estimates

PPG Industries, Inc. PPG reported first-quarter 2024 profit of $400 million or $1.69 per share, up from $264 million or $1.11 per share in the year-ago quarter.

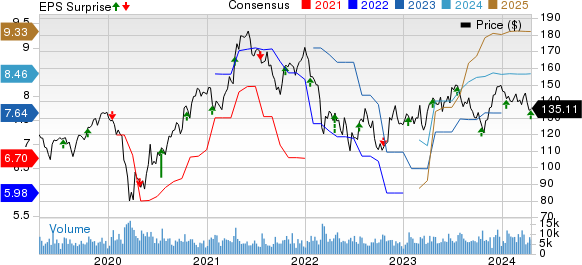

Barring one-time items, adjusted earnings per share (EPS) increased to $1.86 from $1.82 in the year-ago quarter. It was in line with the Zacks Consensus Estimate.

The company’s revenues were $4,311 million in the reported quarter, down around 2% year over year. The downside can be attributed to lower sales volumes. The top line missed the Zacks Consensus Estimate of $4,430.9 million.

The company saw weaker demand in Europe and tepid global demand for industrial coatings. An early Easter holiday also lowered the number of selling days in March.

PPG Industries, Inc. Price, Consensus and EPS Surprise

PPG Industries, Inc. price-consensus-eps-surprise-chart | PPG Industries, Inc. Quote

Segment Review

In the first quarter, the Performance Coatings segment saw a 1% year-over-year decline in sales to $2,614 million. It was below our estimate of $2,702.9 million. Sales fell as lower sales volumes more than offset higher selling prices and favorable foreign currency translation. Higher prices also contributed to a 2% increase in the segment’s income from the previous year’s levels.

For the Industrial Coatings segment, sales declined 3% year-over-year to $1,697 million. It was below our estimate of $1,702.1 million. Sales were impacted by reduced selling prices and modestly lower sales volumes. Segment income rose 4% from the prior year’s figure. The upside can be attributed to moderating input costs from historically high levels and enhanced manufacturing performance.

Financials

At the end of the first quarter, the company had cash and cash equivalents of $1,181 million, down around 17.2%. Long-term debt was $5,940 million, down around 16% from the prior-year quarter’s figure.

The company repurchased shares worth roughly $150 million in the reported quarter. Its board has authorized the buyback of $2.5 billion of outstanding common stock.

Outlook

For the second quarter of 2024, the company projects an adjusted EPS in the band of $2.42-$2.52. For full-year 2024, it sees adjusted EPS to be in the range of $8.34-$8.59.

The effective tax rate for the second quarter is projected to be between 23.5% and 24.5%, modestly higher from the previous year’s figure.

PPG envisions strong organic growth in demand for its products in China. Demand is projected to stabilize in Europe as it progresses through 2024. While economic conditions remain subdued in several end-use markets in the United States, PPG expects overall improvement as the year progresses.

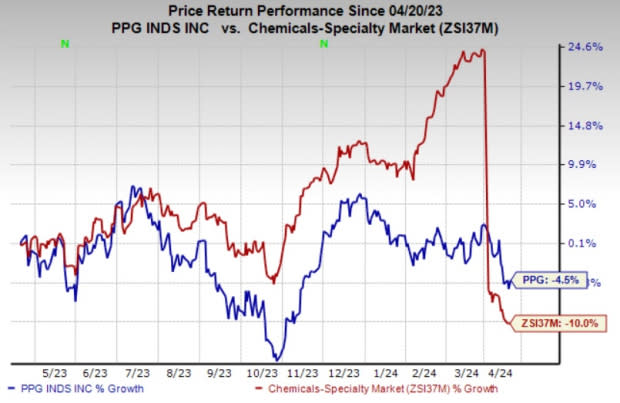

Price Performance

PPG’s shares are down 4.5% in a year compared with a 10% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

PPG currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth a look in the basic materials space include Denison Mines Corp. DNN, Carpenter Technology Corporation CRS and Innospec Inc. IOSP.

Denison Mines beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 300%. The company’s shares have soared roughly 99% in the past year. DNN carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Carpenter Technology’s current fiscal year earnings is pegged at $3.96, indicating a year-over-year surge of 247.4%. CRS beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 12.2%. The company’s shares have rallied around 68% in the past year. CRS currently carries a Zacks Rank #2 (Buy).

The consensus estimate for Innospec’s current-year earnings is pegged at $6.72 per share, indicating a 10.3% year-over-year rise. IOSP, carrying a Zacks Rank #2, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 10.5%. The company’s shares have gained around 15% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Denison Mine Corp (DNN) : Free Stock Analysis Report

Innospec Inc. (IOSP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance